(For informational purposes and not a solicitation)

The hedge fund’s 2025 letter and performance results are out. The Fund is a special investment vehicle near and dear to my heart. I think of it as the long term equivalent of eating my own cooking with a long term and focused investment approach. Limited partners only invest a small percentage of their overall liquid net worth. In time, I hope that it plays a nice complementary role to partners’ overall investments while producing superior longer-term returns.

TO: PARTNERS OF REGENCY CAPITAL MANAGEMENT FUND L.P.

Investment performance for Regency Capital Management Fund L.P. (“Fund” or “Partnership”) ending 2025 were as follows:

| (1) RCM Fund Net Return | (2) S&P 500 Total Return | (1) – (2) Return Difference | |

| 20211 | 15.4% | (3.8%) | 19.2% |

| 2022 | (6.6) | (18.1) | 24.7 |

| 2023 | 25.8 | 26.3 | (0.5) |

| 2024 | 10.1 | 25.0 | (14.9) |

| 2025 | 12.9 | 14.8 | (1.9) |

| Since Inception | 75.1% | 58.1% | 17.0% |

- Inception Date: 29 October 2021 ↩︎

It’s still early days in our partnership; I can’t crow over the Fund’s out-performance to the S&P 500 since inception or be troubled by under-performance the past three calendar years. Four years and change is too soon to feel good about my overall management of the Fund. This is a long term game, and we are still just getting started.

Perhaps the only point worth making regarding performance so far is the Fund has exceeded my expectations given how the market has grown in recent years. We should be significantly under-performing the S&P 500 given the largest corporations in America (almost all digital in nature) have comprised an out-sized and growing share of the earnings, performance, and overall value of the stock market. The largest 10 stocks represented 39% of the stock market’s value at the end of 2025. I estimate well over half of the stock market’s value today is in information technology and internet stocks, and with most of that value in just a handful of stocks, including NVIDIA, Apple, Alphabet (Google), Meta (Facebook and Instagram), Microsoft, and Amazon.

I’ve become increasingly uncomfortable with the idea of investing most of the money this way, even if most investors do.

I have been more comfortable with leaving shorter-term upside on the table. Besides, the goal is growth and superior risk-adjusted returns over the long term. A few important thoughts come to mind:

- Long term success means we must first survive. The “more risk equals more return” notion is a fallacy in the context of the long term. One injury is fatal if it’s serious enough; there are no old gun fighters. My duty, first and foremost, is to prevent permanent capital loss.

- The best investment returns are from those investors that have focused on cutting risk and trying to make the game, “Heads we win; tails we don’t lose much.” Funds that have focused on always having the best performing stocks have rarely, if ever, become smashing successes over the long term.

- Year-to-year relative performance measures are immaterial to long term performance (except massive losses, of course). Focusing on them would almost certainly reduce our results over the long term.

For many years, market risk has paid off nicely, more than nicely. However, I think at this point market risk is rather expensive, or at least too expensive to be the only risk an investor takes on. A large and growing number of investors are doing just that through record levels of index funds and other investments directly or indirectly tied to the S&P 500.

I think other forms of risk have become much cheaper, and investors can improve their risk/reward prospects by incorporating other risk exposures and once again thinking of it as a “market of stocks” rather than a stock market.

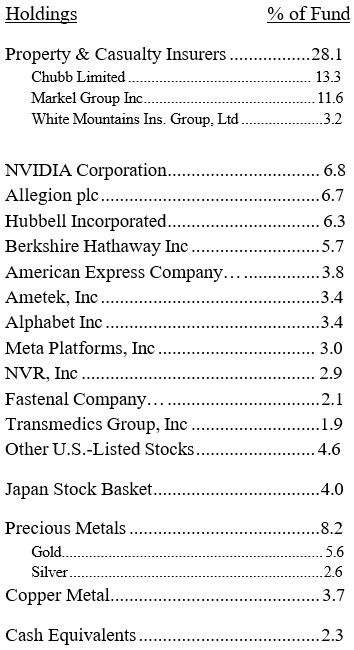

Some examples include stock-specific risk (as in, investing more in your high-conviction stocks); commodities risk (e.g. gold, silver, and copper); and foreign and currency-based risks (foreign stocks and currencies have long underperformed the U.S. and arguably offer timely value).

It’s ironic emphasizing diversification when the Fund itself is about concentrated investments in the service of longer-term gains—but diversification comes cheaply today with historically wide spreads in prices between regions (U.S. vs International), styles (growth vs value), sectors (industry types), and size (large cap vs small cap). We are probably more diversified even though we have far fewer holdings, which helps because this Fund will be plenty volatile, trust me.

Volatility in the short term should amount to longer-term gains. Always looking to lower risks

will be critical to deliver on this. The Fund’s current holdings as of 13 February 2026:

I’ll dive into our holdings and rationale in my next letter.

Enclosed are your latest capital account statement and the Fund’s audited report for 2024. Feel free to call anytime if you have questions.

And thank you for your partnership and trust.

Sincerely,

Neil Rose, CFA