It was a great year at Regency Capital. For me personally, I am learning, we are growing, and we continue to look for ways to improve. Part of this growth is to continually evaluate (kaizen) how we do things, our processes, and make sure we provide the value that clients deserve, value that also distinguishes us from competitors.

Fortunately, in this short period, I have been blessed with an amazing group of new clients. At year end, one of them wrote me a very kind and humbling email thanking us for our work during his transition to retirement. His exact words describing our service were “life changing.” For a young advisor, this was a very impactful compliment, but as I have heard Neil Rose say multiple times, our clients end up changing our lives for the better more than vice versa.

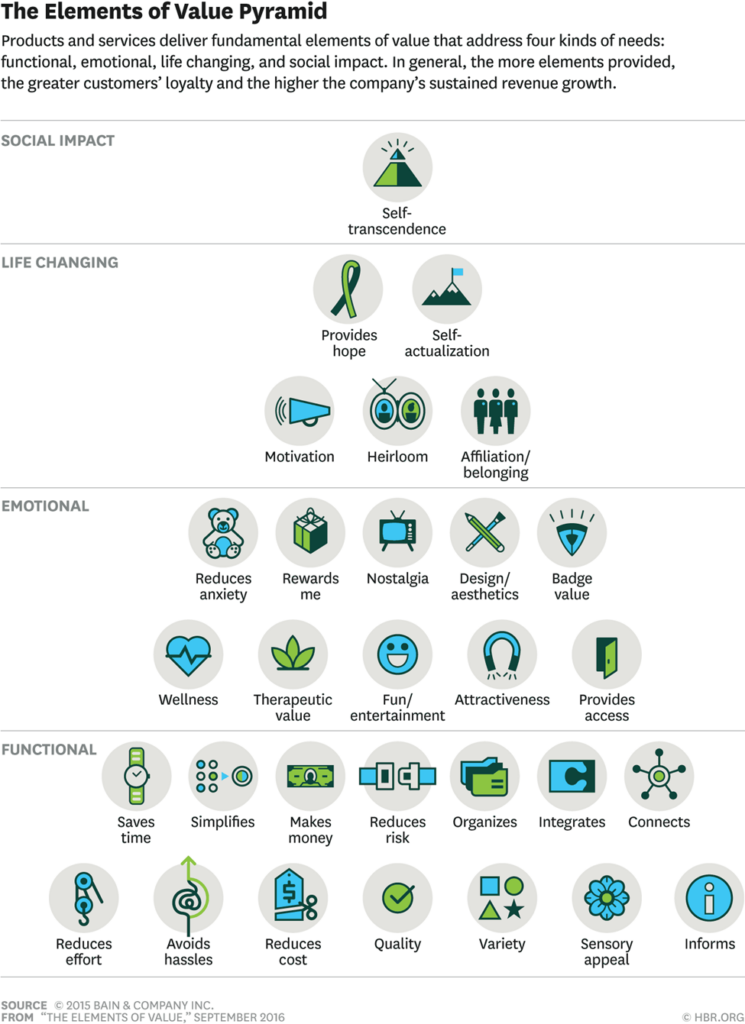

The point of me sharing this story is not to pat ourselves on the back but rather how it led to an internal discussion about quality and value. The email came through just a few days after I studied a chart, The Elements of Value. As you can see, “life changing” is near the top of the pyramid. At Regency, we look to invest in businesses that have long-term durable competitive advantages that give us a margin of safety. Margin of safety is derived from the gap between price and value. Balance sheet analysis and numbers are crucial in this calculation, but so is a look at the overall quality of the business and whether or not it will continue to grow intrinsically.

Costco, one of our favorite businesses, delivers value to its customers through dependable products (select, proven high quality, across a wide spectrum of categories), inexpensive prices, and a customer friendly set of policies. This value has justly earned Costo a loyal customer subscription base, one that grows even when membership prices increase. Buying in bulk and at great prices saves time, reduces effort, and reduces cost, all core elements of functional value, as shown in the pyramid. A membership model and high-quality customer relations can reduce anxiety, reward the customer, create feelings of loyalty and belonging, and maybe even provide some fun for certain customers, like my mother in law. (It’s important to note, however, that some might not necessarily agree that the Costco experience is fun or reduces effort/anxiety, highlighting the fact that value always lies in the eye of the beholder!) Thus, Costco doesn’t only deliver functional elements of value but also certain emotional ones too. And for some, it’s even life changing. The business is worthy of its membership base. It’s worthy of our investment.

One of Neil’s great sayings is, “Value always feels different. And value always wins.” That is true of Costco. And we hope that that is true of Regency Capital as well. Thank you to my team and to our clients for making my first full year at Regency such an enjoyable experience. We look forward to continue to find ways to serve you better.