Click here to view printable pdf.

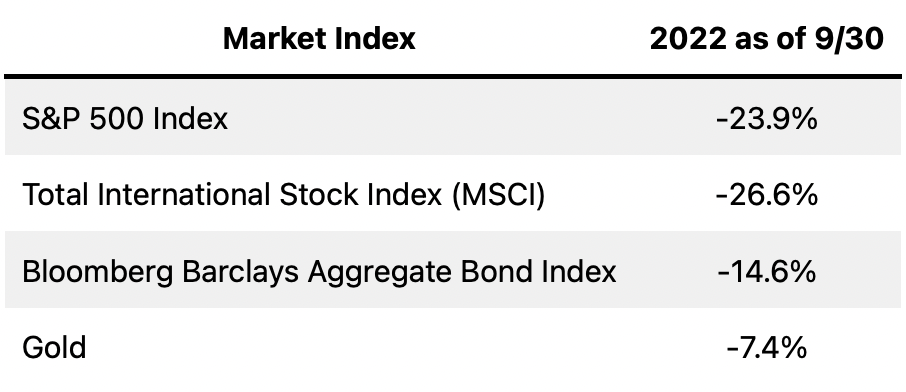

The past few months only extended 2022’s historic losses in fixed income and a bear market in stocks. For those investing for income or with a balanced approach—that is, investors with “conservative” strategies—2022 has been their annus horribilis. Millions of investors have seen account values drop more this year than any previous calendar year. The Great Financial Crisis didn’t exact this much punishment.

Thousands of more typical “Balanced” strategies and their millions of investors are down 20% or more. Yet, at the risk of sounding self-serving, those who entered 2022 without large holdings in long term bonds and stocks at the heart of the recent tech/crypto mania should recognize their fortuitous situation. After many rounds pouring through data and clients’ portfolios, objectives, and financial realities, I’m still not convinced a further slide in stocks and bonds should inflict anything more than temporary discomfort. Instead, our relatively modest losses and current investment positioning mean a likely future of higher returns (and perhaps more than triple the cash income generation) than what we were presented in recent years.

More encouraging than modest losses are how our numbers are somewhat illusory since a portion of the losses come from shorter term fixed income securities (Treasurys and high-quality agency and corporate issues) that at some point must soon reverse their slide to gains when prices rise to “par value” as maturity dates draw closer.

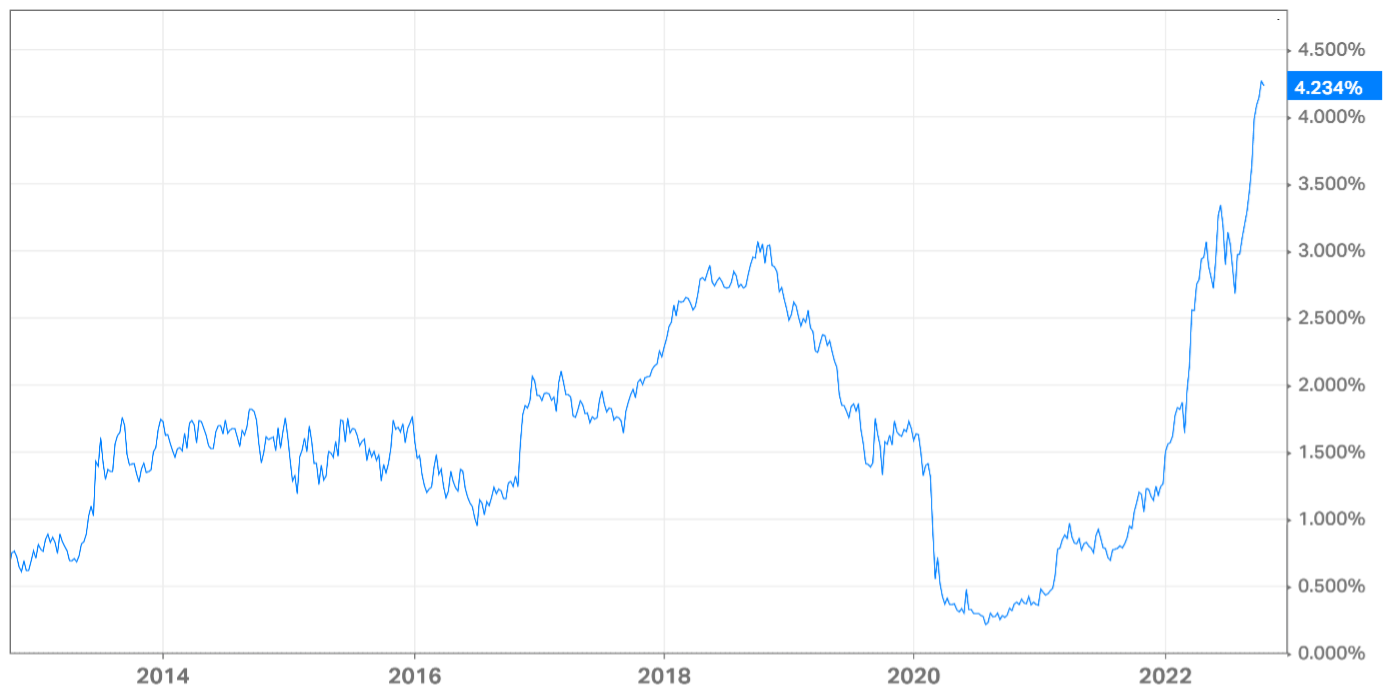

With the exceptions of negative-yielding fixed income securities or those denominated in foreign currency, all fixed income securities inevitably make back any paper losses over time. However, in the case of long term bonds with maturities 10-30 years out, the wait could be long. Fortunately, our investments have included little in longer term bonds, which may not be news as you have heard and read about my growing skepticism towards bonds in the past. What might be news is the state of income being generated. For years, we saw a total portfolio yield—interest and dividends—of less than 1.5% in our typical multi-asset portfolio strategies. Today, the same portfolios show a yield going forward of almost 4% and rising, despite still having a slim allocation in longer term bonds.

5-Year U.S. Treasury Yield

Investors everywhere typically have had around one-quarter of their fixed income exposure committed to bonds 10-30 years in maturity, if only because bond indexes—and the trillions of dollars of mutual and index funds that follow them—are allocated that way. With little long term holdings, we have greater ability to reinvest at higher yields and increase income generation.

Our losses this year could be seen as a small price for replacing a past world of slim yields indefinitely for a world offering 4%-plus and rising as we capture more bonds with yields in excess of 5%, 6%, and possibly more.

Stocks

Higher rates have similarly wrecked stock valuations. However, unlike with shorter term bonds, there is no math assuring us losses will soon reverse, no gravity pulling prices to par. Stocks are not bonds. Whether owned privately or through stocks, businesses represent complex and organic assets with indefinite investment horizons. Their values fluctuate more, especially when publicly traded. And their values can decline indefinitely and irreversibly.

Many of the high growth darlings of the past several years, including new internet companies, mobile payments, and some outside of the technology sector, have seen their stock prices drop 75% or more. As in previous bear markets, there are many lessons being learned and re-learned.

There is cause for optimism here, too. As with fixed income, our approach to stocks has been rather conservative with lower allocations across strategies and being underweight technology and internet- based stocks that still comprise over one-third the stock market’s value. As a result, losses from stocks have been materially less than the market this year.

However, my optimism largely comes from a combination of confidence in the longer term future of the companies we keep and the prospect of acquiring more growth and income generation at lower prices, or better yet, distressed prices.[1]

Like with bonds, the current bear market could worsen but also present an opportunity to parlay our defensiveness with buys of stocks that may drive gains for years to come. So long as what we own represents the attributes we look for—quality, formidable businesses, growth, great management—we should see nice rewards over time and without taking unreasonable risks.

This is not to say I am unconcerned about the world today and all things macro and geopolitics. I could fill pages about the uncertainties and risks of the day. They constantly change in form and origin, but uncertainty and risks are always present. When have they not been?

One day, there may be a new kind of risk or threat that changes everything. But today’s worries of higher interest rates, recession, deficits, debt, war, Russia, China, Covid, and more shouldn’t stop growth over time in GDP, personal income, household net worth, productivity, profits, and all the other measures supporting financial progress, especially in America.

I assume a world of increasing debts, money-printing over the longer term, and inflation remaining a prime risk to economies and investors over time. Stocks still play an important role not just for growth but for hedging longer term risks like inflation or not achieving real gains and purchasing power over time. To these and other needs far in the future, no other investment type has delivered better. We must remember why we invest, including in stocks, as well as the times after a bear market when we told ourselves all the things we would do differently come the next buying opportunity.

Neil Rose, CFA

[1]Both efforts have been enhanced in no small part by the streamlined and always-improving operations and tools the team has put together. The increased time in reading and research afforded to me over the past two years has been game changing for me—and I hope rewarding to us all in the future.

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.