The bull market has hit another gear. New highs are being made weekly as investors pile in, including the many frightened by the increasing brazenness of Donald Trump. Genuine bull markets eventually get everyone to capitulate and buy up.

I’m reminded of a quote from famed investor George Soros: “When I see a bubble forming, I rush in to buy, adding fuel to the fire. That is not irrational.”

Perhaps. I would only agree to the extent bull markets and bubbles persist long after they are obvious. (I remember when Alan Greenspan warned Congress of “irrational exuberance” in 1996, four years before the internet bubble finally popped.) Otherwise, riding bubbles is only as rational as picking up loose change in front of a moving steamroller: the odds of getting squished would have to be very, very low (and that might be a generous comparison). The market steamroller moves fast.

I’m ambivalent about the market and our good fortune. On one hand, making money never hurts, and performance has been more than satisfactory despite us not binging on the more speculative stocks driving the S&P 500’s 14% total return in 2025.

On the other hand, we’ve seen this movie before, where a virtuous cycle of gains and sentiment drives stock performance well ahead of market fundamentals, and investors pivot their rationale to playing off the greed of other investors. Of course, everyone plans to get out just in time and let others hold the bag.

This ambivalence, and a sense that markets are on borrowed time, are reflected in our investments, especially in the conservative, multi-asset portfolios that account for a large majority of clients’ assets. In our view, it’s important as ever to remain sober and humble. It also seems foolish to be too contrarian or obstinate by hiding out in short term Treasurys and cash equivalents, especially given our “dual mandate” of risk management over the shorter and longer term.

Good risk-adjusted returns are always the goal, and we are getting that today. But it won’t always be so, can’t always be so. Underwhelming performance and even poor performance are inevitable given enough time. When that time comes, it should be in the form of too much conservatism with not enough returns rather than too much speculation and huge losses. Not jeopardizing our clients’ financial future will always be first and foremost here.

We also don’t want overall conservatism or prudence to blind us to the positives and new opportunities rapidly developing before us. Despite markets getting ahead of themselves and fiscal and geopolitical challenges snowballing, there is still a case for longer term optimism. We should remember all market manias are always built on some undeniably good truth with promising longer term benefits and opportunities. The current time is no exception.

The evolution and advances we’re seeing in computing and artificial intelligence (AI) are very real, with implications comparable to those of the internet, automobile, railroad, and steam engine. It’s still early, but changes are already afoot with rapid productivity advances, new products, services, and use cases, and the disruption of many businesses and jobs.

Those who truly embrace these new technologies and build with them will see opportunities they couldn’t have imagined, especially among white-collar workers and entrepreneurs. (I think AI will drive more entrepreneurship unlike anything before it.) Those who don’t will quickly fall behind and see an increasingly unfair world.

Though still just a novice, I have found every minute spent diving into all things AI has been a mental and motivational boost. Never have I experienced anything yielding such productivity and instantaneous time savings. That’s just AI’s lowest hanging fruit: elimination of time-consuming, manual, and repetitive tasks and digging with a much larger informational shovel. These are huge wins, but the higher-level, compounding AI stuff—advanced analyses, discovery, an army of customized AI agents—will be game changing. I can’t wait.

The team here knows AI is not optional but something that must soon be a part in every facet of our work. AI and the tools we create will be as necessary to our work as hammers, saws, and tape measures are to carpenters. Whether we like it or not, everyone is now an engineer.

Lastly, I want to offer a nuanced view of investing in AI. As confident as I am in AI as a lasting benefit and game changer, I am not as confident in chasing AI stocks now, at least in the way most are.

Prices are high and even astronomical, as if every AI venture will yield huge profits. They likely will not; many losers will be revealed, just as they were in the past with solar stocks, dot-coms, the “-tronics” companies of the 1960s, early automobiles, and the railroads decades before that.

All previous mega-bull markets and manias were based in real burgeoning and game-changing industries. At the time, it was right to assume that rail, autos, electronics, the internet, telecommunications, and alternative energy would be the future. The thing is, picking winners, especially when great expectations are already priced in, has been a fool’s errand. Even companies that survived saw massive drawdowns. Amazon was down almost 90% after the Tech Bubble burst. A buyer of Microsoft in early 2000 (Microsoft even then was considered a relatively unassailable growth company) had to wait almost 15 years to see a profit.

From the beginning, railroad and automobile investors saw their companies go bankrupt over and over again even as railroads and automobiles only grew in importance.

Memories are short. Few see the connection to the current AI datacenter boom to the telecom boom almost 30 years ago. Back then, massive investments in telecom infrastructure and fiber cables were made for obvious parabolic growth in internet traffic. Too much was built too fast. Telecom giants like Global Crossing and WorldCom crumbled under the debt and creative accounting that fueled their massive buildouts.

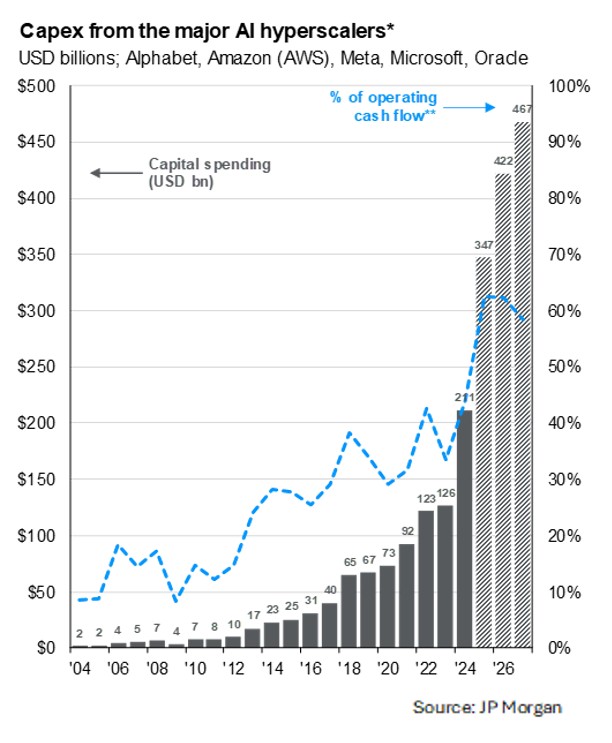

Some parallels are happening today as AI has already triggered the largest capital expenditure wave ever. Every week there seems to be new AI datacenter investments announced in the tens of billions and even hundreds of billions of dollars.

The sums are so large that even companies like Microsoft, Google, Meta, and Oracle, each generating tens of billions in annual profits, are resorting to debt and creative non-cash financing methods. OpenAI, the company behind the popular ChatGPT, signed a $300 billion, five-year deal with Oracle to build datacenters. But it’s unlikely Oracle will receive $300 billion in cash from OpenAI, which currently takes in only $12 billion in annual revenue. Even with rapid growth, OpenAI, like many others, will rely on creative and even circular financing to complete the deal.

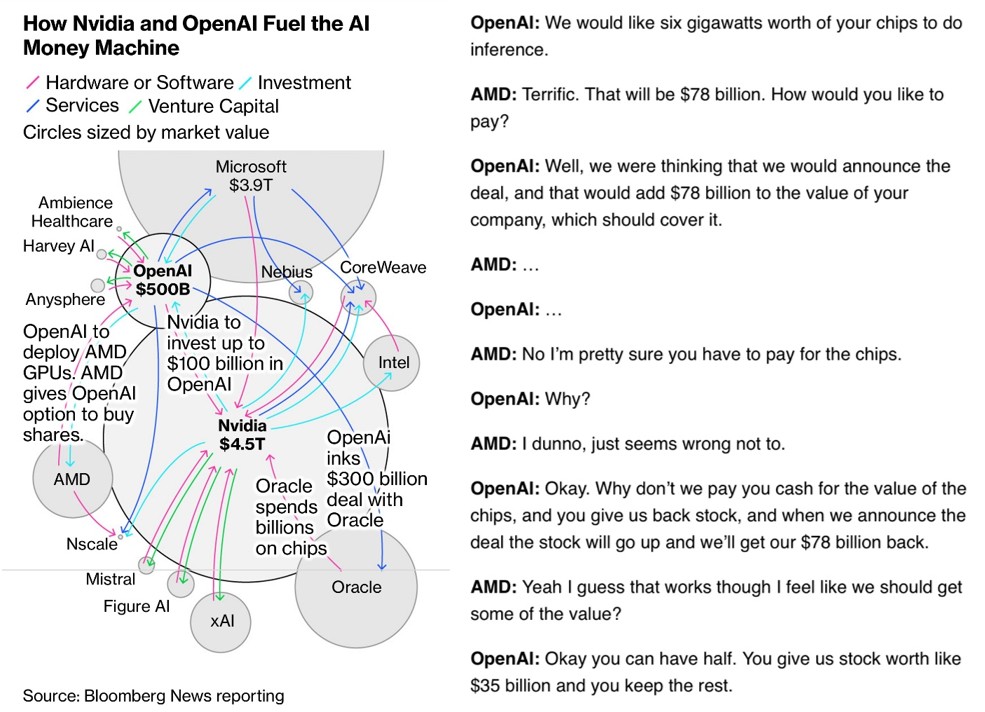

Their circular financing goes like this: Part of Open AI’s order to Oracle will be paid by a $100 billion investment from Nvidia, which will be selling expensive chips to Oracle for its datacenters. The diagram below shows prominent circular deals today. A humorous yet accurate take from Bloomberg’s Matt Levine on OpenAI’s deal with chipmaker AMD sums it all up nicely.

At the very least, these deals require capital markets to be very accommodating to large companies repeatedly selling new stock to the public; or, for non-public companies like OpenAI, sell new stock to other companies or venture capital funds.

For years, tapping investors has not only been easy but increasingly successful as company valuations keep going up. Huge venture capital supply is why companies like OpenAI and Elon Musk’s SpaceX have remained private. Why go through the costs and regulatory headaches of being a public company if raising money is easy?

Generous investor demand has also helped companies subsidize customers’ costs and achieve massive scale. No statue will be erected in honor of the bullish investing masses, but their risk-taking and cheap money allowed SpaceX to find a way to cut space travel by 90%. Tesla and Netflix would not be household names if each couldn’t constantly sell new stock to subsidize car and video subscriptions and sell at a loss—and do this for years. Nothing generates revenue and scale while cutting the competition than selling below cost. Sell a dollar for 60 cents and see what happens to customer demand and sales growth.

The same subsidizing is happening with AI now: companies are allowing all of us to use and build with AI cheaply, at well below their costs. I struggle to find another comparable example where value exceeds price (and most AI apps let you do a lot for free). Paid premium versions of ChatGPT, Claude, Gemini, Perplexity, and others at $5-20 a month are a small fraction of what users would pay. There’s no better time to dive in, tinker, learn, and ultimately build useful things with AI. It could all get a lot pricier when companies can no longer print shares at will.

As for investing in AI, we have some investments with direct and indirect exposure, but to be honest, I don’t expect much from them if only because they are already the biggest companies out there and most investors hold the same stocks. Obvious and crowded generally don’t result in huge gains.

If history is any guide, the best AI investment opportunities will be in concepts and businesses not yet born. Maybe a few are in their infancy and not yet listed on public exchanges. The greatest opportunities will be found in what people build with AI rather than the AI platforms and the datacenters running them. If this is true, there’s no need to be hasty.

We have plenty of time.

***

Neil Rose, CFA