Happy Friday!

We send you this important 40-minute chat where Arthur Mallet and I discuss all things macro and macro-investing. We address important concepts shaping Regency Capital’s approach to investing, the advantages and pitfalls of macro, and the evolution of my macro education.

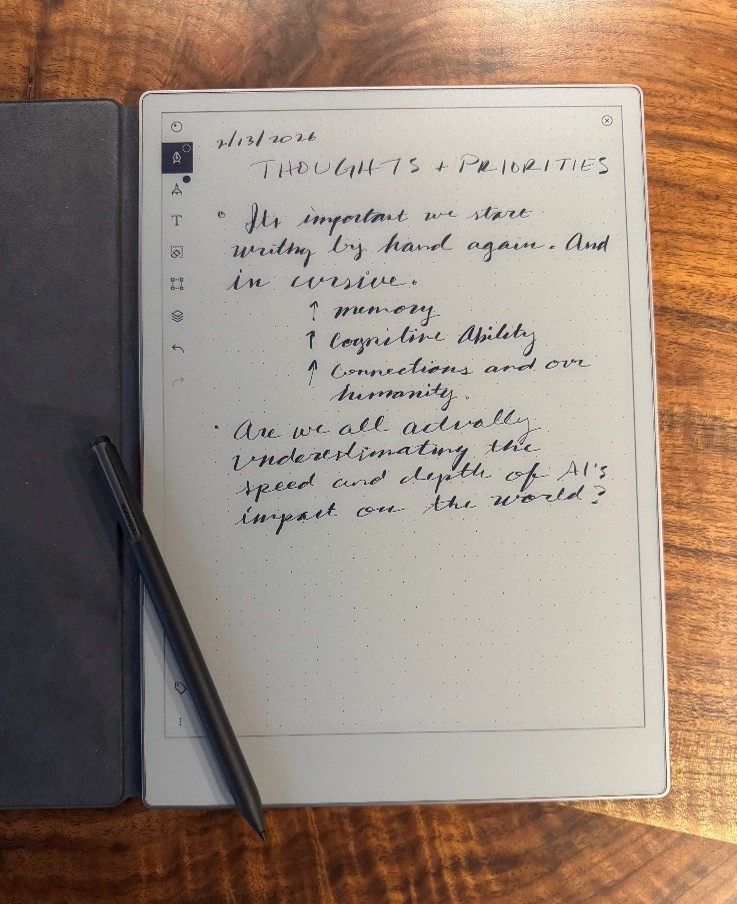

Also discussed in this episode:

- The rise of ESG investing

- Bubbles and absurdities in today’s market

- Inflation

- The biggest macro question of all

- Current investment strategy

Regency Capital’s podcasts can also be found through Apple Podcasts and Spotify.

Have a great weekend!

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.