One Big Beautiful Bill Act: One Big Step Closer to Doom (Who Cares, Right?)

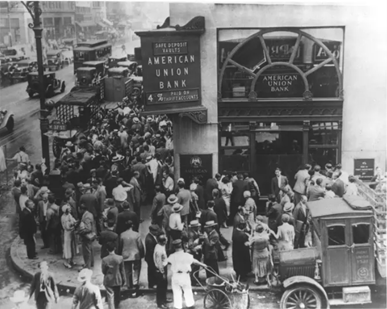

The national debt today is over $36 trillion, representing over 100% of GDP. The Congressional Budget Office (CBO) projects that the debt will exceed $52 trillion by 2035. And, if history repeats, actual numbers in 2035 will exceed estimates.

read more