The S&P 500 is up 10% year to date. The “cost” of that gain was sitting through a nearly 20% drop.

Unusual? Hardly.

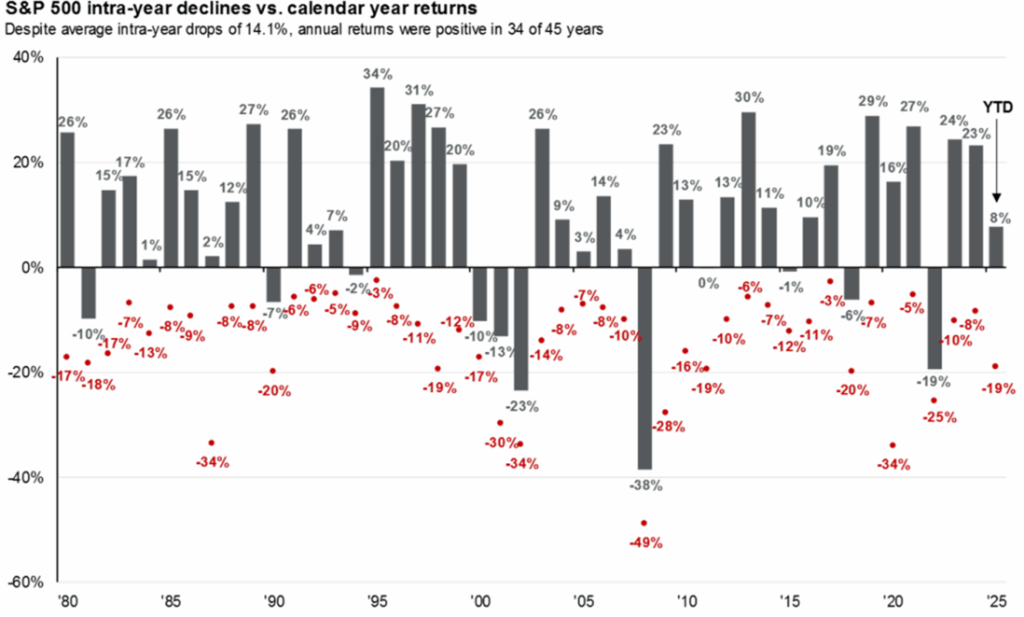

The chart below is a good reminder that the minimum cost of investing is volatility. In any particular year, one’s account value will fall. The S&P 500 sees a peak-to-trough drop of 14% in any particular year on average going back to 1980.

That means a $1,000,000 index fund dropped to $860,000, on average, at some point during the year. In 2008, that drop was to $510,000.

Worse, a drop can persist into the next calendar year or longer, so one’s ultimate peak-to-trough can be huge. Maybe this is why U.S. stocks have outperformed bonds and, yes, real estate over the long term—because it requires more discomfort.