Click here to view printable pdf

Regency Capital’s “Day 1” was two years ago today. Hanging a shingle wasn’t about entrepreneurship but rather a need to apply certain business and investing concepts long germinating in my head. Two years is insufficient for “mission accomplished,” of course, but nothing seems disproven so far. Quite the contrary.

On the investment front, I can’t think of a better two years for testing a new firm, especially with 2022 seeing stocks’ biggest decline since 2008 and the worst bond year ever. We have fared well overall considering absolute and relative performance measures. More encouraging is our relative ability to capture higher yields and income generation. While not particularly optimistic about markets today, I am as optimistic as ever on our chances to weather what comes.

Perhaps clients have provided the most telling assessment. Encouraging feedback, a 100% client-retention rate (a rarity for a firm our size), and a rise in referrals suggest to me that at least we are not screwing it all up.

Lesson from 2022

After two decades in the risk business, I’m still learning new things. With each new lesson comes the notion that complete mastery—or at least the kind of indisputable greatness achieved in chess with grandmaster status—is impossible. It is a humbling yet oddly engaging reality. 2022 proved again how bad we humans truly are at forecasting and quantifying risks. I learned true “risk” really is what’s left after one has considered everything.

In 2019, no one said the biggest impact to markets the following year would be once-a-century pandemic. In 2020, no one saw millions of investors would define primary risks as “not getting it” regarding crypto (often paired with declarations of the dollar’s imminent demise), new internet companies, and other speculative bubbles. In 2021, there were no forecasts for soaring inflation in 2022 or the worst bond losses on record or Russia going to war with Ukraine. The big story that will shape 2023 or 2024 is unlikely found in anyone’s newsletter or investment strategy today.

This is not cause for discouragement, far from it. So long as we invest humbly and seek value, asymmetrical bets (as in, “heads I win, tails I don’t lose much”), and a margin of safety, we only increase our ability to withstand the inevitable shocks—and benefit from the good news that’s also inevitable and unpredictable. Most importantly, we get to utilize the most powerful ingredient for compounding returns: Time.

Easier said than done, of course. With a lot going for us after two years and a feeling that it’s still Day 1, I like our chances.

Firm updates

Getting our sea legs as a firm was pleasantly quick thanks to a talented team. Colleagues deftly and appropriately deflected my attempts to mettle as they built an impressive operating machine and platform. A lot has been invested in our operations and continues to be, so I expect a lot still. From here, success will be measured in terms of continuous improvement and resisting complacency.

We had some exciting developments in 2022. Kawika Shoji joined us in May and quickly exceeded what were already high expectations. I look forward to watching him make an impact in Hawaii.

After eight tedious months of construction, our new “Seattle” office opened in Bainbridge Island, Washington. We also readied two new strategies for prime time:

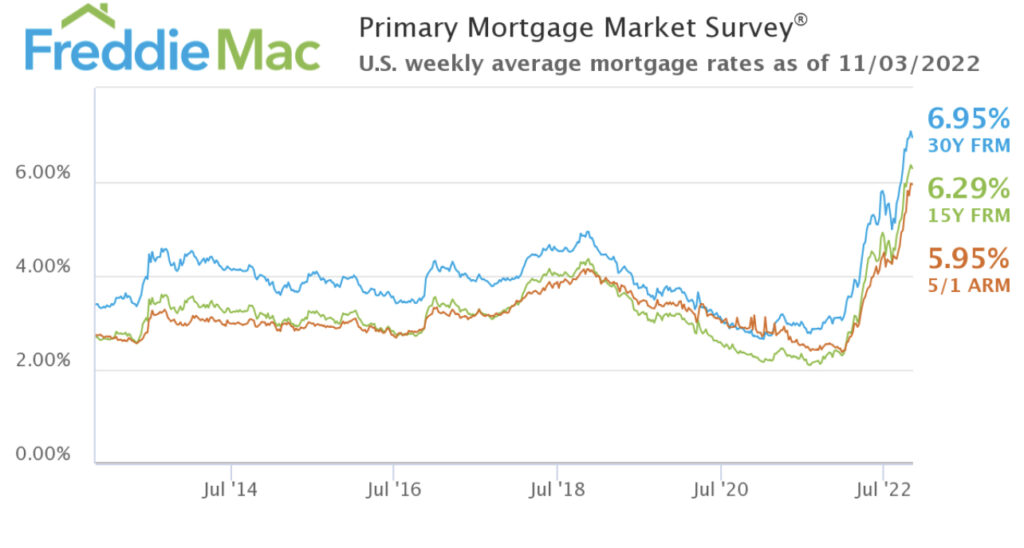

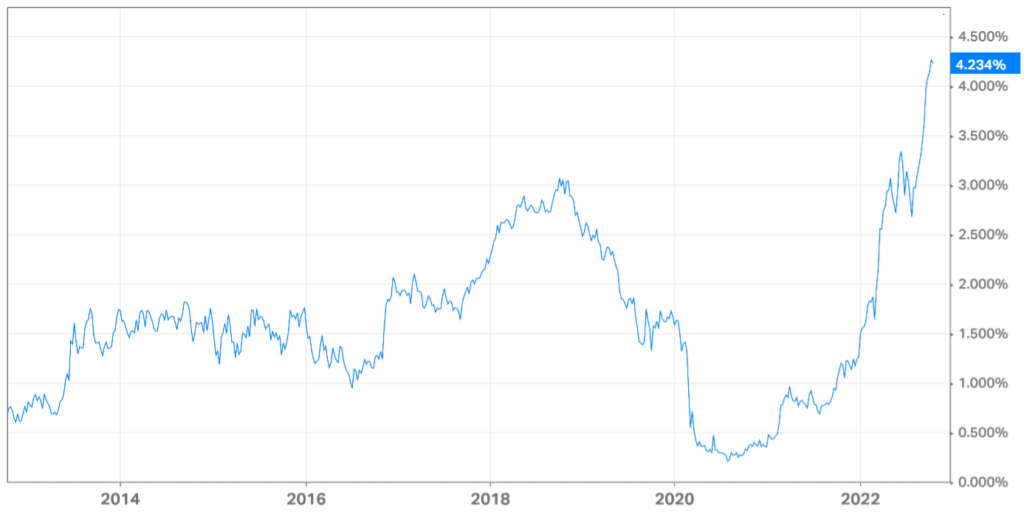

Cash Management needs a new name, but what it lacks in marketing pizazz it makes up for in yield. For far too long, savings accounts, CDs, and other bank products have offered little-to-no yield for customers’ cash, including multimillion-dollar deposits. Higher interest rates today haven’t translated proportionately to more income for banks’ customers. Investment products like money market funds have been only a little better.

Cash Management uses shorter-term U.S. Treasury bills, the world’s safest, most liquid securities, for keeping and investing excess cash. To put it bluntly, I think using Treasury bills instead of banks is as close to a “no-brainer” decision as they come. Key advantages are:

- Higher Yields: 4%-plus (and rising) for shorter-term Treasury bills. I can’t remember when banks’ highest yielding products—CDs—offered more yield.

- Liquidity: Treasury bills are convertible to cash in one business day without penalty. They need not be held to maturity. This is not the case with CDs.

- Stronger Credit Quality: All Treasurys are backed by the full faith and credit of the U.S. government, with no per-person maximum. Bank deposits, it should be remembered, are but loans to the bank, backed only by the bank’s guarantee and $250,000 of FDIC coverage.

- Favorable Tax Treatment: Treasurys are exempt from state income tax.

While markets expect interest rates will rise some more this year, we should assume rates could fall again at any time. However, this does not diminish the case for Treasury bills since banks’ yields would also fall. Either way, Treasury bills are a better deal. If they are not someday, I’ll send my own cash reserves to a bank and tell everyone to do the same.

Regency Capital Management Fund LP: We now manage an investment limited partnership (I refer to it as the “Fund”). The Fund was built to combine focused investing, flexibility (including assets and markets hard to access through standard accounts), and a very long-term time horizon. Adding a new strategy or investment vehicle (like a pooled fund), is not something done lightly or because it makes business sense. Like with Cash Management, the Fund is scratching my own investment itch. I anticipate the fund will comprise a majority of my total investments over time. (The chef not only eats his own cooking, but the menu is also based on his appetite.) This is a good thing and possible when clients and their advisor have similar values, investment goals, and relationship with money. We will never be the financial equivalent of a Japanese restaurant marketing to diners hungry for Szechuan cuisine.

Unlike Cash Management, however, the Fund is far from a “no-brainer” nor something everyone should consider. It’s only suitable for certain “accredited” investors, and so I must refrain from sharing too much or appearing to be soliciting. I mention the Fund because clients are important stakeholders who should be apprised of the goings on at their firm, including new strategies. I am happy to discuss fully with anyone directly and provide materials. Information and disclosures regarding the Fund can also be found in our updated Form ADV 2A filed with the SEC at https://adviserinfo.sec.gov or by requesting a copy from us.

Thank you is not enough to express how grateful I am to you and what you have allowed us to do every single day. I will always feel like we need to earn it, and I hope the output reflects that.

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.