In my February 7, 2025 post, Bonds Have a Place Again, I reflected on interest rates some five years after the peak of the Bond Bubble—when interest rates reached a low never seen in human history—and two years after bond prices finally crashed in 2022. I had summarized our approach to fixed income going forward:

- With interest rates drastically higher, bonds are becoming reasonably priced, especially Treasurys and high-grade corporates).

- Now with positive real yields, bonds offer diversification again to stocks and other assets.

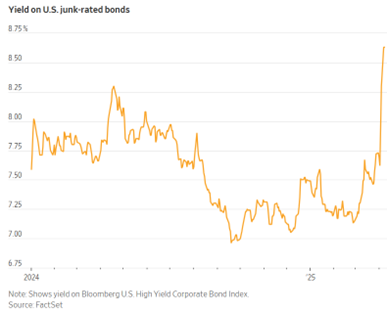

- Avoid lower quality bonds (“high yield” bonds are priced too aggressively like stocks).

- Inflation-Protected Treasurys (TIPS) offer inflation protection for cheap; time to buy.

We have been executing accordingly since then. Our fixed income holdings have expanded, the average maturity has lengthened, and an increasing share has been allocated in TIPS.

The changes have only increased portfolios’ income generation, which is a bonus for total return and risk managing investors like us. Maximizing for yield only gets an investor in trouble, inevitably taking larger risks for smaller rewards. I think of someone picking up pennies in front of a steamroller. That’s the “high yield” investor in pricey markets (like now).

So, the overall thesis hasn’t changed. Fortunately, the past three months have been encouraging. Here are some observations and considerations since then:

Macro trends have materialized on cue. In mid-February, the air started to come out of an inflated U.S. stock market. Donald Trump’s tariff war became official, causing an over-20% drawdown in the S&P 500. Bond prices and the dollar also fell sharply, enough to make Trump blink and put most of his tariffs on temporary hold. (145% tariff on Chinese goods is in effect.)

Economic data have understandably softened considerably across the board.

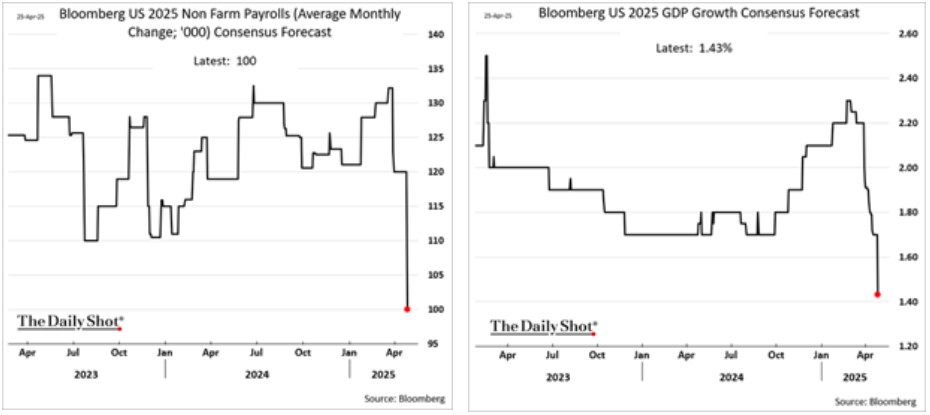

Jobs data is worsening. GDP forecasts are falling. Recession odds are rising. And various expectations and confidence measures among consumers and businesses have plummeted to levels last seen during The Great Recession.

Bonds have become more attractive as investors seek safety and hedge the prospect of the Federal Reserve feeling compelled to lower short term interest rates. Bonds, especially Treasurys with positive real yields (yields exceeding inflation expectations), are a reasonable alternative—and diversifier—to stocks in the face of an economic storm and deflation, at least more so than they were three years ago under the Fed’s ZIRP (Zero Interest Rate Policy).

Credit spreads have also widened. High stock prices had coincided with skinny credit spreads; non-investment grade bonds (aka “high yield” or “junk”) offered just 2.6% more than Treasurys on average in February. By early April, that spread more than doubled. Treasurys and high-quality bonds are not only outperforming junk, they are playing their diversification role to stocks again.

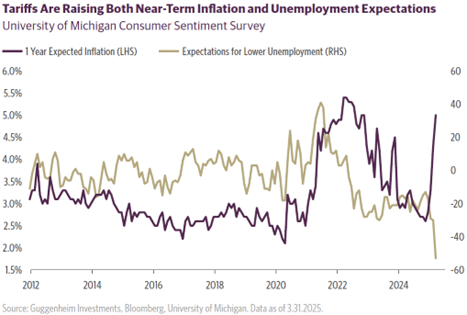

Stagflation is the real monster. Tariffs not only raise the prospects of recession (even depression, if we learned anything about 1930’s Smoot-Hawley Tariff Act), they may be very much inflationary as well, especially if combated with loose and looser monetary policy (i.e. money printing). The Gold Standard reigned in the 1930s, so money could not be printed the way we are now all too familiar. Today, we combat economic threats with trillions of new dollars and limitless credit.

Bonds themselves will do little in a stagflationary world. Among bonds, TIPS would shine. Yet, and this is just a personal observation, very few investors have ever considered TIPS for investment, including (and especially) professional bond managers.

The case for including TIPS on one’s investable radar isn’t about being right about future inflation—it’s about mitigating the effects of being wrong. To most, one of the worst future financial scenarios is stagflation, where we don’t see real economic growth and we bear higher chances of not having enough money later.

Stagflation is a fundamental reason to invest for the long term and why we want as big a financial cushion as possible in the future. Because the money can always go bad (inflate).

The cost of being wrong on future inflation is small and limited if inflation turns out lower than what everyone anticipates. Fixed income in all its forms—fixed pensions, longer term Treasurys, that fixed annuity someone’s trying to sell you—will be fine, or at least not terrible.

The cost of being wrong by underestimating future inflation—or at least not investing as if inflation could be unexpectedly higher—has huge potential downside. A $100 Trillion Zimbabwe bill that sits on my desk reminds me currency is a fragile thing.

Shorter-term inflation expectations have jumped with tariffs.

Curiously, longer-term inflation expectations (as determined by market prices) have fallen.

Today, the Inflation Break Even Rate for 10 Year and 30 Year TIPS is 2.25% and 2.20%, respectively. If annual inflation over the next 10 years is higher than 2.25%, one does better in a 10-year TIPS than a 10-Year Treasury. If annual inflation over the next 30 years is higher than 2.20%, 30-year TIPS would do better than the 30-Year Treasury.

Now imagine if inflation over the next 10 and 30 years is 5%. 10%. The math is astonishing.

There’s an added bonus to TIPS: the cost of being wrong is asymmetrically small. For example, if there is outright deflation over the next 10 years, meaning prices are actually lower 10 years from now than they are today, someone buying the current 10-year TIPS would still make 2.0% annually, based on today’s rates. The underperformance versus today’s 4.25% 10-year Treasury yield would be big, but would the cost of being wrong be nearly as big, especially if only a modest amount was invested in an otherwise diversified, high quality bond portfolio?

No way. And, if you think about it, if 10 years of deflation ensues, we will all have bigger problems than “just” making 2% annually on one security.

The point is it makes sense to have them both. The cost of being wrong by hedging inflation a little is small.

The curious case of municipal bonds. This year’s backup in low quality bonds has corresponded with a backup in municipal bonds. I don’t talk much about munis much because they are rarely worth talking about. Yes, their yields are tax free, but munis almost always have yields so small that one earns more in Treasurys after paying federal taxes. (Treasurys have no state tax liability.)

The muni market is usually not very rational to me, as if made up by folks willing to spend $1.20 to save $1.00 on taxes.

Sometimes, when there is a sharp stock market scare with worries about credit, muni rates can meet and even exceed Treasurys even before taxes are considered. For example, this week I saw some AAA 10-year munis trade at a 4.25% yield. For high earners, that means no 37% federal tax is assessed, nor the 3.8% Obamacare surcharge. The “tax-equivalent” yield on a 4.25% muni is almost 7.2%.

The catch with munis is, even if you’re certain they will not default, munis are illiquid. They cost a lot to buy and a lot to sell, so you must be willing to hold them for a long time.

There are other considerations as well. Call me to discuss if you feel strongly about having some in your taxable portfolio. Or I may call you if the pricing gets better to the point I feel compelled to add some. I’m not there yet.

I have other thoughts, but I might have to leave it for Part III. If you’ve made it this far, thanks for hanging in there. As always, call if you have any questions.

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. The content is information general in nature and is not an attempt to address particular financial circumstances of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.