We have experienced a benign 2025 so far despite a correction in the stock market and higher volatility. Modest stock allocations and gains in insurance stocks (our single largest industry exposure), gold, and newer fixed income buys have buoyed account values.

An overdue reality check has hit the market. For a while now, these letters have repeated a case for more caution and defensiveness, that extreme prices and sentiment in stocks, real estate, crypto, credit, and other assets meant investors faced more risk and less reward.

I suspected what was really behind all the bullishness was investors’ supreme confidence in global policy makers—like those of the U.S. government and Federal Reserve—who would always put a floor under the economy and asset prices. Ever-increasing amounts of fiscal and monetary stimulus had become an expected entitlement.

Our plan was to act as if stocks and other assets had very little room for error, like a driver threatened by a large dagger protruding from the steering wheel: even small accidents risk doom.

The start of Donald Trump’s second presidential term has already proved no small fender bender. Gruesome stuff could be in store for over-extended investors and debtors, but I also expect fantastic opportunities for those with the dry powder, patience, and gumption to act amid the confusion and discomfort. We are set up right so far; we just have to execute.

Trump’s Folly

Trump’s expansion of presidential powers is unprecedented, and his impact on markets day to day is more than any president I can recall. As much as I’d like to avoid politics and especially politicians themselves, Trump’s immense impact on markets means a money manager can’t avoid the subject, even if thoughts are preliminary.

I intend no political harangue or ideological indulgence. The Left-Right context doesn’t really apply to Trump. His populist leanings prevalent over a century ago seem as Bernie Sanders as 21st century Republican.

His first salvoes since inauguration have been uniquely Trump with threats to the sovereignty of Canada, Greenland, Gaza, and Panama; the vilifying of longtime allies and aligning with dictators; his multi-pronged offensive against the Constitution itself, which so far includes usurping congressional powers, disobeying judicial orders, suppressing free speech, eliminating due process, and seeking ways to extend his presidency indefinitely. (To support all of this is to consent to a future president on the other side doing the same.)

His biggest threat to markets so far has been his tariff war against the world. His obsession with bilateral trade deficits has defined his economic policy to the dismay of most of his supporters.

Frankly, Trump’s view on bilateral deficits is bizarre—and dangerous. His trade fallacies dwarf any reasonably constructive economic ideas he may have elsewhere. That’s how big an issue trade is, and that’s how mistaken he is—if he means what he says. Trump might be exaggerating or misleading as usual—or it’s all just a ploy to sell tariff relief for personal gain. It’s possible.

But like with nuclear war, guessing Trump’s seriousness on trade doesn’t matter. Trade wars have already begun and are escalating on several fronts, including China.

Trump believes any deficit with another country is inherently bad and exists because “They’re ripping us off.” There are trade offenses out there to and from the U.S. Instead of addressing specific countries and specific practices, he’s out for the whole world.

He also fails to understand a few inextricable elements about trade. First, American trade deficits in goods are generally coupled with a surplus in services. By and large, America buys lower value goods but are net sellers of software, financial services, travel, pharmaceuticals and other kinds of intellectual property. American companies also make profits overseas and repatriate them back to the U.S., often in the form of management, consulting fees, and royalties.

Most of the value of the iPhone is not in the materials of the phone or its final assembly but in its technology and intellectual property created in the U.S.

I’m reminded of a funny Dave Chappelle bit on Trump and trade:

Stop trying to give us Chinese jobs. [Imitating Trump] ‘I’m going to go to China and bring back those jobs to America.’ For what…so iPhones can be $9,000? Leave that job in China where it belongs—none of us want to work that hard! What is he thinking? I want to wear Nikes. I don’t want to make them. What are you doing?”

Chappelle says something we all know to be true, that future growth and prosperity are not in thousands of new factories, many of which would have to sew t-shirts, mold plastic toys, and engage in other forms of unskilled labor required to neutralize trade deficits. Good luck finding Americans to fill those jobs.

A second element is any real trade deficit corresponds to what’s called a capital account surplus. That means more capital (investment) flows into the U.S. than out. Think about it by following a dollar that goes overseas. That dollar doesn’t hide under a mattress. One way or another, it is repatriated back to the U.S. as debt and equity capital. A dollar gets us goods and other benefits (cleaner air and water), and we get cheap financing for growth and benefits greater than the cost of capital.

Lastly, trade has contributed to the dollar as a hard and stable currency. The dollar is the global financial circulatory system and measure for major commodity prices, giving huge advantages to Americans in purchasing power and wealth accumulation. The dollar has also afforded the U.S. significant seigniorage, which means all the printing of money and Treasury debt isn’t met with a material inflationary cost (at least not yet). That’s real power.

Trump wants a weaker dollar to eviscerate trade deficits but doing so risks the huge structural advantages he never knew he took for granted. Devaluing global trust in the dollar—in America—could be disastrous and potentially very inflationary.

Money has fled the U.S. since his recent “Liberation Day” tariff announcement, leaving a slide in stocks, bonds, and the dollar. Markets are speaking loud and clear. Just as shocking as the ferocious incompetence from Trump with his “Reciprocal Tariff” schedule was the sheer dishonesty of it all.

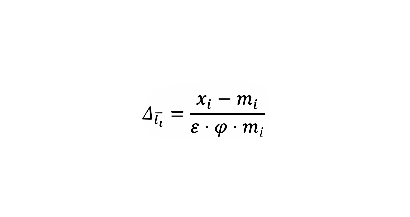

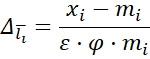

It turns out the Tariffs Charged to the U.SA. column had nothing to do with actual tariff rates. Instead, it was derived from a serious looking formula (because of the Greek letters):

It took the internet minutes to figure out the formula really meant:

The U.S.’s “Reciprocal Tariff” for a country would be half of this number because Trump “wanted to be nice.” For countries like the U.K. where the U.S. has a trade surplus, “10%” was declared for Tariff Charge and Reciprocal Tariff.

The whole thing is classic Trump: destabilize then pilfer; poison then profit with the antidote. This time the global economy is under his gambit, and so far he’s not winning. China isn’t blinking, perhaps because the U.S. has been a declining percentage of China’s trade. The U.S. made up over a quarter of China’s trade in the late 1990s. Today it’s 10% and falling.

After declaring he will never budge on trade, Trump budged on his deadline and said he was flexible. No one knows what’s next, probably not even Trump, but how he plays his hand now will move markets one way or another. There could be longer lasting implications.

Some damage is already done. Much of the world has lost faith in the U.S. as a friendly partner, the effects of which will take time to manifest. The silver lining to this self-inflicted crisis is Trump’s all-in approach has had sharp consequences that could lead to a faster conclusion and recovery. He may have already seen the peak of his powers and even given away next year’s midterm elections. Time will tell.

For now, we are content to keep stock levels relatively low with a focus on value, contrarian opportunities and special situations. We will focus on price while most bet with their crystal ball.

Higher interest rates are also offering better entry points into Treasury notes, including inflation-protected Treasurys (TIPS) which are well suited to mitigate not just inflation risk but especially stagflation risk. The odds of stagflation are rising, in my view, while the prices for protection remain quite low.

Short-term Treasury bills still pay over 4% and comprise the bulk of our cash (our dry powder). Portfolios’ overall yield continues to rise as more money is put into securities with interest rates and dividends more than 4% and even 5%. More income adds to portfolio protection.

I think we are in a good spot. I hope you find your money doesn’t add to any anxiety you may have about what’s going on in the world today. We will work to keep it that way.

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. The content is information general in nature and is not an attempt to address particular financial circumstances of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors. It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.