Click here to view printable pdf.

Summary

- Stock prices are up double digits this year, with markets shrugging off the global pandemic and rising inflation. Most fixed-income (bond) indexes are slightly down year-to-date.

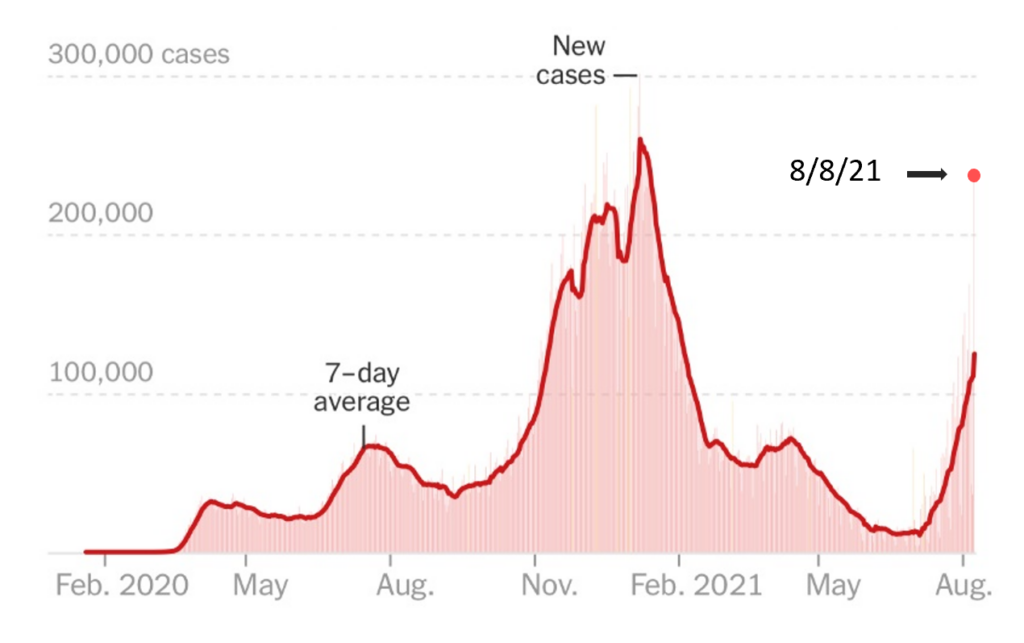

- After months of declining Covid-19 infections, a new wave has emerged with the more contagious Delta variant. Only about half of the U.S. population is fully vaccinated. Shutdowns and other restrictions have commenced in parts of the world. Interest rates have fallen recently on new concerns about the virus and economic growth.

- We have modest assumptions about the macro environment: fiscal and monetary stimuli remain on full tilt. Investor sentiment is decidedly bullish; bubble-like euphoria exists among certain stocks and asset types.

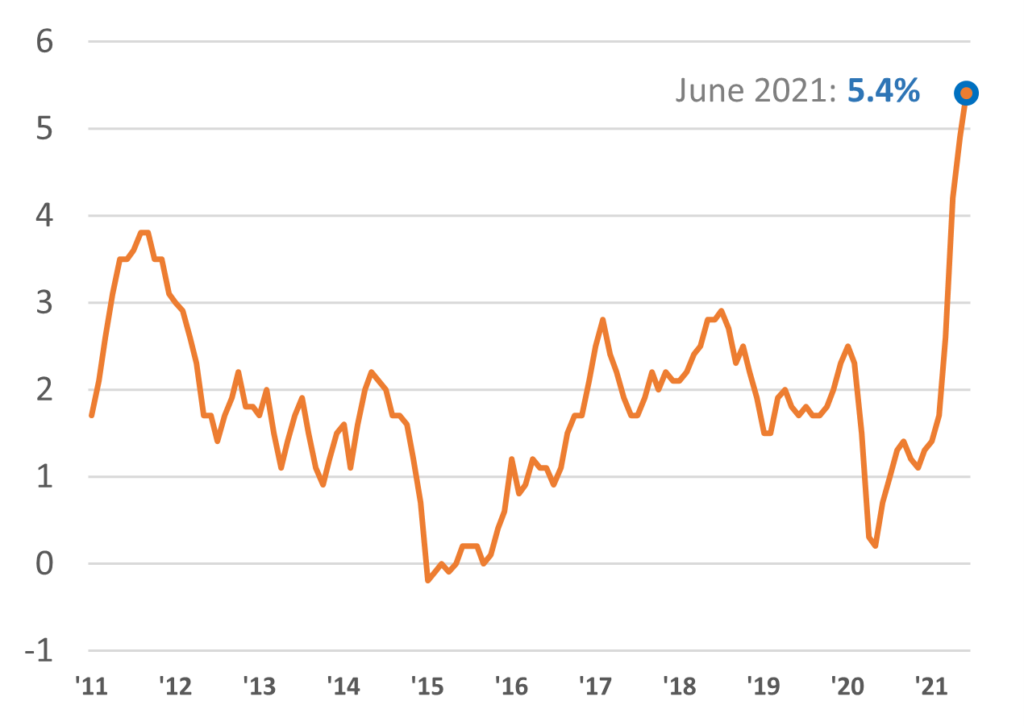

- The debate over inflation vs. deflation is unnecessary, in our view, as it leads to betting on forecasts in direction and timing. We think it’s better to own things that do well regardless.

- We have tilted toward higher quality, growth businesses at reasonable prices after big gains in multi-year laggards, including “value”-labeled stocks.

- We assume gains for investors will not be so easy going forward. Investors must be crystal clear in their strategy. Rather than betting big on market forecasts or rapid trading, our strategy lies primarily in the patient ownership of rather macroeconomic-resistant businesses and focusing on the mundane yet powerful factors under our control. We are also patiently accumulating select income securities.

From the view at the airport or shopping mall, it’s clear America is back open for business. News of sold-out concerts and other large gatherings bring long-awaited relief or anxiety, depending on one’s views (or politics).

New U.S. Covid-19 Cases

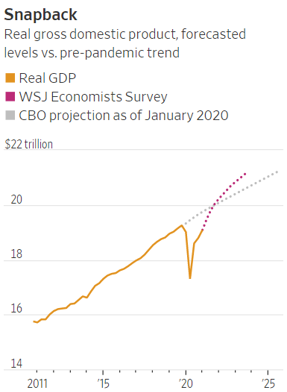

Economic data is decidedly strong in 2021. Stocks are back to all-time highs, and housing prices have reaccelerated in many parts of the country. Some parts are seeing prices up double-digit percentages versus last year’s record prices.

Jobs are plenty, and wages are accelerating. Job openings stand at over 10 million, some two million more than a record set two years ago. Wages among the lowest earners are (finally) rising and at a faster rate than other income groups. Many employers have also had to increase benefits and bonus incentives to fill positions. Consumers (some 70% of the U.S. economy) are spending more than ever, even as household debt ratios have improved tremendously.

More economic activity and a general complacency regarding Covid—including insufficient compliance with getting the vaccine—point to more Covid cases, new mask requirements, and fear. But that doesn’t mean an imminent drop in stock prices and economic growth is inevitable. The thing is, markets more-or-less assume resurging Covid numbers. So are investors less afraid of Covid and more certain about future fiscal and monetary stimulus? Are markets just complacent? Maybe both.

The case for vaccination grows stronger. According to the CDC, some 99.5% who died of Covid-19 over six months in 2021 were unvaccinated. Herd immunity supposedly requires over 80% to be vaccinated.

While we are reluctant to give personal advice, we find the investing principle of asymmetric risk instructive regarding Covid-19. Instead of dealing in coinflips, it is far better to seek favorably skewed outcomes, or “Heads I win, tails I don’t lose much” propositions. Seatbelts in cars come to mind as an example.

The same should apply to Covid-19: A little caution and discomfort are still a small price to pay. Heads I win, tails I don’t lose much.

Markets

While our favorite investment is a curated grouping of exceptional businesses at reasonable prices, we admit growing concerns with a market increasingly driven by greed and FOMO (Fear of Missing Out).

There is plenty of evidence of a heyday right now in capital markets and in the power of policymakers. This is saying something given the market’s remarkable run since the Great Financial Crisis 12 years ago.

Prices for stocks, real estate, high-yield bonds, and commodities march higher to new records. Prices for used cars have jumped so much that some who bought a used car two years ago find they can sell their vehicles today for a profit.

News comes almost daily about the astounding sums paid for collectibles of all sorts, and not just in art and antiques. In April, someone bought a signed basketball card of 24-year-old NBA star Luca Doncic for $4 million. Last month someone’s unopened Nintendo game console from 1996 sold for $1.56 million.

S&P 500: 10 Years

But the market’s exuberance is best revealed in the hot market for financial “non-traditional” assets. Examples are plenty, including the mania in anything blockchain, cryptocurrency, and non-fungible tokens (“NFTs”)—digital assets with ownership cryptographically recorded on a blockchain. People are turning videos, graphics, pictures, memes, and other forms of intellectual property into profitable NFTs. The NBA is churning NFTs of game highlights and basketball cards. Recently, someone paid $387,600 for an NFT of a LeBron James dunk highlight.

At least one artist has destroyed his painting only to sell the NFT version for a large sum. The artist known as Beeple sold an NFT for $69 million at auction at Christie’s, prompting many to question if NFT versions of art should be worth more than the real thing.

The same zeal is driving growing markets for Special Purpose Acquisition Companies (SPACs), the new name for the old “blank check” companies where sponsors can raise capital in an IPO for the promise to buy a high growth private company on the cheap.

According to a recent Harvard Business Review, 59 SPACs were formed in 2019, with $13 billion invested. In 2020, 247 were created, with $80 billion invested. The first quarter of 2021 alone saw 295 new SPACs, with $96 billion invested.

And then there are the “meme stocks.” Memes are images, videos, and phrases typically humorous that “go viral” over the internet. Memes are a part of pop culture and appear powerful enough to drive stock prices.

The two best examples may be the meteoric rise of two companies in decline even before Covid: GameStop, the video game retailer whose customers increasingly buy and download games at home; and AMC Entertainment Holdings, the movie theater operator.

After starting 2021 at $18 per share, GameStop stock reached a high of $483 on January 28. The company has no profitability in sight but still trades around $160 with a market cap of $12 billion.

A bigger meme hit was AMC, which started 2021 at $2 per share before rising ten-fold in a month. AMC management smartly began selling stock, even warning investors AMC’s stock price was unjustified. Meme investors (and the hedge funds that piled on) were not deterred, and the stock rose another six-fold to over $72 from May 21 to June 2. Today the stock trades around $35 and a market cap of $18 billion (plus net debt on the balance sheet of $10 billion!).

Are AMC and movies theaters about to return to former glory? No one thinks so. AMC struggled with profitability before Covid, and even if AMC went back to its most profitable year (about 15 years ago), the stock would still trade at 100 times earnings.

If investors know this, why is the stock still up over 17-fold in 2021? Perhaps it’s speculation another jump in the stock price is near, and someone else will buy their stock at a higher price (“Greater Fool Theory”). There seems to be some truth in Jeremy Grantham’s observation that “the idea that something is worth investing in, or rather gambling on, simply because it is funny…It’s a totally nihilistic parody of actual investing.”

Bubbles are easy to spot. The meme bubble may be the biggest stock bubble ever. The difficulty, however, is knowing when a bubble will pop and whether it will be contained to just one section of the market or spread across the stock market more generally. Maybe we just don’t get it.

There is evidence investors are playing a “greater fool” game with markets in general, reassuring themselves they will exit early and before the turn. But, again, timing such things is tricky at best. A strategy around getting out quickly leads to frenetic trading. False positives cause selling on dips only to buy back in after stocks rebound and over again.

We are not immune from these kinds of mistakes. No one is. The mission is to reduce mistakes, especially repeated mistakes, and constantly improve the craft. On that note, we have endeavored to align ourselves in a way where we will be less emotional about markets as a whole and less tempted to engage in frequent market-timing tactics—especially when the near-term future is highly uncertain.

Strategy

So, what’s the game plan? It starts with an overall goal to be as rational as possible and aim to be approximately smart in our investing. Trying to be perfectly smart or right—in timing, allocation, or securities—raises the odds of being incredibly wrong.

It seems rational to stay relatively balanced with a healthy, but not heavy, allocation in exceptional businesses. Stocks of all sorts are expensive historically by price-to-earnings and other fundamental measures, sure. But that doesn’t mean stocks are equally expensive. Some—including almost all the stocks we own—strike us as at least reasonable. Some even seem downright cheap.

We think it now pays to be more discerning between stocks instead of thinking of stocks as a homogenous asset class where one stock is as good as another.

To be fair, recent history suggests otherwise. The rise and success of indexing and “buying the market” has yielded superior results (and over many years) to almost any other “active” strategy, especially those based on prudence, conservatism, and value.

In hindsight, risk management seems to have been useless. Perhaps we should have known a combination of billions and trillions of printed money, increasing

concentration of growth among “Big Tech”, and the rise of indexing/buying-the-market would create a sustained, self-reinforcing loop. The big becomes bigger, rendering diversification and value-seeking a costly handicap.

The largest five companies by market value—Apple, Microsoft, Alphabet (Google), Amazon, and Facebook were recently a quarter of the U.S. stock market. Those owning the market via indexing or the many large mutual funds suspiciously mirroring the S&P 500 Index did better (and sometimes far better) than most, including those invested in the Big Five but not in such size.

We don’t know when the trend will turn or when risk management becomes useful again in generating performance. The drivers of money printing, Big Tech’s superior growth, and rising indexing/buying-the-market continue, with seemingly no end in sight.

The good news is we don’t need to know when this prolonged trend finally turns. We don’t have the singular objective of beating the S&P 500 this year.

Instead, our objective is to invest to meet client-specific goals. Clients are concerned with growing assets over time, preserving capital, mitigating risks, ensuring money lasts, and other similar matters. While we love to talk about our investments and anticipate above-average returns over the longer term, we know this is far less important than forging and executing a prudent overall framework.

The truth is, the most crucial component of meeting and exceeding objectives is avoiding disaster, now and in the future. It is easy to figure out how to cause disaster and, therefore, how to avoid it. A process of working backward from what not to do toward portfolio construction, asset allocation, and specific investments lowers the odds of failure, in our view.

Our focus and positioning today to avoid disaster and be approximately right and prudent can be summarized as follows:

- Invest in exceptional businesses with high returns on capital, durable longer-term advantages, and excellent management. We recognize it is far easier to identify firms with a high likelihood to compound over time and through economic cycles than to predict what the stock market will do this year. Thus, over time, quality stocks should comprise a large majority of our total portfolio income while reducing longer-term risks investors face (inflation, not having enough money, etc.).

- We believe a diversified allocation in these kinds of stocks is the best bet over the long term. But quality stocks may also represent relative value in the near term with frothy and even bubble-like pricing among many stocks and almost all fixed-income securities. With tens of trillions of dollars of near-zero to negative-yielding fixed-income securities out there, how expensive is a quality grower at 25-times or 30-times earnings?

- A healthy allocation of cash equivalents (money market funds and Treasury bills) is another principal investment choice today. Much of our cash is due to our relatively low investment in fixed-income securities, which we see as over-priced and risky, perhaps more than ever. Cash increases conservatism in the short run, but it also increases our return potential over time. Having cash means one doesn’t have to invest in only today’s investment set. Cash means having the option to invest in the opportunities of tomorrow and beyond.

- Portfolio managers almost always feel compelled to have a detailed macro view, including future inflation or deflation. They make forecasts (often expressing little doubt) and invest accordingly. Unfortunately, investing in macro forecasts is difficult at best and the cause of numerous investment catastrophes. The kind of macro insight that reasonably warrants a significant allocation shift are few and far between, typically at “inflection points” when game-changing policy decisions combine with extreme bullish or bearish excess among investors. Unlike baseball, there are no called strikes in betting on macro forecasts; we prefer to wait and swing only at easy pitches.

We feel no need to assume a particular rate of inflation or deflation in the near term. The Federal Reserve and other central banks abroad are trying to manufacture 2% inflation, knowing deflationary forces grow with an increasing global debt crisis and aging population. Central banks’ tools are but a few blunt instruments, principally money printing and money shredding, so it’s possible or even probable central banks will ultimately fail at delivering precise inflation outcomes but succeed in causing unintended consequences (e.g., high inflation).

Inflation Rate: Consumer Price Index

A combination of great businesses, asset types, and a good amount of cash means we are less susceptible to unexpected deflation or inflation. Like stocks, we want robust portfolios with “Heads I win, tails I don’t lose much” characteristics when it comes to inflation.

- Results in the near term will be driven mainly by our stocks. A number of our holdings are relatively new and perhaps unfamiliar to most. Yet, virtually all are growing and profitable 800-pound gorillas in their respective industries. We like that even though our stocks share a lot of characteristics, they seem adequately diversified across sectors and size. We have Big Tech in Alphabet (Google), Amazon, Apple, Microsoft, and Facebook. However, we are more excited about exceptional technology leaders few talk about, including Ansys, Amphenol, and Nintendo. In addition, we are finding growth in other sectors with impressive niche leaders in industrials (including Graco, Watsco, Ferguson, Ritchie Brothers, Avery Dennison, Canadian National Rail) and health care and research (Charles River Labs, Thermo Fisher Scientific, Becton Dickenson, Chemed).

We have found bargains and growth in the consumer and financial sectors, two areas we do not favor in general but realize offer diversified opportunities and value. We opened small positions in a number of companies, including Home Depot, Lowes, McCormick, Clorox, ViacomCBS, Moody’s, S&P Global, Broadridge, Bank of New York Mellon, Goldman Sachs, CME Group, and CBOE Global Markets.

And, of course, we hold (and have added to) our core long-term favorites, including our #1 and #2 stocks by investment: Costco and Berkshire Hathaway.

In the future, you will receive information on many of the companies we keep. We hope writing about the companies we own and their broader lessons make for interesting case studies. Writing also allows us to get feedback and learn. Among our clientele and peers, we have an expert network across numerous industries and specialties. We hope you don’t hesitate to teach us something we should know. We anticipate a process of continuous learning and improvement will serve as an advantage over time. We are interested in truth and great ideas, not our ideas. Ego has no place in investments, so never worry about hurting our feelings.

On a personal note, 2021 has been a dream in more ways than I could have anticipated. Thank you for making Regency Capital an instant success and (dare I say) already an exceptional firm in Hawaii and beyond.

I’m still wondering how I got so lucky in having such great people in my life. The Regency Capital team and I will strive to be deserving of our good fortune. Thank you for your trust, confidence, and support.

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.