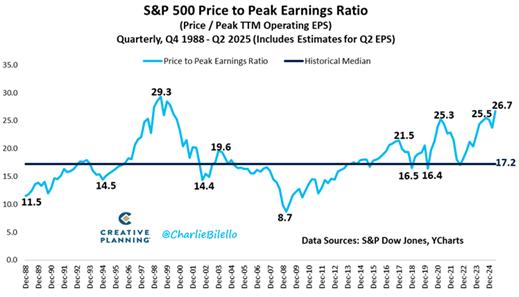

P/Es are high…

and investors know this (91% of fund managers say U.S. stocks are overvalued) …

yet stock allocations are the highest since 2007.

Corporate stock repurchases are at record pace. A contrarian indicator, typically.

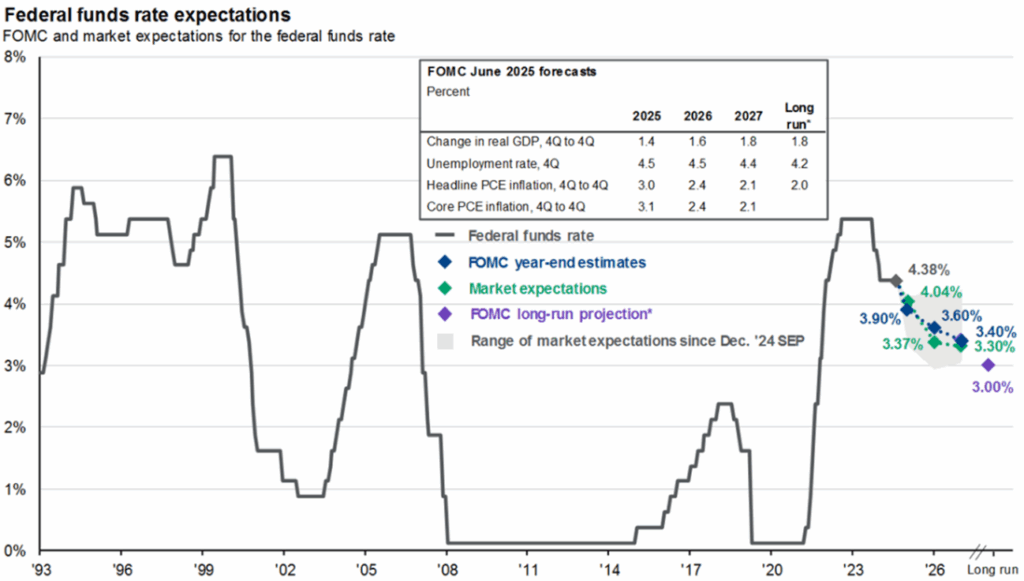

Stocks, real estate, and especially crypto are dependent on imminent interest rate cuts.

The market is pricing in a 85% chance of a 0.25% interest rate cut in September and anticipating more cuts thereafter.

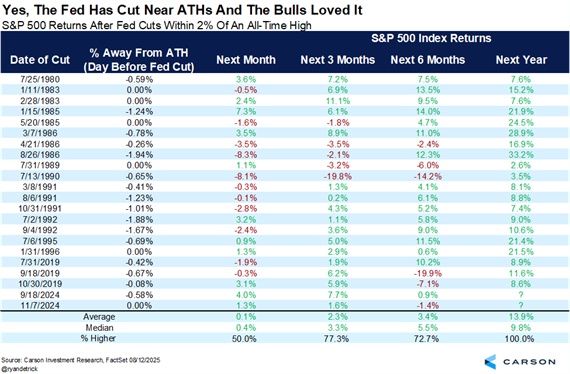

Bulls take heart: Fed rate cuts when stocks are near all-time highs have always been good for stocks one year out.