Regency Capital Management Fund L.P Letter

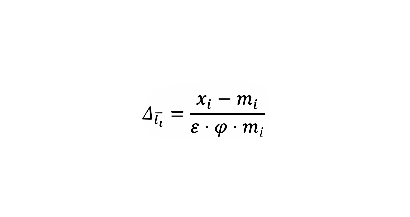

A detailed 2025 year‑end letter from Regency Capital Management Fund L.P., providing investment performance results, commentary on market conditions, long‑term strategy, risk management philosophy, and a breakdown of current holdings.

read more