Category: Articles

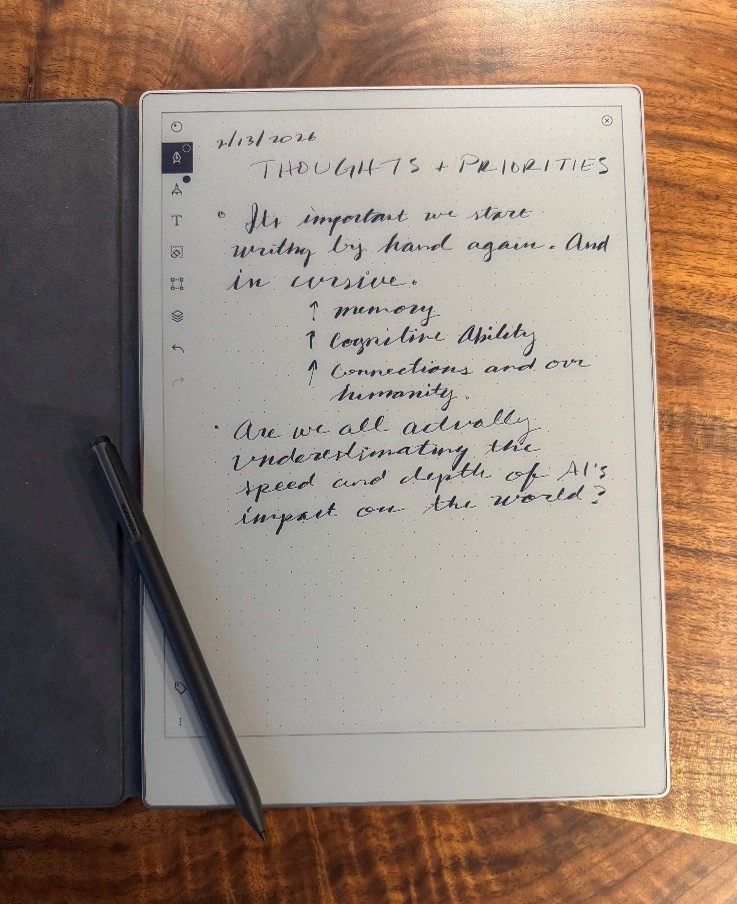

Make Analog Great Again: Starting with a Case for Handwriting vs Typing

A spirited ode to slowing down in a sped‑up world—exploring why pens, paper, and a little analog rebellion might just reboot our brains, our kids, and our sanity.

read more

Investment Letter | August 2025

The S&P 500 may be hitting new highs, but the best value could lie in smaller, overlooked companies. Explore our 2025 small cap investing outlook, why these stocks may outperform, and how we’re positioning portfolios for quality, diversification, and long-term growth.

read more

5 Things the Market Thinks Right Now

Most money managers are guilty of only telling their side of the story—what they expect, where they see value. I know I am.

But it’s always wise to know what the market itself thinks. The market is the collective wisdom (and sometimes foolishness) of the millions of self-interested buyers and sellers trading right now.

read more