Tag: bonds

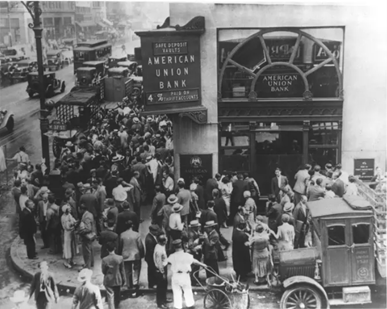

One Big Beautiful Bill Act: One Big Step Closer to Doom (Who Cares, Right?)

The national debt today is over $36 trillion, representing over 100% of GDP. The Congressional Budget Office (CBO) projects that the debt will exceed $52 trillion by 2035. And, if history repeats, actual numbers in 2035 will exceed estimates.

read more

Why Fixed Income Needs a Steady Hand Right Now

For much of the past decade, fixed income felt like an afterthought. Ultra-low interest rates meant bonds offered little income and even less value. Then came 2022—when bond prices finally cracked under the weight of distorted valuations. Even now, many investors in broad bond indexes are still waiting to break even.

read more

Bonds Have a Place Again, Part II

In my February 7, 2025 post, Bonds Have a Place Again, I reflected on interest rates some five years after the peak of the Bond Bubble—when interest rates reached a low never seen in human history—and two years after bond prices finally crashed in 2022. I had summarized our approach to fixed income going forward: […]

read more

Investment Letter | April 2025

We have experienced a benign 2025 so far despite a correction in the stock market and higher volatility. Modest stock allocations and gains in insurance stocks (our single largest industry exposure), gold, and newer fixed income buys have buoyed account values.

read more

Five Years After the Bond Bubble

Nearly five years ago, bond yields dropped to levels never seen in the thousands of years humans have been lending to one another. The shortest maturity fixed-income securities yielded virtually zero in the U.S. and less than zero in Europe and Japan.

read more

Investment Letter

Returns this year have been kinder than I would have expected given our rather conservative positioning. Stock allocations have been lower than usual, with little in information technology and internet-related stocks, two areas that have accounted for the lion’s share of the stock market’s returns in recent years.

read more

Investment Commentary Q4 2023

Capital markets in 2023 showed investors’ resilience—or was it complacency? Clearer was yet another lesson on the dangers in following forecasts, especially those of policymakers, PhDs, and Wall Street strategists. The Fed’s interest rate hikes and tough inflation talk didn’t cause an “inevitable” 2023 recession after all.

read more