Tag: inflation

Investment Commentary Q2 2023

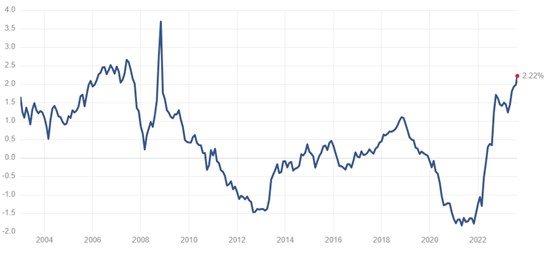

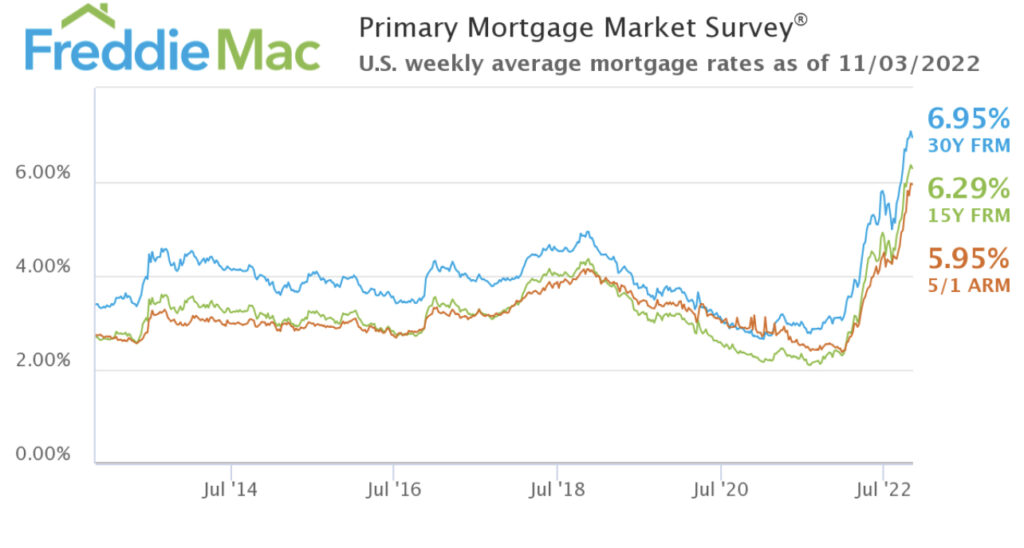

It can’t be overstated how powerful ultra-low interest rates have been for asset prices and wealth accumulation over the past four decades—and the bubbles. But perhaps it is now time to think how unsustainable constant intervention and stimulus are, despite government’s good intentions.

read more