Inflation has been falling, but the case for Inflation Protected Treasury Securities (TIPS) keeps rising. Yesterday, we added a little to our TIPS holdings.

TIPS aren’t always a good deal or worth owning, but they should be a part of one’s list of market bell weathers, alongside the S&P 500 and various interest rates and commodity prices. This is especially true if (1) one’s investment objectives including matching and beating inflation over the longer term—i.e. earning a real return on one’s money; and (2) one considers the government’s Consumer Price Index (CPI) is at least a tolerable measure for broad inflation over time.

Since interest rates and inflation expectations fluctuate, it pays to pay attention to TIPS. Sometimes inflation protection comes very cheaply.

Just two years ago, TIPS could be characterized as rather confiscatory instruments of wealth as TIPS of any maturity came with a negative interest rate due to the Federal Reserve’s Zero Interest Rate Policy (ZIRP) and the market’s singular worry about deflation.

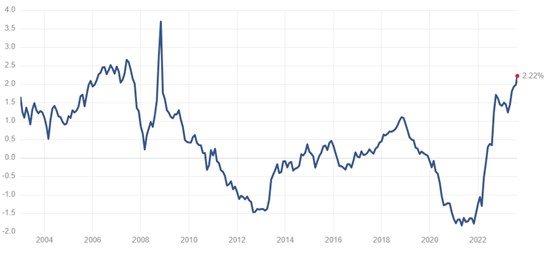

Today, the five-year inflation protected Treasury has a real interest rate of 2.22%, meaning investors receive 2.22% plus inflation over the next five years. Real yields haven’t been this high since the Great Financial Crisis.

5-YEAR REAL INTEREST RATE

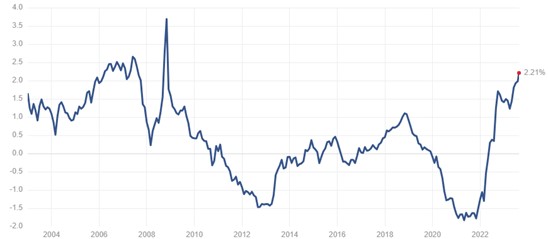

Comparing TIPS yields to regular Treasurys of the same maturity shows the market’s inflation expectations. The “breakeven inflation rate,” which can be found online, including the St. Louis Federal Reserve’s website, represents the threshold by which TIPS would do better.

Using a five-year horizon (10, 20, and 30-year breakeven data is also available), we see that TIPS successfully hedge inflation if inflation runs above 2.21% annually over the next five years.

5-YEAR BREAKEVEN INFLATION RATE

As it is, markets are pricing in a rather quick drop to near 2% for the foreseeable future. In fact, the 30-year breakeven inflation rate is only 2.27%.

The risk to investors, and acutely to long-term fixed income investors, is inflation runs higher. This is plausible given runaway deficits and debts, and the Fed’s willingness (eagerness, even) to print money to remedy bear markets and recessions. Frankly, the Fed and other central banks are increasing printing money just to pay government bills. How likely is it everyone will become less dependent on more free money?

At today’s prices, inflation protection is cheap, in my view. Perhaps, it’s very cheap considering the inflation bet isn’t necessarily a double-edged sword. That is because TIPS prices have a floor at maturity; they can mature at a price less than par.

In other words, I think TIPS today represent a compelling asymmetric bet, as in, “Heads I win; tails I don’t lose much.”

Using a five-year horizon again, one can buy the five-year Treasury yielding just under 4.4% or a 5-year TIPS yielding 2.2% plus CPI. The yield will be less on the latter if inflation runs less than 2.2% annually over the next five years and more if it is above.

But the five-year TIPS can’t yield less than the real yield of 2.2%, even if massive 1930s-style deflation ensues. In such a world, that 2.2% will represent a real “win” if prices for food, fuel, stocks, and real estate fall, wouldn’t it?

Meanwhile, one is protected should inflation exceed expectations. 3%, 4%, 5%, or higher is possible, no? The market isn’t betting on it. In fact, the market is selling you insurance on this for cheap.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.