The simple, no-brainer way to get safety and yield

Diversification, it is said, is the only free lunch when it comes to investing. I think there is another free lunch when it comes to cash reserves that’s not of immediate need but could be at any moment.

It puzzles me that society is still conditioned to keep all our cash at a bank and why people still buy Certificates of Deposit (CDs) and lock up their money for up to five years in exchange for skimpy yields.

The “smart money” does something different with cash that’s simple and rational. Warren Buffett (the quintessential example of smart money) needs no introduction, but one of his overlooked tactics is how he manages cash.

He doesn’t put Berkshire Hathaway’s cash reserves—$150 billion and climbing—in banks.

Instead, he banks with Uncle Sam in the form of U.S. Treasury bills, the world’s largest, safest, and most liquid securities—and the lifeblood of the global financial system. Treasury bills are zero-coupon Treasurys issued with maturities ranging from days to 12 months. Instead of a coupon, the bills are issued at a discount to “par,” the face value at maturity.

Treasurys are sold in denominations of $1,000 face value. so almost one thousand dollars is all it takes to manage cash this way. One doesn’t have to have millions or billions to get the best deal in finance.

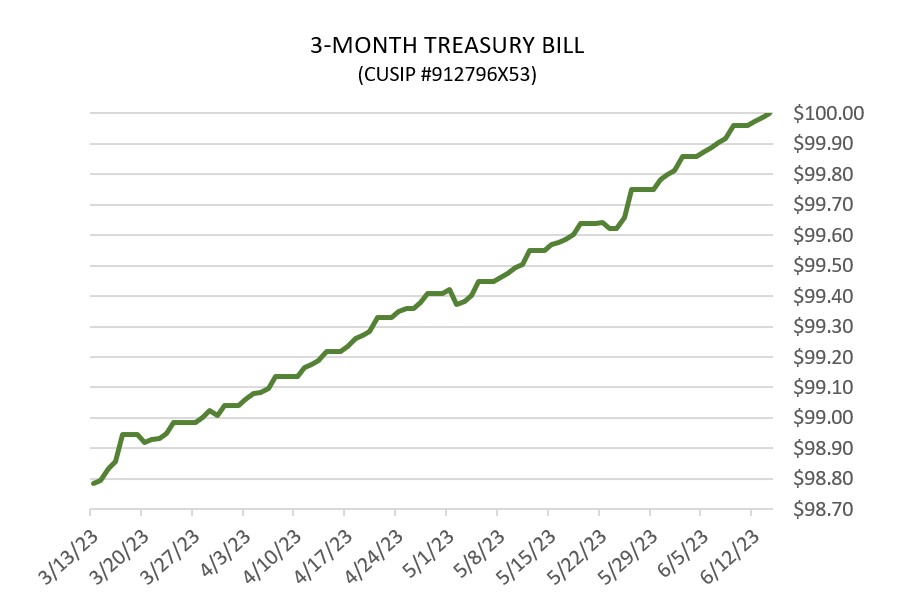

Since it’s simpler to understand, Treasury prices are often quoted as if par is $100. Let’s use the three-month Treasury bill as an example for cash management. Yes, using shorter notes, say one-month and one-week issues would be a closer “cash equivalent,” technically speaking. However, even three-month bills are fairly cash like while requiring less work and offering more yield.

The reason even three-month bills are cash-like is the discount to par, especially in today’s higher interest rate environment. The higher the interest rate—which is controlled by Federal Reserve policy—the greater the discount to par. Getting that $100 three months out acts as a kind of gravity on price. With each passing day, the maturity date draws nearer, and the bill’s discount to par diminishes. If it didn’t, then that bill’s implied interest rate would soar, and capital around the world would seize on what would be a free lunch.

Here’s an actual example of a recent three-month Treasury bill that matured in June. Notice how it marches toward par over the period. (This chart plots end-of-day pricing, so the price glidepath to par looks more jagged than it really is.)

The yield you receive is simply a function of time and how much the discount to par closes by (i.e. how much the price goes up). Treasury bills are also quoted in annualized yields, but that doesn’t mean they must be held until maturity. They are very liquid instruments, so one can hop off early with whatever yield/profit they collected—and with no penalties.

The three-month Treasury bill today has a yield above 5.4%. Yields may go up from here if the Fed continues its aggressive inflation fight. But it’s highly likely yields will at some point start to decline soon, especially if economic data starts to worsen and the odds of recession increase.

No matter. For now, think of Treasury bills as free money, regardless of the rate. Regardless of the yield, they are almost always superior to other cash vehicles (which also fall in yield when interest rates decline)—and with no state income taxation.

Most importantly, all Treasurys come with the full faith and credit of the U.S. government, regardless of amount. Bank accounts and CDs are still limited to $250,000 coverage by FDIC.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.