History rhymes even if it doesn’t repeat. Today walls of worry are being climbed with a 1970s Nifty Fifty (or the late 1990s tech boom) notion that growth stocks cure all. Growth and quality are good things but risky when they become gateways to complacent and manic behavior.

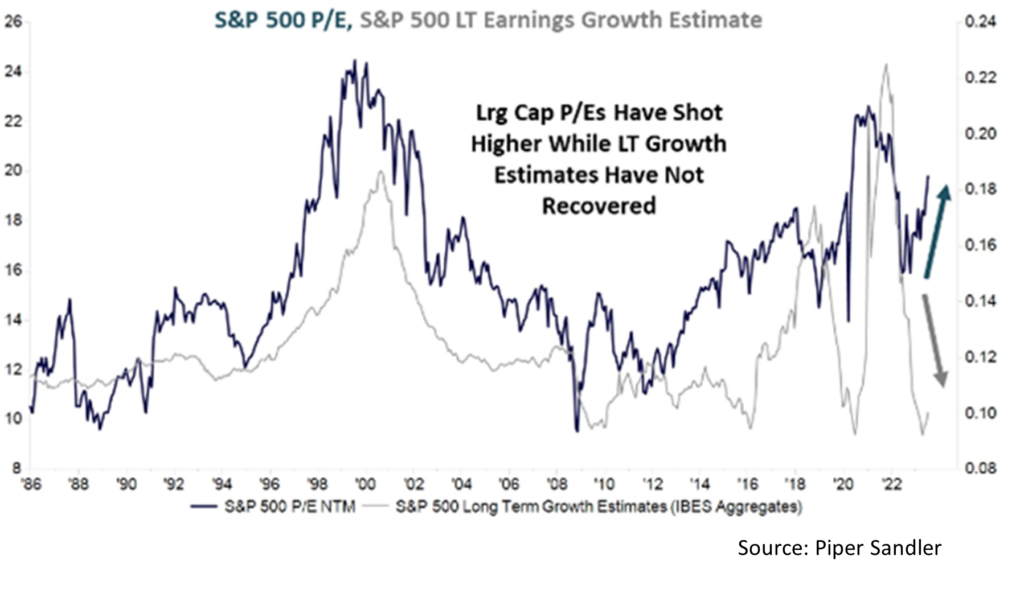

Price is becoming increasingly overlooked. Just because something is likely or even true doesn’t mean joining in is the conservative or safe bet. For most investments—business, real estate, you name it—what’s conservative at one price is aggressive in another. Price is perhaps the easiest macro or stock market hedge rather than trying to predict the market’s next move.

If the stock market is a horse race, the handful of mega-cap technology stocks comprising an ever-larger percentage of the total value of all companies, amount to an extreme odds-on favorite. So much so that it looks like an asymmetrical bet, but of the wrong kind: a small payoff for being right and a large loss if wrong.

Done right, investing is finding the opposite propositions.

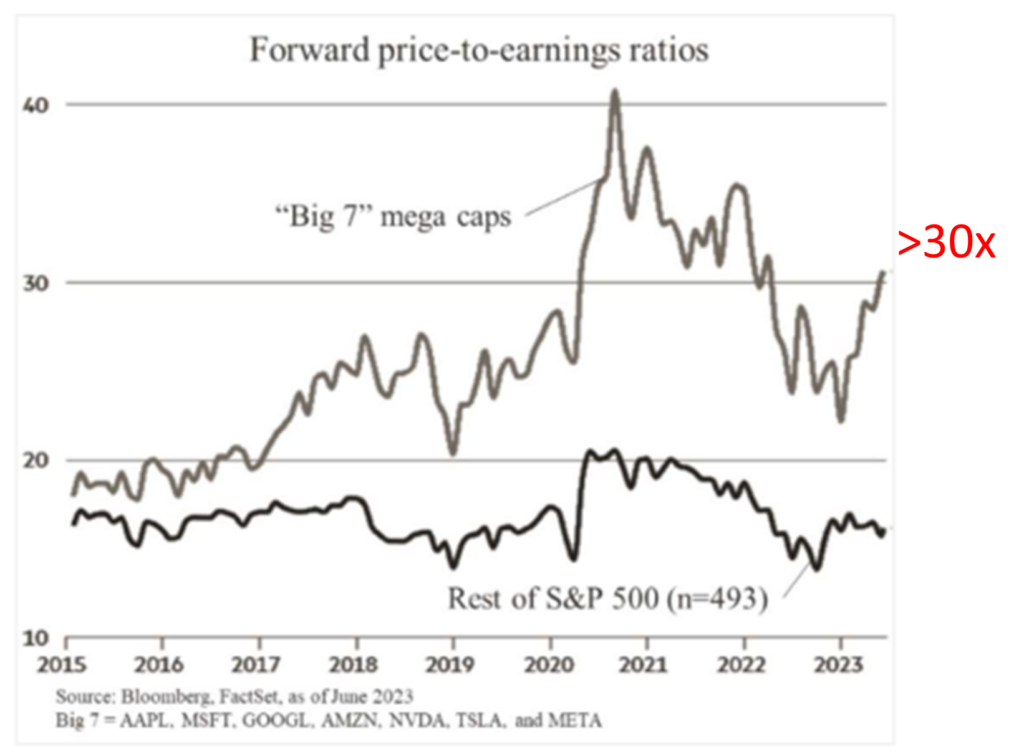

Today’s Magnificent Seven—Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta—have accounted for almost three-quarters of the market’s returns so far this year. The performance leadership of the largest of large (almost all tech) companies has stretched more than a decade with just a couple of interruptions.

The prices and multiples investors are paying for these stocks continue to climb, now averaging

over 30x forward earnings. Note for high growth companies, the calculated price difference between current (trailing) earnings and forward earnings is immense. A quick calculation places the current P/E of these seven companies over 50x earnings. (One is priced over 50x sales.)

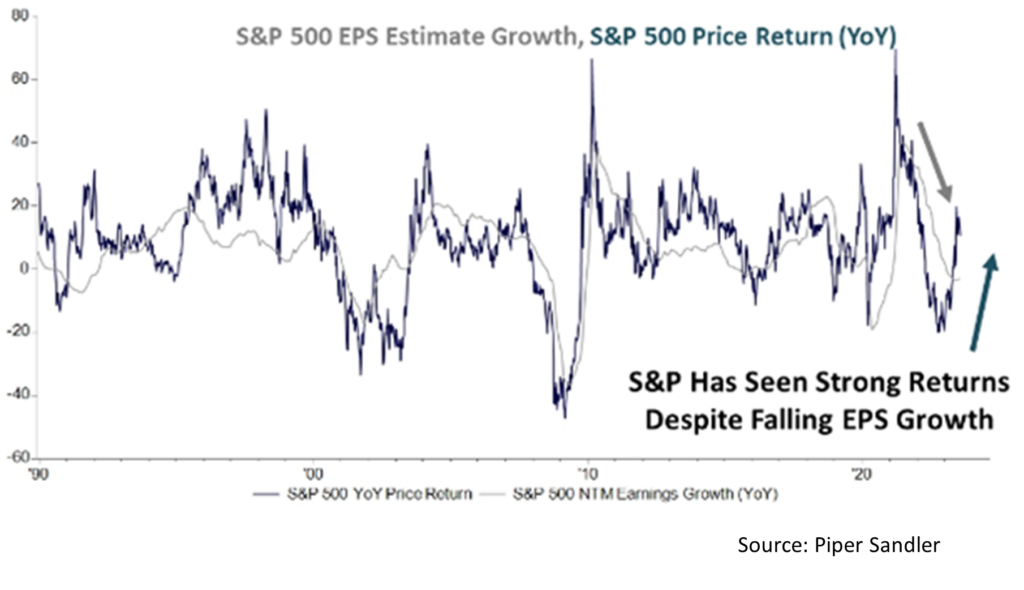

Earnings growth is no longer a sufficient justification for higher prices from here. In fact, the earnings picture is now deteriorating even as prices and P/Es rise.

More caution and skepticism seem appropriate, especially as interest rates rise.