Markets continue to climb, although many assets seem stretched. Across our strategies, the goal is always good risk-adjusted returns. Given portfolio returns and, more importantly, the degrees of risk we’ve been taking, we seem to be at least on track. I admit returns have exceeded what I had expected given our relatively sober positioning.

Luck gets a lot of credit; we will never delude ourselves into thinking that wins are only of our making.

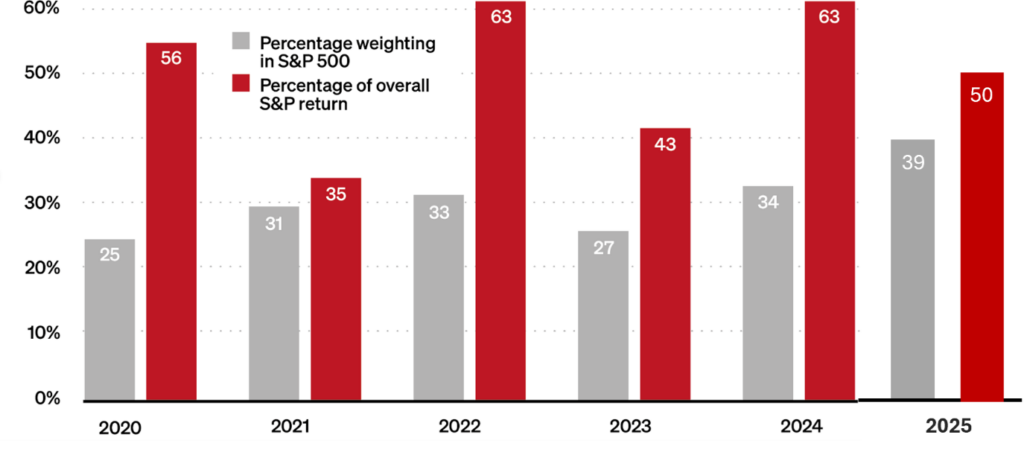

2025 repeated a familiar story: a handful of the largest companies in America accounted for an outsized portion of the stock market’s total return. In contrast, our holdings have been less reliant on these giant technology champions and more diversified (which is ironic given we hold far fewer stocks than stock market proxies like the S&P 500).

To be sure, the S&P 500 and similar market indexes are more than ever driven by larger, mostly information technology and internet companies. I calculate it’s one-half today. The largest 10 companies alone (almost all of which are digital) now make up 39% of the S&P 500, exceeding the previous high set in 1930 and almost double the last spike in 2000 when the top 10 were 21% of the index.

Concentration of Performance from Top 10 Stocks in S&P 500

Source: Fundsmith, UBS Global Investment Returns Yearbook 2025

The top 10’s contribution to total performance has been even more significant. Over the past six years, the ten largest stocks accounted for 52% of the market’s returns on average. To put it in perspective the size at the very top:

- Nvidia ($4.5 trillion market cap) alone is worth more than the index’s Utilities, Energy, and Materials stocks combined. This includes utilities, oil, natural gas, chemicals, fertilizers, metals, and miners.

- Apple ($3.8 trillion market cap) is $600 billion bigger than the Consumer Staples sector which includes mega stores Walmart, Costco, Target, Big Tobacco, Coca-Cola, and the many makers of food, soda, beer, wine, personal care products, household cleaners, diapers, and other categories found at the grocery store.

- Alphabet ($4 trillion) and Microsoft ($3.6 trillion) together are about $1.5 trillion biggerthan all Health Care stocks which include health insurers, Big Pharma, medical devices, hospitals, biotech, and drug stores.

What good is a 500-stock index if most of its members hardly matter statistically? My guess is investors will re-examine what it means to be diversified. Our diversification approach includes considering factor diversification with holdings across not just size and sectors but also across U.S. and international, growth and value, momentum and contrarian, and cyclical and secular. With more thoughtful diversification, I think we are better equipped to handle eventual turbulence in the economy and capital markets.

Diversifying properly while still requiring quality hasn’t hurt us, especially when quality outside the biggest stocks comes cheaper. This route becomes more compelling as markets get even more top-heavy and momentum driven.

Surely, the higher concentration happening is largely logical and deserved. These giants are great businesses that build valuable and immensely profitable products and services. With their earnings growth outpacing the rest of the market, total corporate earnings have also concentrated. To be sure, investing in these giants makes sense. We do. But it’s all a matter of degrees, position sizing, and not getting carried away.

This leads to another consideration regarding the concentration trend: one must recognize the self-reinforcing nature occurring (I am surprised it has lasted this long, but I wouldn’t bet on when it ends).

Enter indexing, which has been increasingly intertwined with the big getting bigger. Indexing and index funds have great utility: they are low cost, efficient ways to get broad exposure or beta. We use exchange traded funds (ETFs) which are index funds that trade like stocks. Almost all accounts we manage have some, and we rely on them exclusively for some accounts.

The case for index funds is rooted in the notion that markets are efficient or mostly efficient, meaning the prices of securities are always properly priced by the market. This requires the market to be mostly comprised of active investors acting rationally. Indexing takes a sort of “free ride” on market participants due diligence and resulting price discovery.

But what happens when most of the market is index-based, which has recently become the case for the first time? At the very least, it means a cycle where more automatic investment in the largest stocks makes them larger, which in turn causes more investment.

At some point, the trend breaks, and stocks are sold in droves as investors sell their index funds and ETFs as easily as they bought them. Easy in, easy out with a couple of mouse clicks or smartphone taps. When the trend breaks is anyone’s guess. For now markets are increasingly a function of these champions, and that means a function of their success in AI.

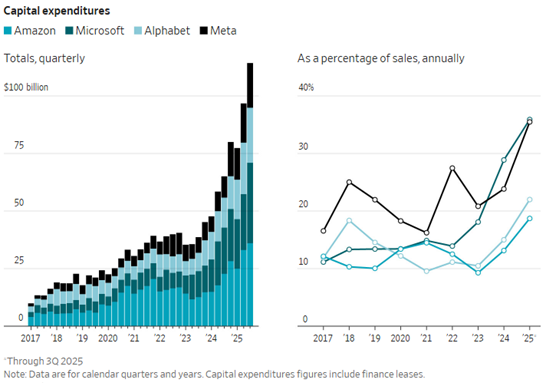

Digital giants that were historically capital-light and cash generating have entered into the AI era, requiring parabolic spending in R&D and especially data centers. The surge in data center spending can’t be ignored. Led by Amazon, Microsoft, Alphabet, and Meta, nearly $500 billion was invested in plant and equipment (including powerful semiconductors) in 2025. Spending is estimated to rise to over a trillion dollars annually over the next four years.

Source: The Companies

Even with monster profits, the AI surge presents risks to each, especially as they resort to more aggressive accounting maneuvers and large debt financings (Meta, Alphabet, and Oracle’s practices have come under scrutiny lately for both).

It all bears watching closely. Maybe half the stock market today by value is directly or indirectly driven by AI developments. Like previous era-defining technology leaps like steam engines, petrochemicals, aerospace, microprocessor, and the internet—much of the invested capital will fail to produce returns. Winners and losers will be revealed, but the real winners should once again be a world harnessing the new technology.

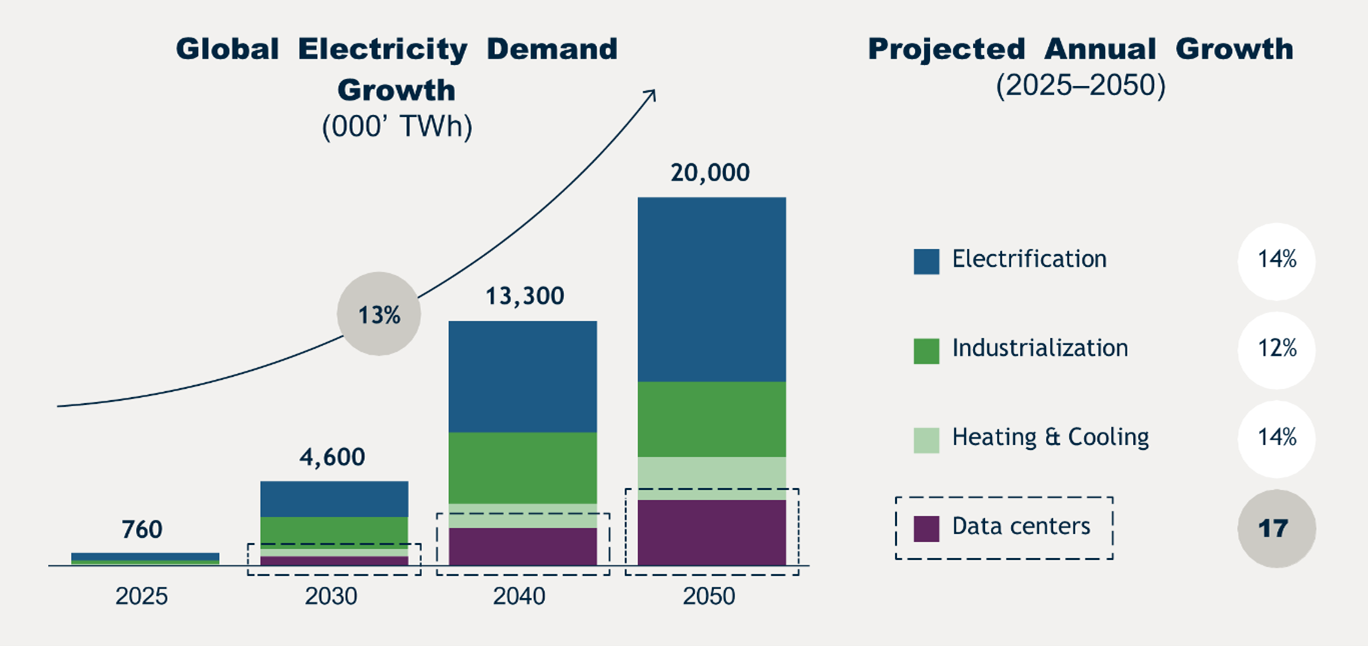

For now, we are participating in direct AI plays modestly, opting instead for those companies enjoying downstream benefits. Many great companies will be made even better and more profitable with AI. And then there’s the widening deficit AI data centers present to power infrastructure. Data centers are poised to rise to 10% of the U.S. electricity consumption by the end of the decade. This only adds to a demand wave from millions of new electric vehicles annually around the world.

Source: Brookfield Asset Management

Meanwhile, current capacity is already maxed out and grossly outdated. The U.S. especially won’t be able to produce the power it needs without massive investment. There are plenty of low-risk growth opportunities outside the glitz and glamour at the top, and they are relatively inexpensive.

Macro Thoughts

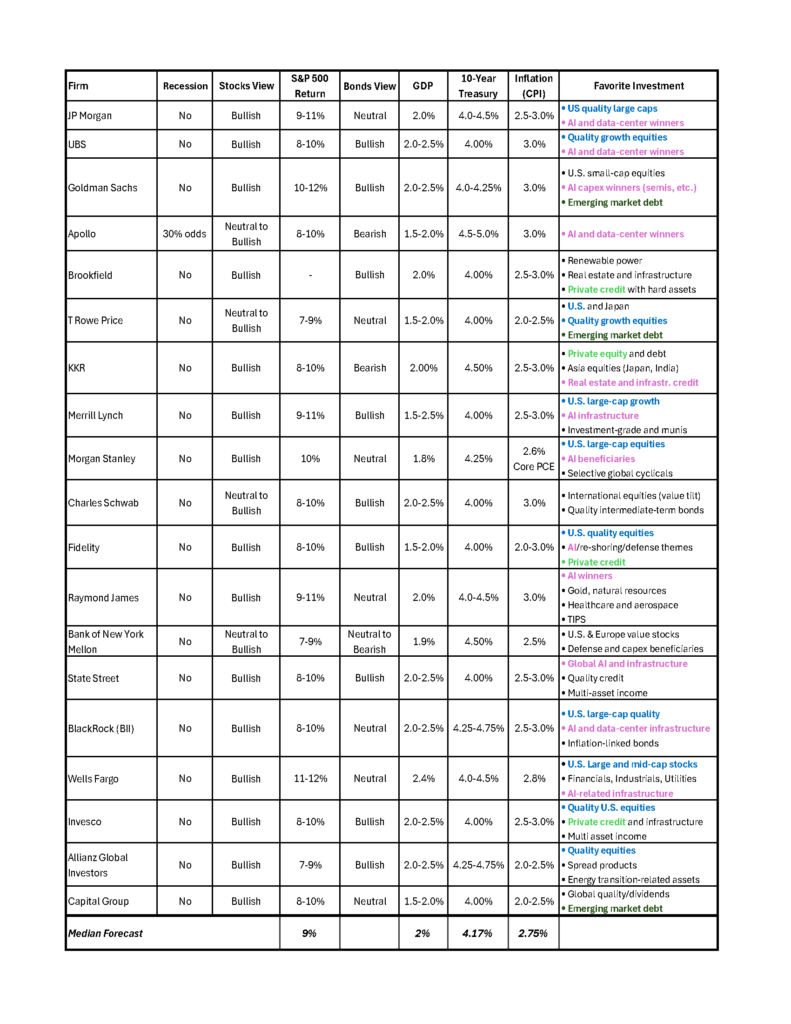

The market seems particularly unified in its views of the economy going forward. Forecasts point to modest GDP growth, 9% S&P 500 earnings growth, higher profit margins, and a steeping yield curve with the Federal Reserve cutting short term interest rates.

The lack of forecast variation is shown in the table at the bottom. While I have no forecasts of my own, I am (as always) skeptical when everyone seems to think the same way. We will refrain from basing your investments on exacting assumptions, including our own.

Rather than forecasts, we prefer to build in a margin of safety and think of the many ways one can lose money. That doesn’t prevent losses, of course, but it lowers the risk of permanent capital loss. Clients (myself included) can afford a flesh wound but not bleeding out.

It seems prudent today to question a lot of what’s going on in the world and think about the costs of major inflection points in geopolitics, runaway deficits, fracturing global trade, and the even the brazen, unprecedented, and constitutionally questionable actions of the American president.[1]

A fixture of our macro approach is thinking about the effects and unintended consequences of ever-increasing deficits, debts, and money printing. For the long-term investor, inflation is a principal risk, even if an underestimated one in the eyes of the market.

The market’s complacency made hedging inflation risk and dollar risk cheap. Hedging is still cheap, in my view. We continue holding modest hedges in the form of inflation protected bonds, precious metals, and stocks with pricing power. More commodities and infrastructure could find their way into portfolios this year.

Five Years

It doesn’t feel like this laboratory started five years ago. I’m pleased to say the ideas and practices motivating Regency’s very existence found validation. From here we double down on them. I think we are just getting started.

I thank you deeply for your trust and confidence.

Neil Rose, CFA

Appendix: Wall Street forecast sampling:

[1] Even if one agrees with everything Donald Trump does, consider the precedents set with Trump’s expansion of presidential powers and wanton self-interest; they will one day be used by a future president you don’t agree with. A stronger and unilateral president, one that can bypass Congress at will or ignore court orders, adds uncertainty if not risk.