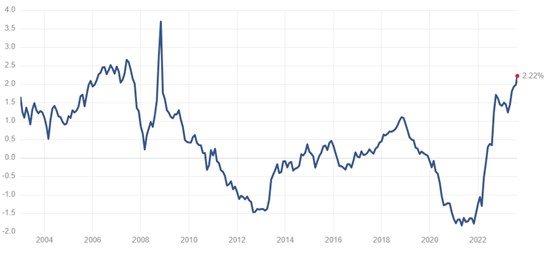

3-Minute Update: Fading the Herd

Neil Rose explains why he's taking some profits and getting more defensive as investors continue to pump up stock valuations, especially Big Tech. Neil worries the markets are now depending on one big assumption, and the costs of being wrong are high.

read more