Invest long enough, and you learn markets are a clever con man, with a talent for making most people wrong most of the time. Markets look for large and vocal crowds and find a way to extract their money.

This isn’t to say it’s wrong to share a view with a crowd or accept the conventional wisdom of the day. The problem isn’t in agreeing with the consensus take, which is most often the reasonable if not compelling view based on the facts—at the time. The problem is how people have bet on the strong consensus view, how they didn’t leave themselves an out if everyone was wrong. The problem is almost always overconfidence and a failure to ask how much upside there is if the crowd’s right and how much there is to lose if the crowd is proved wrong.

Because we are human, we are programmed to believe what we think and act upon it. The thing is, markets are punishing when too many of us do just that.

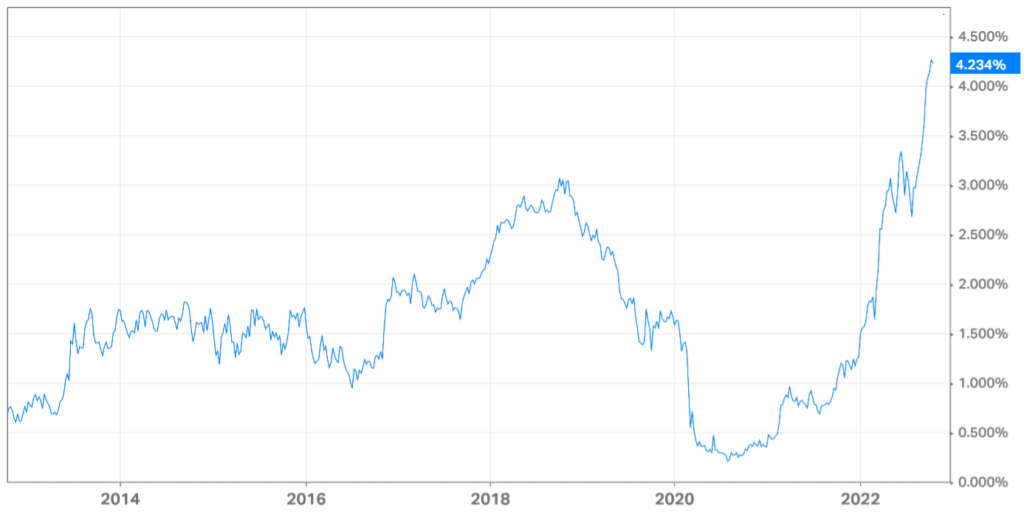

There’s lots of punishment this year, especially in crypto, internet stocks, and long term Treasurys. Punishment has even found new Vanguard converts who (wrongly) conflate “passive” investing with low-risk investing. In reality, all of these tribes were really one consensus and one assumption that interest rates (and inflation) would remain low and stable, forever.

A hard consensus remains even if it has altered its view. The new consensus is of an economic “soft landing” and goes something like this:

The Fed will continue raising rates because it can’t tame inflation until the economy cracks and a recession comes—but that’s okay because it will be a mild one (starting in 2023). The Fed will then lower interest rates and gains will resume in stocks and bonds.

I can’t scoff at this. It seems reasonable. It’s what our monetary overlords think and are working toward. And you don’t fight the Fed, right?

Maybe, but amid all the crowd’s soft landing talk, we might be well served to remember it can be dangerous to believe what we think. It’s dangerous to trust forecasts, including and especially from policymakers.

It is far safer to act as though surging interest rates mean a lot can happen.

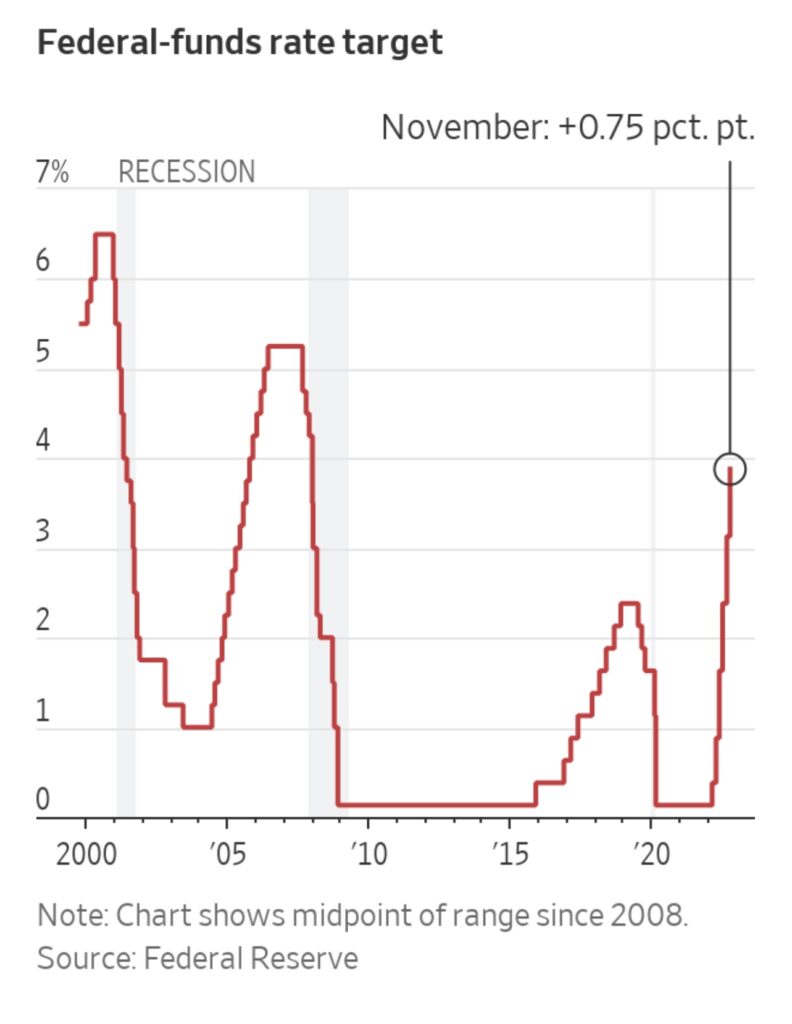

Last Wednesday, the Federal Reserve raised its Federal Funds Rate again by 0.75%. Fed chairman Jerome Powell reiterated worry about sticky inflation and telegraphed more rate hikes to come. Throwing a bone to investors, Powell conceded that monetary policy works with a lag, so the Fed doesn’t need to see 2% inflation before it eases up on monetary tightening.

The bit of encouragement did little for markets. Maybe investors are realizing the Fed—and the economy—are walking a finer line with each Fed meeting. A soft landing might be the fortuitous outcome—maybe still the most likely outcome—but there is less room for error now.

The problem with all the soft landing talk is a rather benign scenario might be priced in already. A longer and/or deeper bear market could be in store if history is an indicator of what happens after aggressive rate hikes (and surging dollar for overseas considerations).

For now, I think it’s good to play extra-cautious as the crowd remains calm.

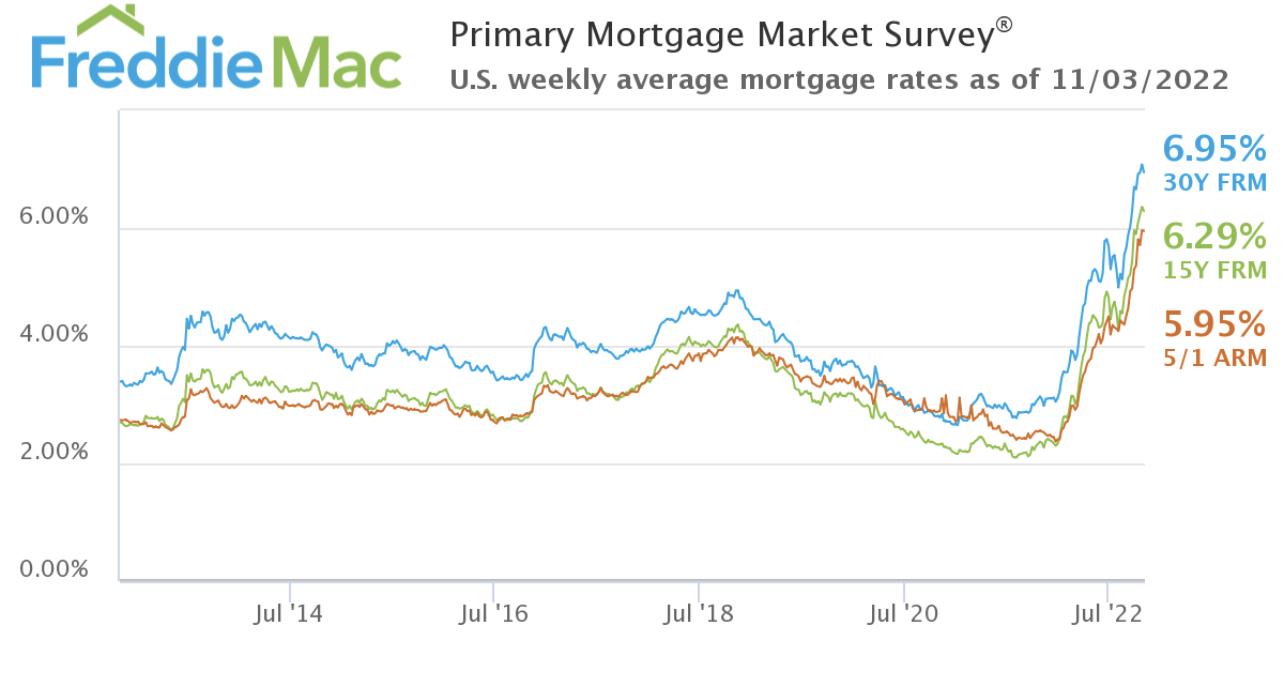

Answers might come from what happens to real estate, which has cooled from a frenzy in 2021. Higher interest rates have pushed borrowing rates to levels not seen in over two decades. The average cost of a 30-year mortgage rate rose above 7% this month. Calculating mortgage payments offers a bracing reality. A $500,000 30-year fixed mortgage at 3% last year meant a $2,108 monthly payment in principal and interest. Today the same loan at 7% means one is paying $3,326 a month, a 58% increase.

CoreLogic, a leading data and analytics firm that various players in real estate industry depend on, announced housing prices in the U.S. dropped 0.5% in September from the prior month while forecasting a 3.9% rise in housing prices over the next year.

Is real estate somehow immune from the higher rates ailing everything else? Commercial real estate might be on thinner ice since commercial loans are relatively shorter in term and require frequent refinancing. What happens when commercial real estate investors must inevitably refinance, or buyers recognize they can earn more yield in short term Treasurys than by owning a strip mall or office building?

Bottom line is it seems prudent not to bet on a soft landing consensus that might only exist in a time with lots of hope, denial, and jobs available everywhere.

We will keep our exposures light for the time being and keep losses modest, keeping a mind that losses are inevitable but relatively smaller losses can be a huge advantage. The trick is to parlay our survival and stronger position and take advantage of the crowd’s distress.

Easier said than done, of course. But I like our situation. The parlay has already begun.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.