Returns this year have been kinder than I would have expected given our rather conservative positioning. Stock allocations have been lower than usual, with little in information technology and internet-related stocks, two areas that have accounted for the lion’s share of the stock market’s returns in recent years.

Despite this, we haven’t had to suffer the way many value-conscious investors did in the late 1990s, the last time stocks were ruled by Big Tech. Many of today’s investing giants then had flat or negative returns while the stock market roared year after year. Stories were even written about why Warren Buffett was finished.

This is not to say today is another dot-com bubble. I have no idea, nor do I think it’s worth guessing. More money can be lost trying to avoid bear markets than the bear markets themselves. The only bubble I’m interested in is the one forming in fiscal and monetary policy—a possibly profound macro bubble. But even then, timing when the bubble pops is a fool’s errand. I know this, and yet I find myself increasingly paranoid by investors’ growing assumption that asset prices will always be propped up with an endless supply of stimulus.

We have our faults and blind spots like anyone else, but we work to avoid the sins of envy and greed, even if they lead to lower upside returns.

Macro investing is hard and most often reduced to politics, market-timing, and short-termism, driven by emotions more than anything else. The result is almost always underwhelming returns and risk management.

I think it’s better to primarily invest in terms of micro—basing decisions on price versus value received—but worry about the macro. There is no better hedge—macro or otherwise—than buying cheap.

A more sensible approach to macro is something like trying to establish guardrails to avoid careening off cliffs. The approach limits overindulging in greed and fear, and it helps separate value from value-traps (most “cheap” stocks are just businesses circling the drain). Getting a real beat on changing investment winds is rare. Today, my macro views are lightly held, at best. I think it’s better to admit the times are new, the conditions different, and no one in charge has a reliable roadmap. In other words, be careful and humble.

Goldilocks

With a 0.50% cut in its short-term interest rate policy to 4.75-5.00%, the Fed enters its eighth easing cycle in 40 years. The Fed and the market expect a 0.25% cut will be announced after the Fed’s meeting on November 1, followed by another 0.25% cut on December 13.

Prices of interest rate futures show the market shares the Fed’s forecasts of four more quarter-point cuts in 2025 with rates at 3.25-3.50% by next year’s end.

What’s unusual is that these anticipated rate cuts are planned even though economic numbers have stabilized and even improved. Consensus GDP growth forecasts for 2025 have ticked up to 1.8%, moving closer to the Fed’s assumption of 2.0%. Recession fears have mostly abated. And corporate earnings are anticipated to grow 11% this year and 15% next year. It’s a Goldilocks time. One could be forgiven for thinking policymakers might know what they’re doing.

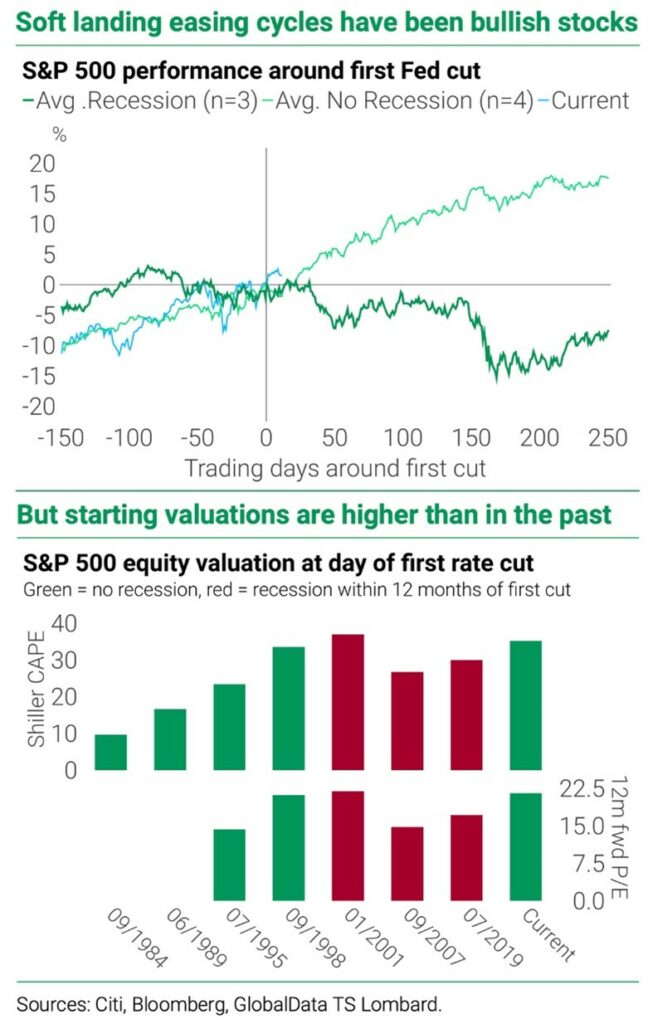

More encouraging news is the market’s rise since last month’s rate cut, if the previous seven easing cycles are any indication. The three times that stocks were down immediately after the first rate cut, a recession followed. The four times that stocks were up immediately, a recession didn’t come, and the average stock market gain 12 months out was 18%. We’ll see if history repeats.

Another thing to consider, if not a caveat: this easing cycle starts with the highest P/E ratios outside the height of the dot-com era. Price matters.

Investments

Our stocks haven’t changed much overall, although it may not seem like it with all the trading confirmations filling your mailbox or inbox. Inconveniences continue to also come with benefits, including better and more timely tax gain/loss harvesting; and spreading out buys to reduce the importance of exactly when we buy a stock.

We have accumulated several positions among property and casualty insurers (P&C) over the last year. The industry is still cheap at 10-11x earnings while enjoying a new phase of stronger pricing power as competitors are fewer and weaker now that money isn’t so cheap.

We have several macro themes and influences at work now (macro isn’t just about the politics of money). Some of our macro themes are hedging in nature; others I view as secular opportunities. Examples include:

- Electrification—insufficient infrastructure combines with an indefinite surge in electricity demand from multiplying electric vehicles and energy-thirsty AI servers. Trillions of dollars in new spending globally are inevitable.

- War—an increasing specter of world war hasn’t impacted markets yet. It might soon. Investing here provides a hedge while possibly benefiting from higher defense spending among the U.S.’s allies in Europe and East Asia.

- Commodities—there are many reasons to consider commodities as part of a robust investment portfolio, especially those needed for electrification. Other reasons include commodities’ low prices and inflation hedging properties.

Some assets, like uranium and copper, intersect two or three of these themes. I expect we will have more invested or hedged in these areas over time.

I look forward to offering further details of specific themes and investments at work.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. The content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.