After nearly 40 years of benign inflation, markets have long since written off inflation as a material risk. In fact, policymakers have been so successful at suppressing inflation, many investors and almost all economists only worry about deflation.

It’s as if America’s economic ghost is the deflation and depression of the 1930s, not the inflation of the 1970s.

Today, rising numbers in broad measures of inflation are making some rethink their assumptions. Markets are talking about inflation again. But are people having the right conversations about it and not just the obvious ones: Is inflation going up or down, should you be worried, what should you invest in, etc. It seems any talk of inflation ultimately turns to talking politics or preaching monetary theory and how the world should be.

This is to say, maybe a lot of inflation talk is not very productive or helpful in the service of financial goals, like mitigating the risk of running out of money in the future. To this end, here are five things that come to mind that are missing from most inflation discussions. Maybe they can help understand what exactly we’re talking about when we talk about inflation and be more instructive in thinking about risk and what needs changing if anything.

1. There is no one inflation. When we say “Inflation,” what do we mean, exactly? For general inflation, there are many measures and methodologies. Are we talking Consumer Price Index (CPI) or Personal Consumption Expenditures (PCE)? Are we stripping out more volatile food and energy prices? Are we looking at seasonally adjusted numbers or not? There are differences among broad inflation measures that policymakers and academics care about. However, they are tiny compared to the actual inflation experienced between people.

Annual Inflation Rate as Measured by CPI (%)

Source: Bureau of Labor Statistics

It’s important also to identify the context of our inflation talk—is it for monetary policy, ramifications on trade and the dollar, transitory versus stickier prices. Or, are we talking inflation as a risk to our unique objectives, financial situation, and specific assets? (Isn’t this what we really care about, yet how often does personal financial advice utilize a definition of inflation—and inflation risk—that’s uniquely yours?)

This leads us to,

2. Your inflation (and risk) is different from someone else’s. This should be self-evident, so why are financial plans constructed with some (low) estimate of CPI?

The time since the financial crisis illustrates how different inflation experiences—and risks—can be among individuals.

Consider two individuals:

- Kim is a single 25-year-old with a good salary and prospects, diligently saving for a first home purchase. Her 401(k) is new. Young and single, she’s out with friends a lot and finds life easier eating out.

- Jane is a 42-year-old professional who owns her home with a long-term, low-rate mortgage. She contributes the maximum amount possible to her 401(k). Meals are usually made at home with the family. They look forward to the two big vacations they take every year.

Is each person’s inflation rate—and inflation risks—the same?

For Kim, mortgage rates have fallen since she started saving for her house. But property prices have also risen by 35% over the same time frame. Her $200,000 savings goal for the down payment is now $270,000, and the mortgage she will need is now bigger. The costs of her meals out and fun activities with friends seem to jump constantly. Kim watches CNBC and laughs whenever a guest expert talks about persistently low inflation. “Sure there’s no inflation in clothes and televisions, but there’s lots of it in housing, stocks, and bitcoin!” she says.

For Jane, rising house prices impact her little, expense-wise, as her monthly principal and interest payments will be the same for the next 134 months. Or lower: The same CNBC broadcast reminds her to call the mortgage broker to see if it makes sense to refinance. Jane, too, doubts the guy on the screen saying there’s no inflation; she worries about rising living costs a little more lately, especially after the quotes she received from some busy landscapers. Jane is encouraged when she looks at her 401(k) and the kids’ college accounts, and every time someone mentions property prices, she almost can’t believe the low price she paid for her house in 2014.

Kim and Jane have some differences in where their money is spent, so there are differences in the inflation rate they experience. But, more importantly, there is a big difference in how each of their circumstances have changed. Inflation in housing and financial assets has benefited Jane while being a risk to Kim’s financial future. So Kim and Jane arguably face very different levels of inflation risk.

3. Everyone is lousy at forecasting inflation. Almost everyone has made a great call or two. Many have forecasted and anticipated something few had. The problem is no one has been consistent enough in predicting the future. Prove me wrong, and I’ll change my mind.

4. Most don’t do enough to hedge (and benefit) from inflation risks. It isn’t enough to hinge a financial plan on a 2%, 2.5%, or 3% inflation rate over the next 25 years; nor is having the same 40% allocation in (mostly) longer-term bonds today with yields near zero (and even negative among some foreign bonds). But maybe it is enough; we can’t know for sure. The point is, inflation has for too long been something glossed over, a piece of unexamined thought. Instead, future inflation scenarios—inflation, deflation, and unexpectedly high amounts of either—should be discussed, then applied to one’s unique asset mix and circumstances.

5. An accurate inflation forecast is NOT necessary for good returns. If it were—and because #3 is true—would there be so many millionaire-next-door types, successful entrepreneurs, famous investors, members of the Forbes 400? None of them got there constantly being right about inflation.

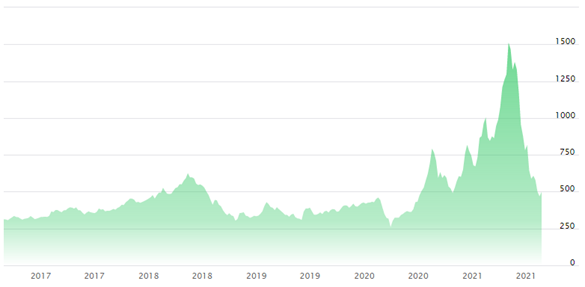

“Transitory” Inflation: Spot Lumber Prices (5 Years)

The cure for high prices is high prices. The cure for low prices is low prices.

Source: NASDAQ

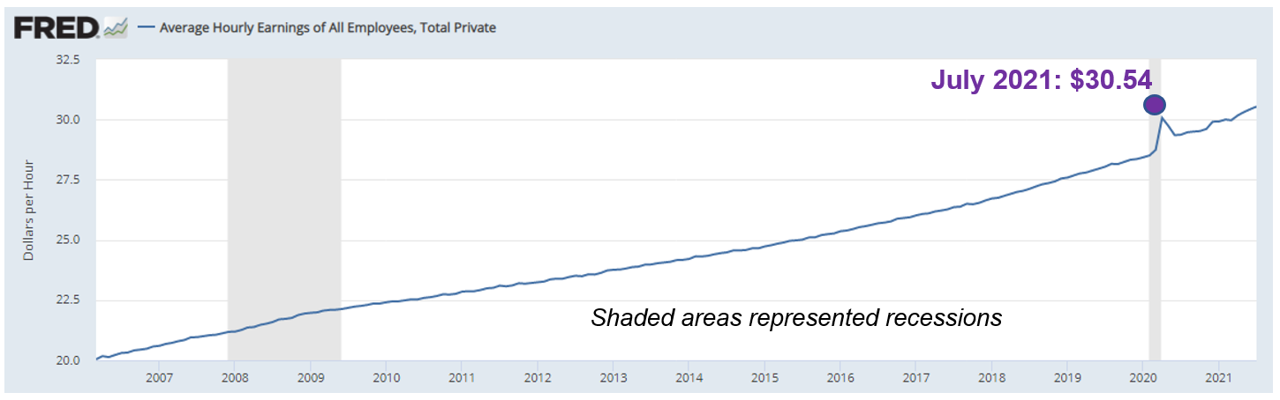

Stickier Inflation: Average Hourly Earnings

Source: St. Louis Fed.

From the Neighborhood McDonald’s

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.