Tag: investment strategy

Investment Letter

Returns this year have been kinder than I would have expected given our rather conservative positioning. Stock allocations have been lower than usual, with little in information technology and internet-related stocks, two areas that have accounted for the lion’s share of the stock market’s returns in recent years.

read more

3-Minute Update: Fading the Herd

Neil Rose explains why he's taking some profits and getting more defensive as investors continue to pump up stock valuations, especially Big Tech. Neil worries the markets are now depending on one big assumption, and the costs of being wrong are high.

read more

Investment Commentary Q4 2023

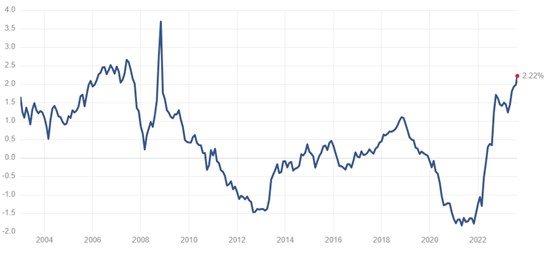

Capital markets in 2023 showed investors’ resilience—or was it complacency? Clearer was yet another lesson on the dangers in following forecasts, especially those of policymakers, PhDs, and Wall Street strategists. The Fed’s interest rate hikes and tough inflation talk didn’t cause an “inevitable” 2023 recession after all.

read more