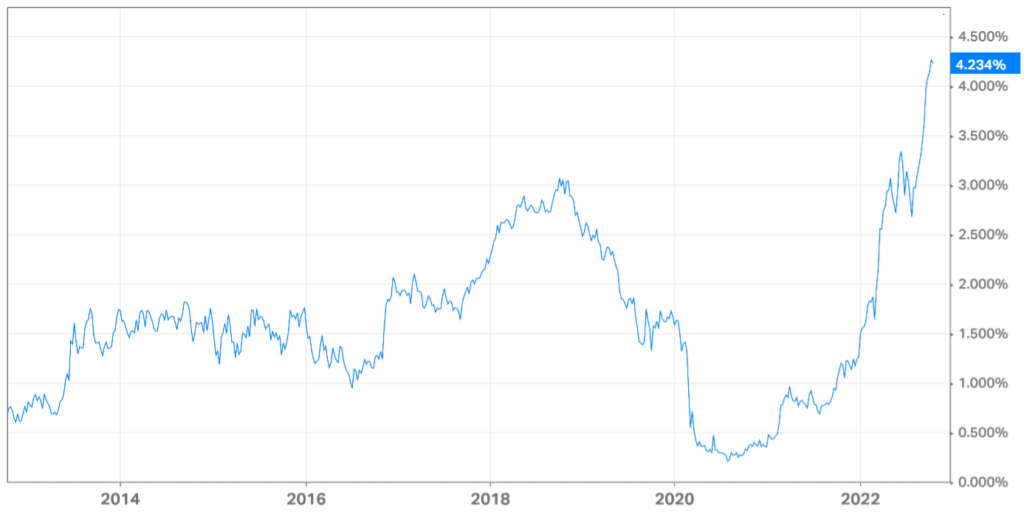

Mid-Year Update 2023

Neil and Co. catch up and talk about a market resembling both the late 1990s tech boom and the Nifty Fifty craze of over 50 years ago. Also discussed is Neil’s current research adventures into commodities and thoughts on electric vehicles and where he’s seeing value today.

Listen