2024 was another good year for stocks overall thanks to continued strength in just a handful of the largest technology and internet companies. The famed “Magnificent Seven” once again comprised the bulk of stocks’ overall returns.

The remarkable surge over the years in technology and internet stocks requires adjusting what exactly we mean by “stock market” or talk about the S&P 500. Today, just seven stocks comprise over one-third of the market’s overall value, a record. By my calculations, tech and internet stocks comprise half of the total value of the S&P 500 today. The stock market is now mostly digital and intangible—human capital, rather than physical with tangible products made by tangible assets.

To be sure, this is a good thing. Only human capital has endless potential and endless supply. And it seems only human capital can ultimately raise the living standards of an increasingly crowded and hotter world.

Yet, I did not foresee just how much the markets would so disproportionately reward the biggest proxies for human capital, including the Magnificent Seven; nor did I foresee 2024 being the year artificial intelligence would finally take hold and be the biggest technological inflection point since the internet.

Not investing more in the new digital overlords might have been an unforced error, but I don’t think it’s wise to capitulate and chase. There are speculative excesses everywhere.

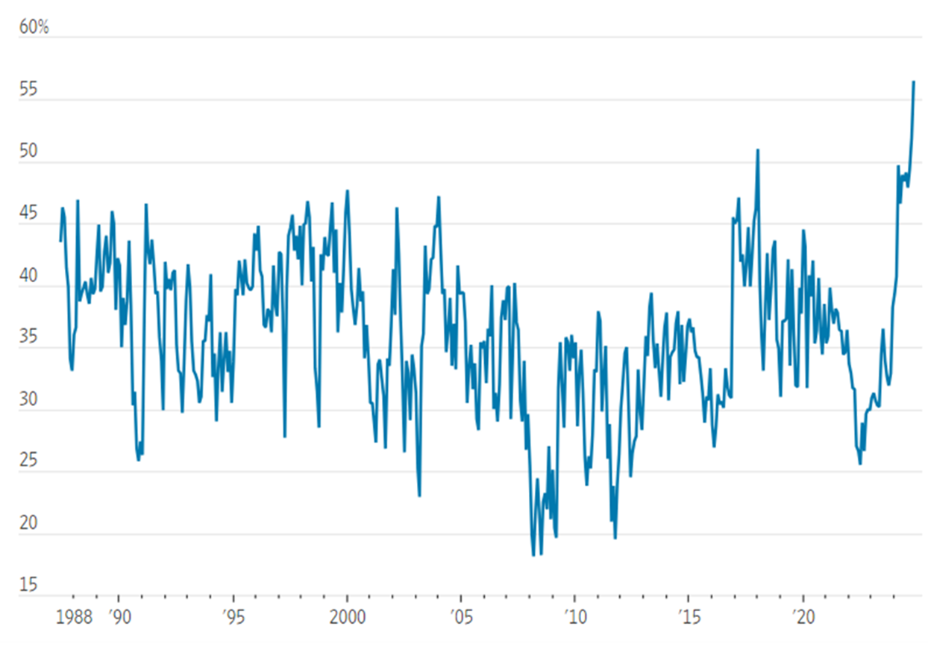

The seminal Conference Board’s survey recently reported record bullishness in stocks.

Crypto is making a comeback. Bitcoin was up 121% in 2024 and now has a price of over $100,000. Donald Trump just launched his own “Trump memecoin.” In just a week, Trump saw his net worth jump over $50 billion at one point (It will be harder for him to cash-in without crashing the price.)

Other coins with no practical utility or inherent value are also making instant millionaires and billionaires. After an October launch, “Fartcoin” is now worth $2 billion! Lunacy.

Recently, an art piece in the form of a banana duct-taped to a wall, sold for $6.2 million at auction.

November’s election has brought new bullishness (or at least relief) in stocks. Investors now anticipate broad tax increases scheduled for 2026 won’t happen after all. (The ramifications of the election are something to ponder; I’ll offer some initial thoughts in a future memo.)

Sobriety and even suspicion will continue to influence our portfolio compositions, in part because all the bullish factors and good news are already known and perhaps even built into today’s stock prices.

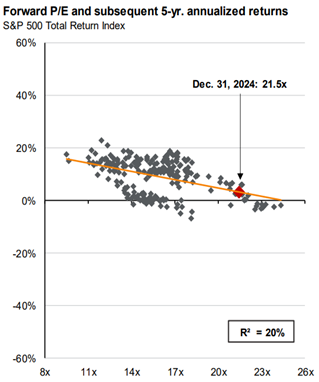

It’s hard to argue the stock market doesn’t reflect optimism. Price-to-earnings multiples for stocks are up to levels that have always preceded a downturn in stocks. A recent study from J.P. Morgan shows the inverse relationship between market P/E ratios and returns over the next five years. It seems prudent to temper expectations of general stock returns going forward.

Interest rates are a bigger reason to not be greedy.

Interest rates drive bond prices, but they are also key to what other assets like stocks and real estate are worth. They represent opportunity cost—specifically what one can earn by just investing in U.S. Treasury bonds.

How interest rates always present a comparison for our investment dollars is better explained with an example: If the 10-year Treasury jumps from 1.0% to 4.6% (where it is today), its price lowers but its prospective value rises. Investors now get paid more for doing nothing.

All things equal, the value of stocks and real estate should fall because the less risky option has become more attractive, in this case much more attractive given the magnitude of the rise in yield. 1.0% to 4.6% is a big change on the margin.

But the current jump in Treasury yields hasn’t impacted stocks, at least not yet. Instead, investors have grown more optimistic about the future, including future earnings.

The point here is higher prices and higher opportunity costs mean stocks and real estate have less room for error, less capacity to roll with any bad news. Our overall stock allocations in multi-asset and conservative portfolios have decreased as a result, even as our conviction in certain stocks has increased. For the first time in a while, we are balanced between stocks and bonds.

Recent Buys

We have been accumulating Alexander & Baldwin (Ticker: ALEX), now a pureplay Hawaiian commercial REIT. I looked into the company almost 15 years ago when A&B was a unique conglomerate (and not in a good way). It was a resort developer, owner of commercial real estate in Hawaii and on the mainland, land bank of 88,000 acres in Hawaii, farmer of sugarcane, and oligopoly shipper (Matson). A&B was a perpetual under-earner, often losing money on its volatile development and farming businesses.

Today, shipping, farming, and development are gone. Mainland investments have been repatriated back to Hawaii. 2,300 employees are now fewer than 100.

A&B is now almost four million leasable square feet and 142 acres of ground lease—all in Hawaii. I think its value materially exceeds its $1.3 billion market capitalization (it also has $454 million in net debt). More importantly, with a simpler operation and new, shareholder-oriented management, the downside risk to the stock seems low. Also, Hawaii hasn’t been flooded with new retail space like most of the country. Outside of Manhattan, no major metropolitan area in the U.S. has less retail space per capita than Hawaii.

The dividend yield is 5.2%. Find more information on its properties in A&B’s latest investor presentation: https://bit.ly/3WocjZS

Property & Casualty stocks remain our largest industry bet among stocks. Our basket is mostly comprised of Chubb (Ticker: CB), Markel Group (Ticker: MKL) and Berkshire Hathaway (Ticker: BRK/b) with smaller holdings in Aflac (Ticker: AFL) and AON plc (Ticker: AON). We added more to our holdings across 2024.

We re-entered Thermo Fisher Scientific (Ticker: TMO), the largest maker of equipment and technologies for life sciences and drug discovery. Historically a secular grower, Thermo Fisher has had to weather a bear market among its pharmaceutical and biotechnology customers, resulting in flattish revenue and earnings over the past three years. The company should resume double-digit percentage growth this year or next. In the meantime, the stock trades a modest multiple of trough-like earnings.

Few would recognize our new investment, ASML Holding N.V. (Ticker: ASML), even though it’s Europe’s third most valuable company. ASML is a monopoly on extreme ultraviolet lithography technologies required to make the world’s most advanced microchips. ASML’s machines are the stuff of science fiction, with so much complexity and precision needed that their $370 million machines must be operated by ASML employees at their customers’ fabs.

After reaching $1,110 per share in July, ASML stock dropped to $645 in November. Today, the stock trades around $750. Earnings should grow 15-20% per year over the next three years. AMSLs growth, profitability (30% net profit margins), and critical role in AI justify a P/E of 30x this year’s earnings.

Donald Trump’s win in November and a congressional shift right could be the catalyst for companies that have long been in stock-purgatory. We added Schlumberger N.V. (Ticker: SLB), a leading oilfield services company. SLB offers the services and technologies needed to find and produce oil and gas over land and sea. At 11x earnings, SLB is cheap, especially compared to today’s market and its own history. Cheapness is rarely rewarded without a catalyst; a new administration might be it.

Bonds

We have also increased our bond allocation gradually as interest rates climb. We will likely continue to do so over the next few months. It’s a loosely held thesis, but I think high stock P/Es and the current level of interest rates can’t coexist for long; something must give.

The rise in rates is almost all in real interest rates rather than from higher inflation expectations. This means bonds are increasingly attractive: investors are getting a yield reflecting a real yield on top of expected inflation.

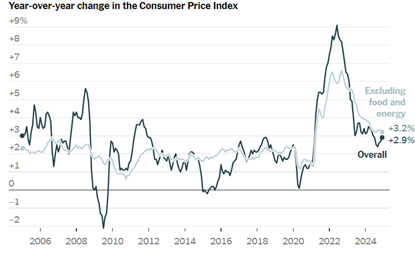

Take the 4.6%-yielding 10-year Treasury mentioned earlier. Similar maturity inflation protected Treasurys (TIPS) yield 2.2% today. The difference of 2.4% is the market’s annual inflation expectations over the next 10 years. If CPI comes in above 2.4% over the next 10 years, then the TIPS will outperform the traditional Treasury. If CPI is less than 2.4%, the traditional Treasury will outperform.

Since inflation is a principal risk to the long-term investor, TIPS should always be on the investor’s radar, especially since TIPS are not a double-edged sword. Investors get one-for-one inflation returns (plus a real yield), but not so if what comes is not inflation but deflation.

We will likely add more TIPS to portfolios along with traditional bonds. With endless deficits and debt accumulation in store—and zero political will to realistically solve it—inflation might be the only thing we should fear financially over the longer-term. It might be smart to get protection now while the market remains unconcerned.

To borrow a concept from Marty Whitman, we will be aggressively conservative in managing money, knowing that to do so requires occasionally buying a compelling value in size. Conservative is not just characterized by avoiding stocks and holding cash, which presents trading risk and longer-term performance risk. And what could be more conservative for a long-term investor than a truly great deal on a long-term investment?

* * * *

Neil Rose, CFA

The content provided in this document is for informational purposes and does not

constitute a solicitation, recommendation, endorsement, or offer to purchase or sell

securities. Nothing should be considered personal financial, investment, legal, tax, or

any other advice. The content is information general in nature and is not an attempt to

address particular financial circumstance of any client or prospect. Clients receive

advice directly and are encouraged to contact their Adviser for counsel and to answer

any questions. Any information or commentary represents the views of the Adviser at

the time of each report and is subject to change without notice. There is no assurance

that any securities discussed herein will remain in an account at the time you receive

this report or that securities sold have not been repurchased. Any securities discussed

may or may not be included in all client accounts due to individual needs or

circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed

was or will prove to be profitable, or that the investment recommendations or

decisions we make in the future will be profitable or will equal the investment

performance of the securities discussed herein.