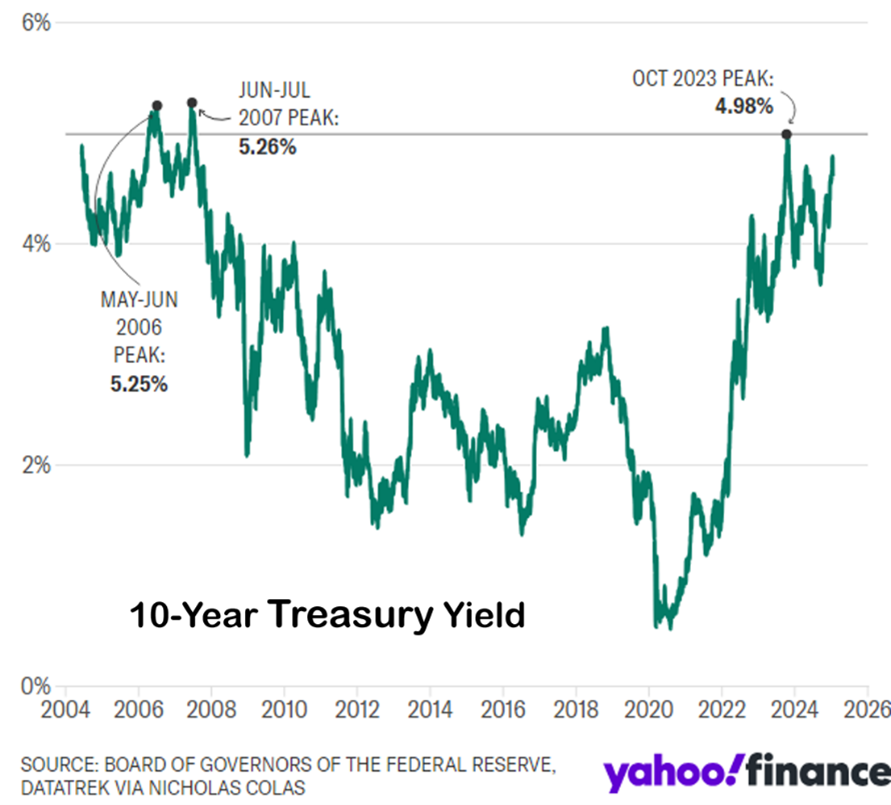

Nearly five years ago, bond yields dropped to levels never seen in the thousands of years humans have been lending to one another. The shortest maturity fixed-income securities yielded virtually zero in the U.S. and less than zero in Europe and Japan.

At one point, even trillions of dollars’ worth of long-term bonds were priced for a negative yield; as in, here are securities guaranteed to lose you money by their maturity dates.

Yet, somehow bonds always seemed to be adorned with a reassuring “conservative” or “safe” descriptor. “On Wall Street, bond yields fell to yet another record low as investors sought safety…”

Only on Wall Street and among policymakers was the bond market not absurd. Some things are clear only in hindsight. Bonds back then weren’t one of them.

Over the past five years, bonds—as represented by broad bond indexes—are not yet break-even. Investors in longer-term bonds (like banks) are still underwater. Most bond investors have received return-free risk instead of something closer to risk-free return.

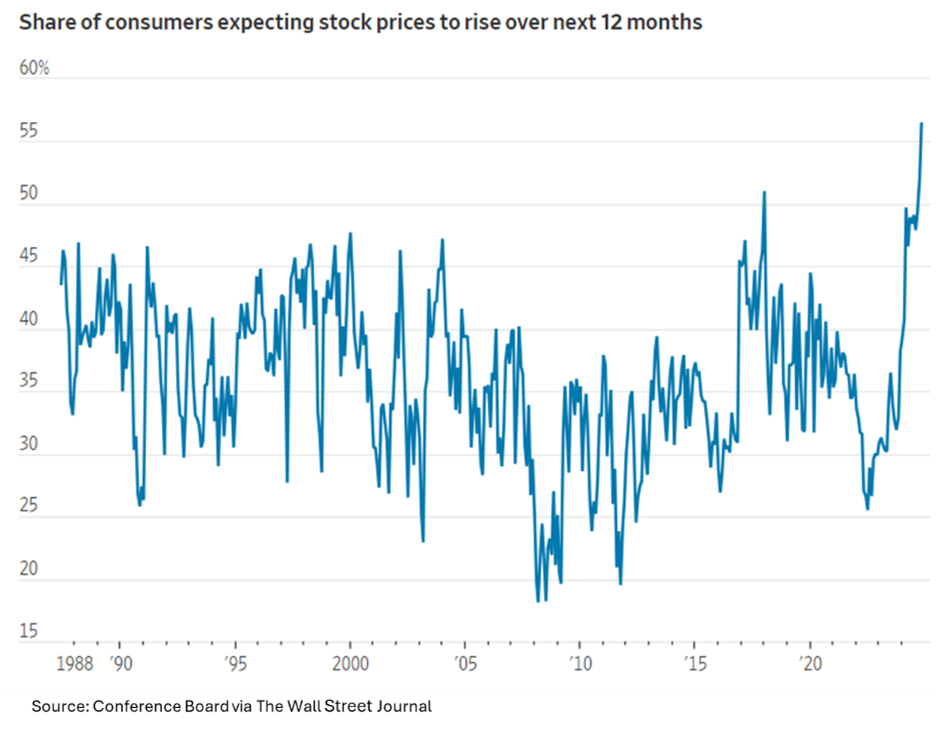

Bond prices and investor sentiment have changed over the past five years. Today, investors clearly favor stocks and worry about bonds. Stock allocations are up to historical highs among institutional and individual investors. Overall optimism is arguably higher than ever, as is the stock market’s average P/E.

Meanwhile, yields have risen considerably. 10-year Treasury has moved from 0.5% to over 4.5%. Bond prices have dropped as stock prices have leaped.

In our multi-asset and conservative portfolios, we have been adding bonds while reducing our stock holdings.

Later this week, I’ll detail why we’re returning to bonds in multi-asset and conservative portfolios.