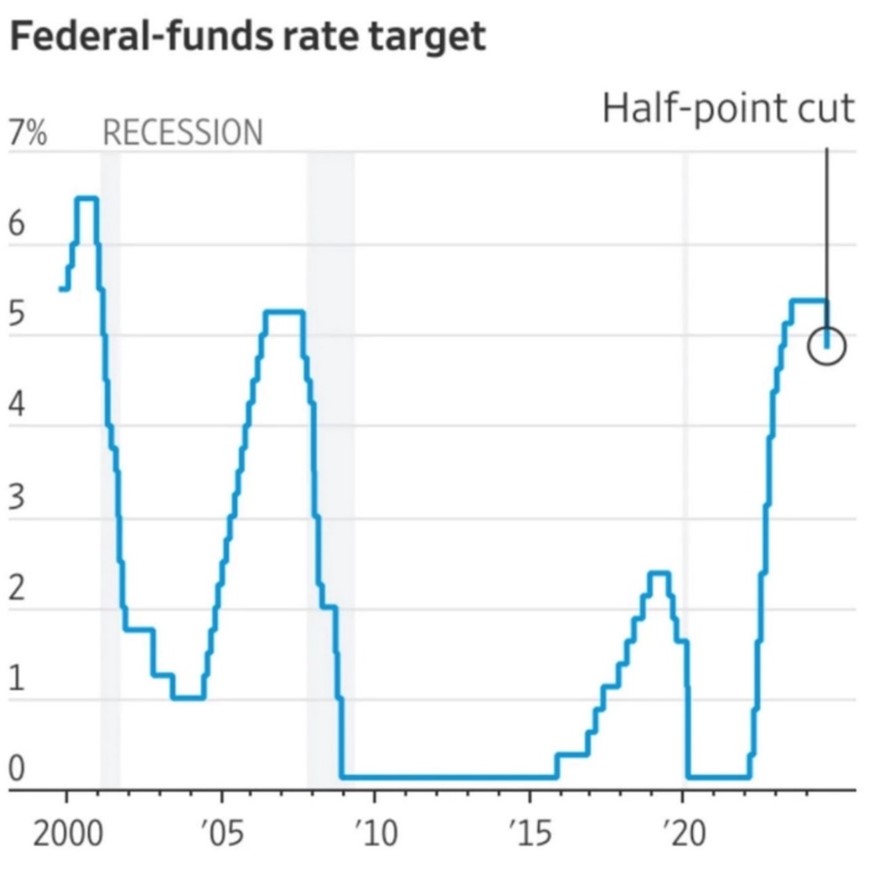

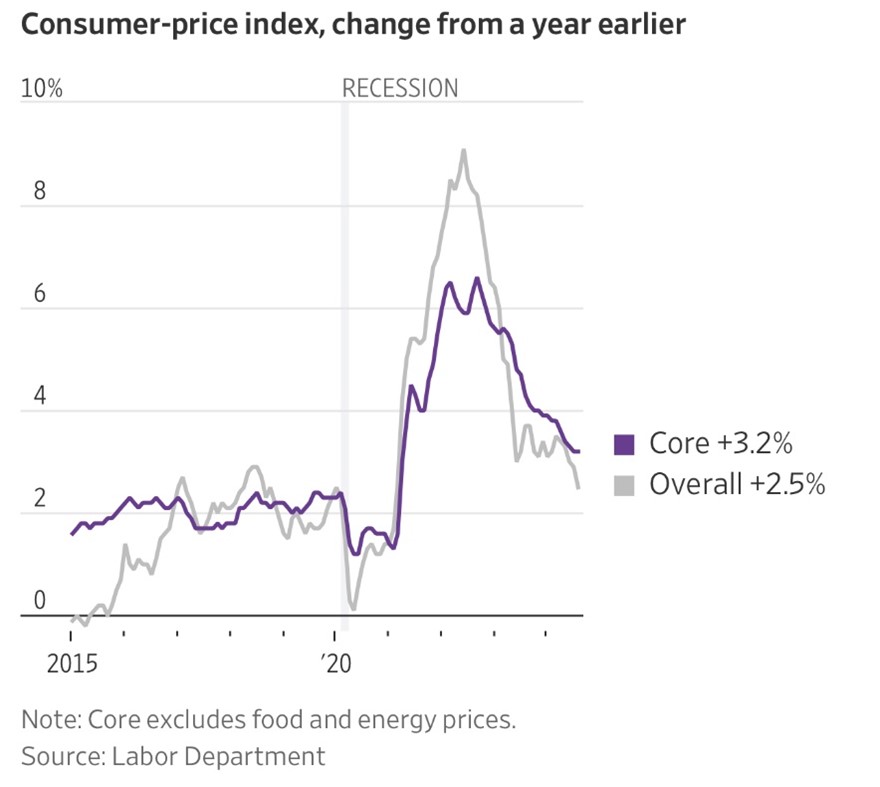

This week the Federal Reserve cut its short-term interest rate policy by half a percent to 4.75%-5.00%, marking an end to a two-year effort to recoup some of the excesses in Covid stimulus. The new phase of lower interest rates and easier money also signal it’s more or less “mission accomplished” in tampering inflation.

The Fed seems to be in “Maestro” mode once again.

We’ve been fortunate, and despite it’s apparent overall success, I’m not sure there’s anything prescriptive or validating regarding monetary policy these last several years (or, to be honest, since the horrors of 2008).

When I think about today’s central bankers and the Fed in particular, I can’t help but think of the 2012 film Flight. Denzel Washington plays Captain Whip Whitaker, a commercial airline pilot who performs a miracle open-field landing after a mechanical failure. The landing, requiring pulling the plane out of a steep dive then rolling to an inverted position while blowing out the engines to create a final level-glide, is a feat the film’s National Traffic Safety Board (NTSB) admits its pilots couldn’t replicate on a simulator. He was that good.

There were some casualties, but it’s clear all would have likely died had another pilot been at the helm. Captain Whitaker is a hero, at least until it is discovered he was high and drunk at the time. A similar landing would be ideal by The Federal Reserve as it reverses course on two years of driving up short term interest rates, which was itself a reversal of the largest monetary stimulus effort in history.

With a few blunt instruments that amount to just money printing and money erasing, the modern Fed must deliver growth, jobs, and higher asset prices while keeping inflation steady and speculators in check. That’s the law. The Fed has to see the future and act ever boldly.

Even though the Fed’s forecasts have been breathtakingly wrong, it all has seemed to work out. Stocks are up, inflation is back under control, people are employed. With each new cycle, crisis, and bubble, the stakes get bigger, the Fed’s actions bolder. However, the consequences of getting it wrong do, too. I think it’s good to assume as much, anyway.

Flight isn’t about an incredible landing or how morality and consequences should be filtered through results. Rather, it’s a film about a man struggling to come to terms with his demons and accepting responsibility.

Right and wrong isn’t up for much debate in the film. Good results rarely forgive clearly dangerous and illegal behavior. Maybe I think of Flight in hopes the Fed will think a little more like the NTSB or other safety regulators that must think counter factually or in a priori terms. Instead, the Fed today is made to judge only by results, like determining that someone betting it all on a game of Russian roulette did the right thing because he didn’t get the bullet.

Already many economic indicators are down materially. The two-year Treasury rate is falling to levels suggesting the Fed might be overly optimistic in its economic outlook and it will have to drop interest rates (and print money) by more than it currently anticipates.

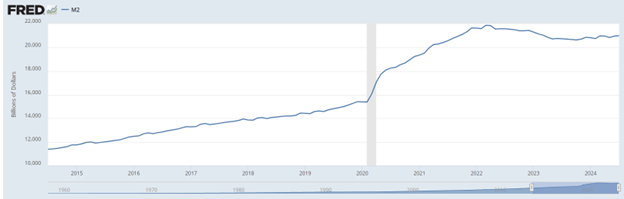

For now, markets seem to be more influenced by (1) the still-enormous levels of money sloshing around the system; all the tightening of the last two years hasn’t made much of a dent in the amount of money injected into the economy since Covid; and (2) the notion that lower interest rates inherently raise the present value of future cash flows—which is in the end, what any stock or business is.

(M2 is a proxy for money in the economy, consisting mostly of cash, checking and savings account balances, and non-IRA balances in money market funds and small CDs.)

We have been buying more stocks and bonds, as you may have noticed with recent trade confirmations in your inbox or mailbox. I’ll highlight these and overall investment strategy in my next post.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.