The S&P 500 has surged to new highs after falling 20% earlier this year. Optimism is widespread and bolstered by key assumptions:

- Donald Trump’s tariff war is more bark than bite.

- The Federal Reserve will resume cutting interest rates in September.

- Recession is off the table, and the economy and corporate earnings are now tailwinds.

- Artificial intelligence (AI) will bring generational growth opportunities.

Also driving markets is recent passage of the One Big Beautiful Bill Act extending the 2017 tax cuts. Low tax rates, new tax cuts, and huge government spending have only furthered a bullish “risk-on” case for stocks and commodities at the expense of bonds and other interest rate sensitive assets.

Investor sentiment is high, if not extreme, as evidenced by investors’ stock allocations and record margin loan balances. Options speculation has exploded and in a crack cocaine form with zero-day options. Zero-day options are options that expire at the end of the trading day. They are unambiguous gambling instruments.

Combine these with historically aggressive pricing, and investors have enough reasons for caution. Forget deficits, debt, inflation, and the other costs of fiscal and monetary gluttony. Don’t bother trying to understand the ramifications of the new, bipartisan, economic-flat-Earth[1] majority in Washington. And I’m not sure how wise it is to rely on macro news for investing with whimsical (if not unconstitutional) edicts issued daily by presidential tweet.

I think longer-term risks to the system are increasing if not accelerating. But maybe the market isn’t so irrational in its bullishness and shortsightedness after all. It’s just human and imperfect, in the same way I still eat too much and exercise too little despite knowing that’s riskier behavior as I get older. Now 45 years old, I know I must get my act together—soon.

Our overall allocations in stocks in our multi-asset strategies (Balanced & Diversified and All-Weather Absolute Return) have increased somewhat but still reflect overall conservatism and neutrality between stocks and bonds. Rather than economic or market views, our stock allocation is a result of specific bottom-up bets and finding new investments in smaller, overlooked slices of the market.

Small is beautiful, too

Just ten stocks generated over half of the overall stock market’s gains since 2000.[2] Outperformance in Big Tech has been chronicled in these letters, but one aspect bears repeating to give some context to our strategy today.

The top-heavy leadership creates a virtuous cycle. The biggest stocks get bigger, indexing and broad investing become increasingly appealing as the whole stock market is driven by fewer stocks at the top, and more money is automatically invested there. The biggest get bigger again and the cycle repeats.

Active investment portfolios and funds, especially those hugging their S&P benchmarks, similarly concentrate investments at the top and have narrowed their investment opportunity set. Many, including most “growth” stock strategies, omit the vast majority of the stocks in the S&P 500, an index already without most of the 5,000 or so stocks trading publicly.

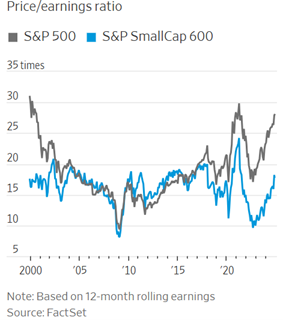

As a result, more opportunities are found in smaller U.S. stocks and among international markets (another long-time laggard to U.S. stocks); their significantly lower price tags support this view. Conversely, larger stocks get riskier as a virtuous cycle gets closer to turning into a vicious one.

“Smaller” is a relative term, of course, so to avoid misunderstanding, let’s define “small caps” as stocks approximately $1-10 billion by market capitalization and “mid caps” approximately $10-25 billion. To be sure, small and mid caps are very large corporations by any definition except when compared to the largest corporations on Earth, including Nvidia and its $4.5 trillion market cap.

A 6’3” NBA player like Steph Curry is only small on a NBA court; most of his day is spent being tall.

When it comes to NBA players, most wouldn’t necessarily equate smaller with less skilled or less valuable. Point guards aren’t less valuable than centers. A 6’10” forward may or may not be a better player than one 6’7”. Interestingly, average height in the NBA has trended downward over the past two decades and is now at a 41-year low.[3]

The stock market has taken the opposite trend: larger stocks’ premium to smaller stocks has widened significantly over the past two decades. It’s wise to remember potential upside and risk are mostly defined by price, not just the characteristics of the business. Smaller stocks can be better players and even Steph Curry-like.

Large or small, our criteria for stocks are the same:

- A business with durable competitive advantages, as evidenced by sustained high returns on capital.

- Honest, able, and fiduciary-minded management.

- A compelling price.

Smaller companies that are special are often so because the markets they serve are of limited scale, small enough that larger companies have no desire to enter and compete against a firmly established monopoly or oligopoly. Even if a new giant entrant spent enough money and attention to supplant the leader in a niche, the incremental profits probably wouldn’t be meaningful to the giant anyway. Sometimes the monopoly or oligopoly is government-granted, as is the case with utilities and various infrastructure-related industries.

Our newest buys, Allegion plc, Olympus Corp, Spirax Group, Ralliant Corp, and Amrize plc, are small-to-mid cap in size but 800-pound gorillas in their respective markets. Lennox International, another new addition, was added to the S&P 500 only last December.

I think these additions have increased the quality, diversification, and relative value of our overall stock holdings despite each being smaller and less well known.

New colleague

Please welcome our newest addition to the Regency team. Darienne Schoonmaker joins our Bainbridge Island office after working in business operations at a technology company. Darienne’s experiences come at the right time as we grow and require more institutional precision, process, and scale. We have already benefited from her strategic contributions, and she is turbocharging and streamlining my daily work. That my weaknesses are her strengths is greatly appreciated. Welcome, Darienne!

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. The content is information general in nature and is not an attempt to address particular financial circumstances of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

[1] i.e. Debts, deficits, and money-printing don’t matter; tariffs are good.

[2] Torsten Slok, Apollo Management, July 25, 2025