Most money managers are guilty of only telling their side of the story—what they expect, where they see value. I know I am.

But it’s always wise to know what the market itself thinks. The market is the collective wisdom (and sometimes foolishness) of the millions of self-interested buyers and sellers trading right now.

Price tells a lot. It’s helpful and maybe even critical for the thoughtful investor to also understand why the market thinks what it does. That often requires reverse-engineering current prices with current data and future indicators to find the market’s expectations and conviction levels.

Only then can an investor identify any variant or contrarian views—and justify why they are invested differently than the collective wisdom of the masses. I’m reminded of one of the many axioms of the late Charlie Munger who said you only deserve to have a strong opinion if you can make the other side’s argument better than they can.

If only people approached politics this way…

Market: TACO Time!

As an attempt at some intellectual honesty, I submit some windows to the market’s take on the world and the future, free of any arguments from me.

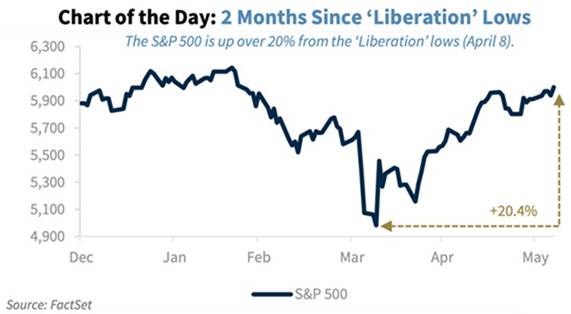

Markets have roared back from Donald Trump’s tough tariff talk beginning in January and cresting with his “Liberation Day” speech officially declaring a trade war against the world.

The markets spoke, and Trump retreated. It was not the first time Trump caved to markets. The internet, in all its ruthless hilarity, speculated that the market’s strength is rooted in theory of TACO: Trump Always Chickens Out.

Fears of a damaging tariff war have largely abated. The market favors what was punished the most: Big Tech.

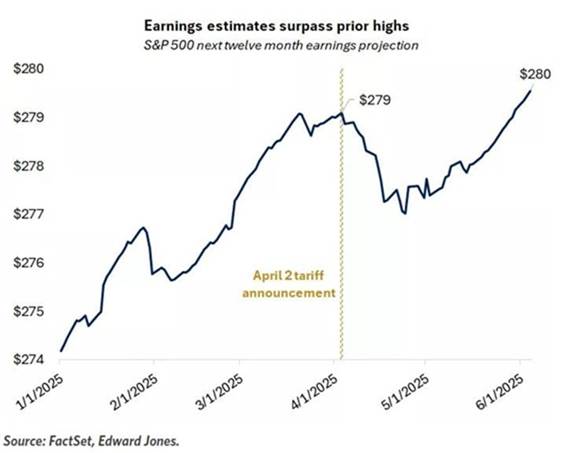

Market: Corporate Earnings Will Improve

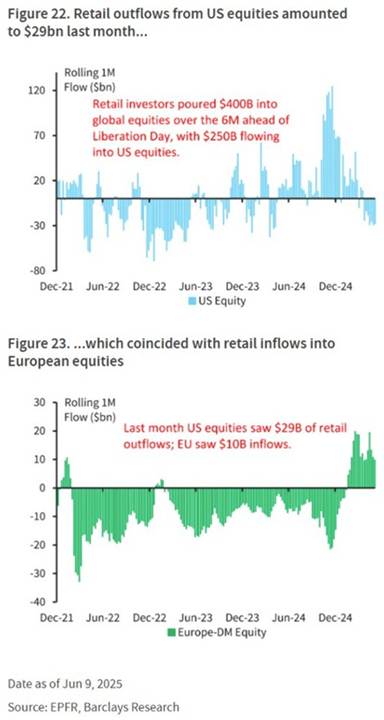

Market: Foreign > U.S. (though I like Big Tech again); small cap stocks stink.

The return of Big Tech leadership hasn’t meant a return of U.S. leadership versus foreign stocks. Investors continue to buy stocks outside the U.S.

The dollar is falling. Year to date it’s down 10% against foreign currency and foreign stocks are catching a bid. That’s a big departure from the U.S.-centric dominance of the past decade.

As shown in the chart above, the market clearly disfavors small cap stocks (Russell 2000 index).

Market: I love gold.

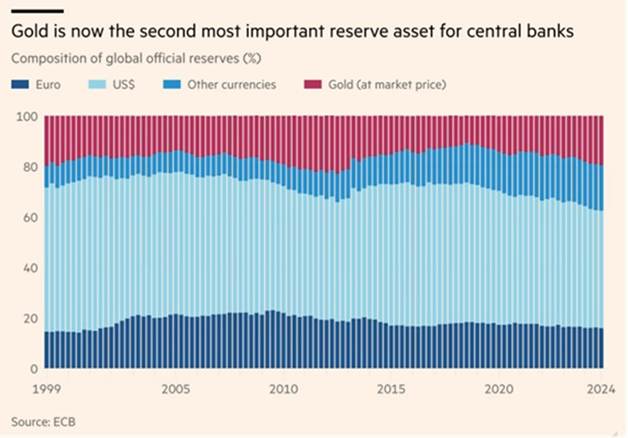

Gold has had a remarkable year so far, up almost 30%. Central banks are accumulating more of it. Gold has just passed the euro as the second largest reserve asset after the U.S. dollar.

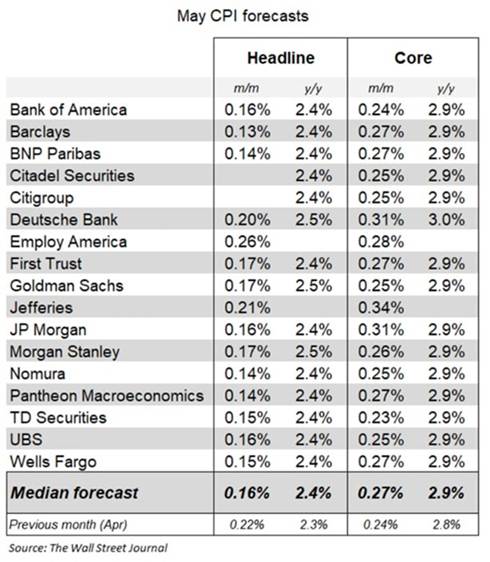

Market: Don’t Worry About Inflation.

Inflation expectations are cooling. The current inflation consensus is 2.4%.

The market only expects inflation to be low and steady going forward and over the long term. The spread between U.S. Treasury yields and the Inflation-Protected Treasury yields is arguably the best indication of what the market thinks inflation (CPI) will be in the future.

The Market’s inflation assumptions (average annual):

Over Next 5 Years: 2.46 %

Over Next 10 Years: 2.30 %

Over Next 30 Years: 2.25 %

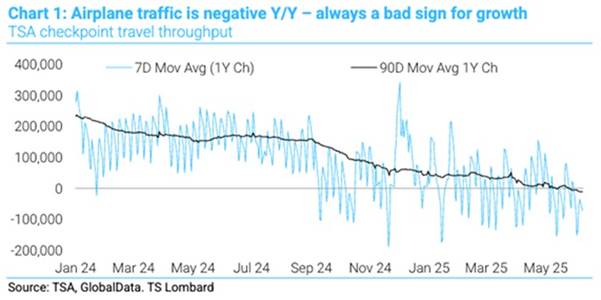

Bonus: Americans are flying less.

Random, but troubling: domestic air travel is down. Whether it’s economics, sentiment, or lifestyle, the trend speaks to shifting behavior.