Click here to view printable pdf.

I think markets are experiencing a major inflection point.

An inflection point marks a significant change to a fundamental driver determining value. It is not just the news of the day behind market swings. Inflection points can come with sea changes in fiscal or monetary policy. Exogenous factors such as shifts in demographics or technology can also mark an inflection point. Regardless of type or cause, investors inevitably see more value in some assets and less in others going forward.

The current inflection point stems from the convergence of certain longer-term trends that now look unsustainable or otherwise require painful tradeoffs. The past 40 years have been an era of flowing fiscal and monetary tailwinds: lower interest rates and inflation, more fiscal spending and deficits, and a rising tolerance for bailouts. Overall, a Goldilocks time in human history.

These trends culminated with the new and soaring stimulus packages employed since the start of the Great Financial Crisis (GFC). The last 15 years have been a time of repeated money printing, interest rate suppression (to the lowest levels in human history), and new and creative stimulus. Until recently, all of this came consequence-free with no rise in interest rates or inflation.

Policymakers’ “help” to support jobs and economic growth also fueled widespread risk-taking and speculation. A long bullish run in stocks, bonds, and real estate also came with episodic bubbles starting in 2000, first in tech stocks, then real estate six years later. The GFC rescue eventually fueled bubbles in commodities and “emerging markets.”. Several years later an absurd “digital” bubble came in the wake of massive Covid stimulus.

Two years ago people were buying JPEGs for millions of dollars; and Dogecoin, a cryptocurrency made as a joke to poke fun at the crypto craze, became a meme and catapulted to a value of $90 billion. (It still has a value of $10 billion today.)

It can’t be overstated how powerful ultra-low interest rates have been for asset prices and wealth accumulation over the past four decades (and for the several bubbles along the way). But perhaps it is now time to recognize how unsustainable constant intervention and stimulus are, despite governments’ good intentions.

At some point, more debt and money printing have consequences. Rising inflation and interest rates beginning last year have finally suggested that maybe we can’t have our cake and eat it, too. For the first time in over four decades, central banks must choose between fighting inflation and juicing the economy and markets.

The Federal Reserve has chosen combating inflation for now, until it pushes the economy to recession. (That everyone seems to agree the recession will be historically mild should bother us.) After that, the Fed will resume with money printing and lower interest rates—and, presumably, new bailout vehicles with euphemistic names. That’s the plan.

Perhaps this tidy and convenient forecast is behind stocks’ rebound so far in 2023. It seems fears of recession are more than matched by a belief in the “Fed Put.”[1] Investors have come back to the prime beneficiaries of easy money, namely large U.S. technology giants.

A New “Nifty Fifty”

The market’s penchant for Big Tech also seems rooted in the same psychology of the “Nifty Fifty” craze of the late 1960s and early 1970s. The Nifty Fifty were comprised of large American “blue chip” growth stocks—bulletproof companies that could fly above economic and political tumult. Investors believed no price was too high for quality, crowd-pleasing stocks; no premium was too dear to look prudent. Money managers thought they couldn’t be fired for holding Coca-Cola, Xerox, IBM, and General Electric, even if paying 50 to100-times earnings.

However, investors learned quality doesn’t guarantee safety or successful investing. By 1974, Nifty Fifty stocks were down some 90% from their peak.

Today there’s a new Nifty Fifty mindset. The macro concerns of the day are being soothed by holding stocks representing assured growth—perhaps in a more extreme way this time given even higher levels of concentration. Today’s Nifty Fifty is rather the Magnificent Seven, technology stocks that are now the largest seven companies in America by value.

| Company | Market Cap | Current P/E |

| Apple | $3.0 Trillion | 33x |

| Microsoft | $2.6 Trillion | 37x |

| Alphabet (Google) | $1.6 Trillion | 28x |

| Amazon | $1.4 Trillion | 85x |

| Nvidia | $1.1 Trillion | 237x |

| Tesla | $909 Billion | 83x |

| Meta (Facebook) | $787 Billion | 37x |

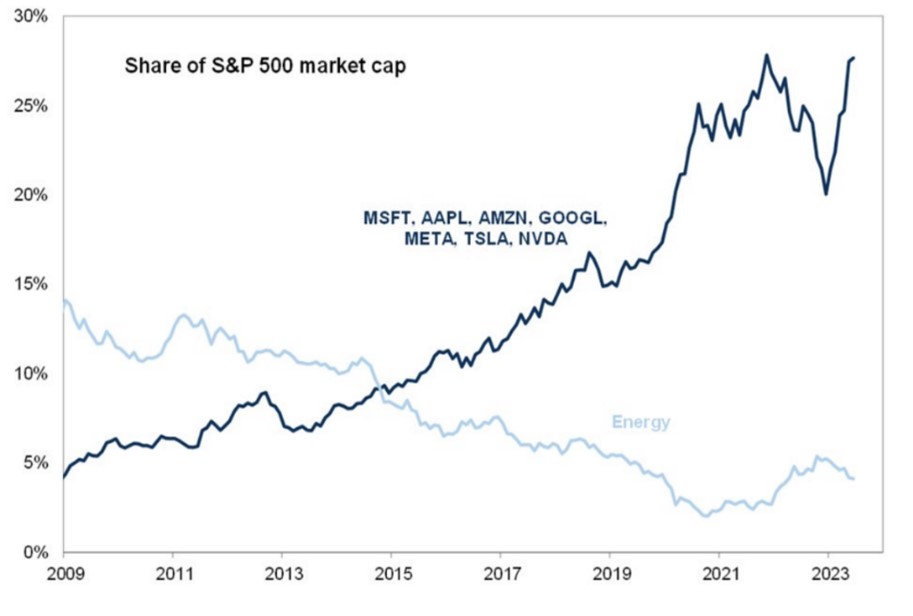

Quality, growth, and “AI” exposure are what the crowd wants, and it will pay anything for it. Two of these companies (Tesla and Meta) have doubled so far in 2023. Nvidia has tripled. Like the dot.com era, a handful of technology giants comprise a significant and growing percentage of the total stock market.

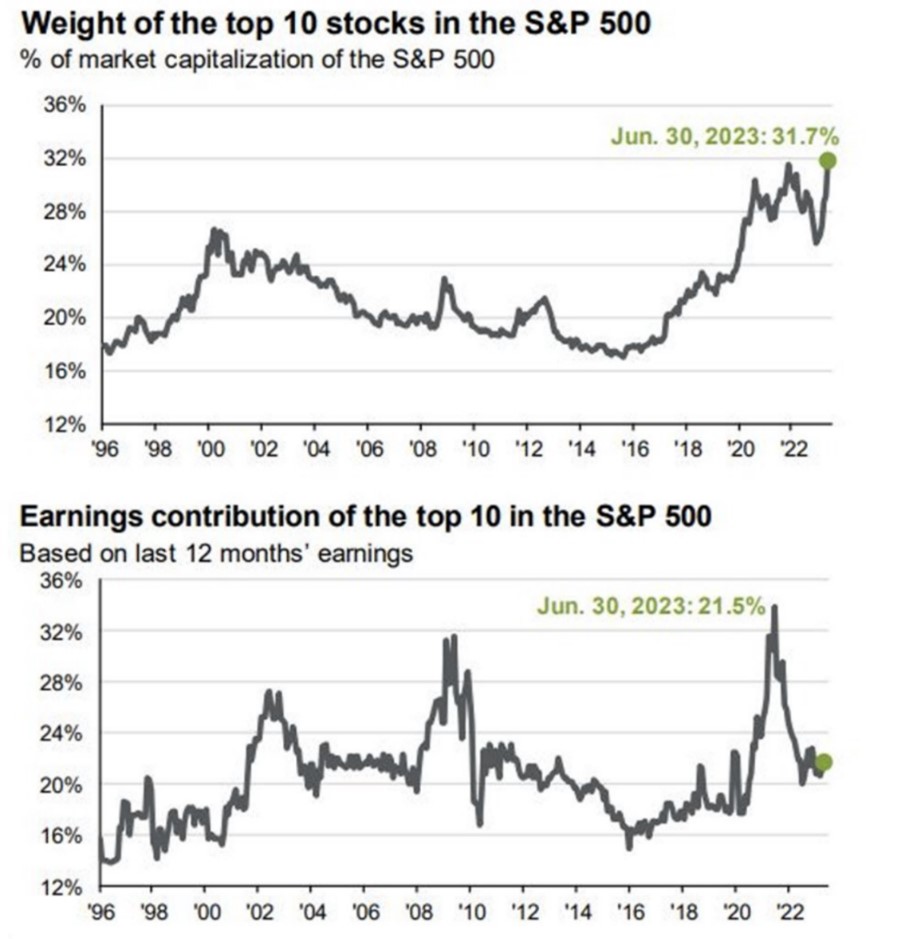

The largest 10 stocks in the S&P 500 now represent almost one-third of the S&P 500’s total value. The “size effect” in stocks is also happening within the tech sector. The Magnificent Seven today commands 55% of the tech-heavy Nasdaq 100 index. And, as their index weights grow, so does future investor demand, including from mutual fund and index fund investors. With each payroll deferral to a 401(k) account, investors are buying greater amounts of these champions whether they know it or not.

In other words, as performance leadership becomes more concentrated, the stock market becomes less diversified, more expensive, and riskier. I hesitate to forecast, but history has not been kind to investors piling into the hot stocks of the hot industry.

The good news is this kind of mania is not something to lament for the thoughtful investor. More opportunities and value are found as the investing masses concentrate and look for safety in numbers.

Examples of where we are finding value include:

- Capital intensive “moats.” While we prefer capital light businesses, capital intensive ones experience unexpected growth in profitability when capital becomes scarce. We are looking to invest in atoms not bits (i.e. physical assets instead of tweets).

- Small cap stocks. Today, smaller stocks come with a material discount to large companies. We especially like companies that are 800-pound gorillas in a niche market. Their high returns on investment are protected, in part, because their industries are too small to justify new, larger companies from entering and competing.

- Foreign-based stocks. Like with small caps, companies based outside the U.S. carry a large discount to domestically-based ones—even if their operations have the same geographic footprint. The U.S.’s superior performance to international has been one of the longest market trends today (the dollar’s leadership versus foreign currencies has also been stark). Foreign flagged stocks also carry possible catalysts, including acquisition, currency tailwinds, or moving their stock listing to the NYSE or Nasdaq.

- Deep value. Just as the stocks in the highest decile of P/E multiples climb further from the rest of the market, stocks in the lowest decile of P/E multiples now have outsized discounts. The highest and lowest P/Es in the market have rarely moved this far from the market’s average (currently 19-times). I can’t remember another time where so many stocks traded at five-times earnings or when five-times earnings came with decent balance sheets.

- “Hydra” like capital allocators. Over the years, I’ve learned the value of owning (and trying to emulate) “antifragile” companies (borrowing Nassim Taleb’s concept in his book, Antifragile). More than simply “robust,” antifragile companies are strengthened from calamity and disorder, like the multi-headed Hydra that would grow two heads if one was cut off. Berkshire Hathaway became a Hydra during the GFC, buying on the cheap companies and assets that would massively increase Berkshire’s earnings power and growth. There are also lesser-known Hydras using smart capital allocation to take advantage of markets.

As is usually the case, finding good areas to invest is easier by starting with a process of elimination: by identifying those investment types we would seek if we were seeking to lose. In addition to today’s tech darlings, companies with high debt loads should be dismissed. For years, lower interest rates helped many unhealthy companies avoid bankruptcy. The interest rate winds have changed; many won’t make it. Airlines, cars, and retailers come to mind as (still) un-investable.

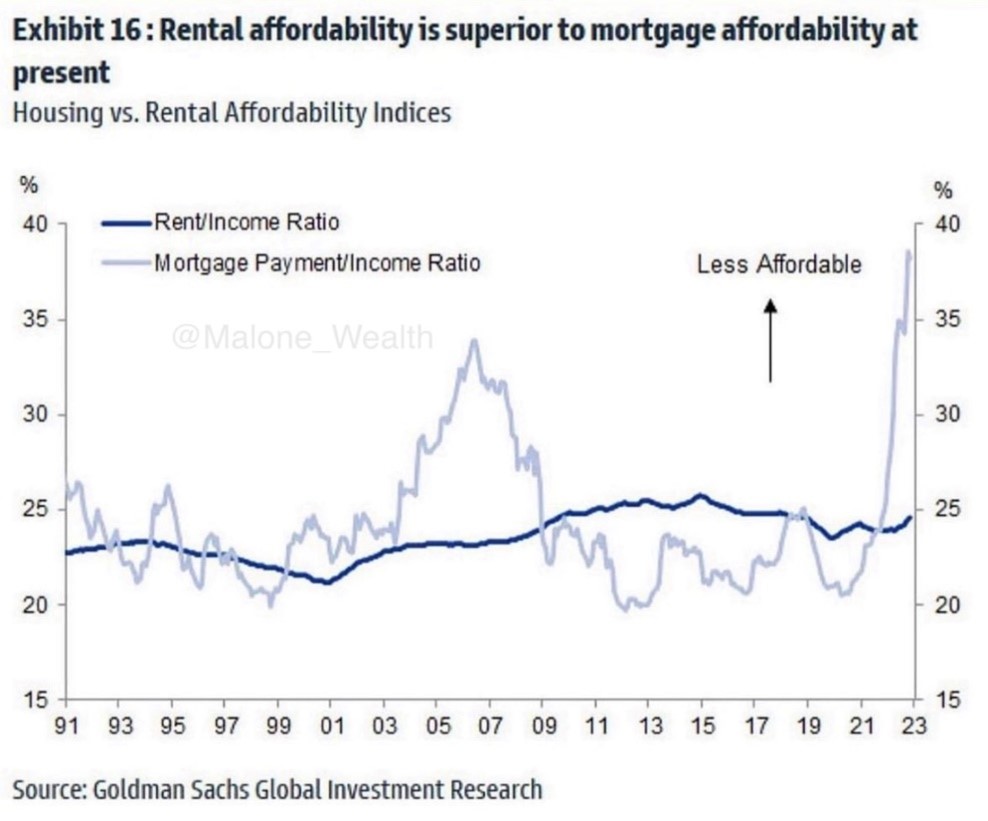

The area I’m worried about most is real estate. Commercial real estate will see more distress with costlier refinancing along with buyers requiring more yield in their purchases. Residential real estate has been stickier, if only because fewer are choosing to sell and switch from their 3% mortgage to a new 7% one. Time will tell if the only pain inflected by today’s high prices and lower affordability is a temporary drop in the number of listings. If it is, I would have to rethink my critical views of our money printing overlords.

Our bond strategy hasn’t changed—heavy in short-term notes, Treasury bills, and inflation-protected Treasurys (TIPS). The latter represents the fixed income’s best risk/reward with the highest real interest rates in years. Today, inflation protection comes for free with new or recently issued TIPS.

In all, I feel we are well diversified and potentially Hydra-like with adverse changes in markets. I look forward to reporting soon on some notable new investments and themes currently in the works.

Please don’t hesitate to call if you have any questions or would like more color on anything.

Neil Rose, CFA

[1] This term is often used to describe the belief that the Fed will step in accommodative monetary policy (money printing) to support asset prices, including stocks, if they fall. Supporting equity and real estate prices seems to now be Fed policy, if only implicitly.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.