Click here to view printable pdf.

While I was pleased with 2021’s gains, I have been more encouraged with developments across strategies so far in 2022. Looking at current positioning in the context of our clients’ longer-term financial goals, I can only conclude that 2022 has actually improved clients’ financial prospects.

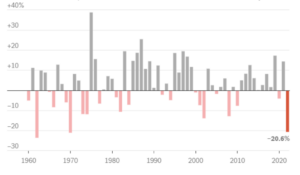

A major inflection point marked the start of 2022. Bubbles popped in cryptocurrencies, non-fungible tokens, collectibles, and fast-growing but cash-burning technology companies. The S&P 500 had the worst first half of the year in over 50 years. More significant were the biggest losses in fixed income since bond indexes began tracking in the 1970s and 1980s. Various data and research suggest George Washington was president the last time bond investors lost this much through June 30.1 2022 has been terrible for investors of all types.

There are no guarantees in life, of course, but I think we are staring at a rare opportunity to make significant progress financially and for the longer-term (if your investment adviser doesn’t screw it up, of course).

First, our losses in 2022 have been relatively modest. Most of our clients, almost all of whom have conservative/absolute-return or balanced objectives, were down between nine and ten percent on average in the first half of 2022 (however, some 40 percent of those losses have since been reversed in July).

Stock Portfolios saw over half of their losses through June 30 (-12.3 percent) reversed in July.

While I always hesitate to put value in short-term performance, I admit it’s gratifying to see relative performance in a bull and bear market.

Our approach starting last year included lowering vulnerability to euphoric pricing in stocks and bonds, both of which seemed to require indefinite money-printing from central banks (with no inflationary consequence). We didn’t need to bet on forecasts when prices reflected extreme belief in financial alchemy.

S&P 500 performance in the first six months of each year

1 Another contributor here is the rather short history of longer-term bonds. For example, the 30-year Treasury didn’t exist until 1977. Since bond prices are more sensitive to interest rate movements the longer the maturity date is, comparing bond markets over time isn’t quite apples-to-apples.

Blessing in disguise

More than relative performance, I’m encouraged by rising interest rates even as they’ve been the cause of losses in stocks and bonds. Our positioning in the latter should prove fortuitous. Over a third of our fixed income investments have been in securities maturing under a year; over half have been maturities under three years. By comparison, most invest in traditional index-hugging bond portfolios with an average maturity of approximately nine years. All bonds showing paper losses do reverse with time; however, ours will reverse much faster, all things equal, as we trade cash and Treasury bills for bonds with increasing yields.

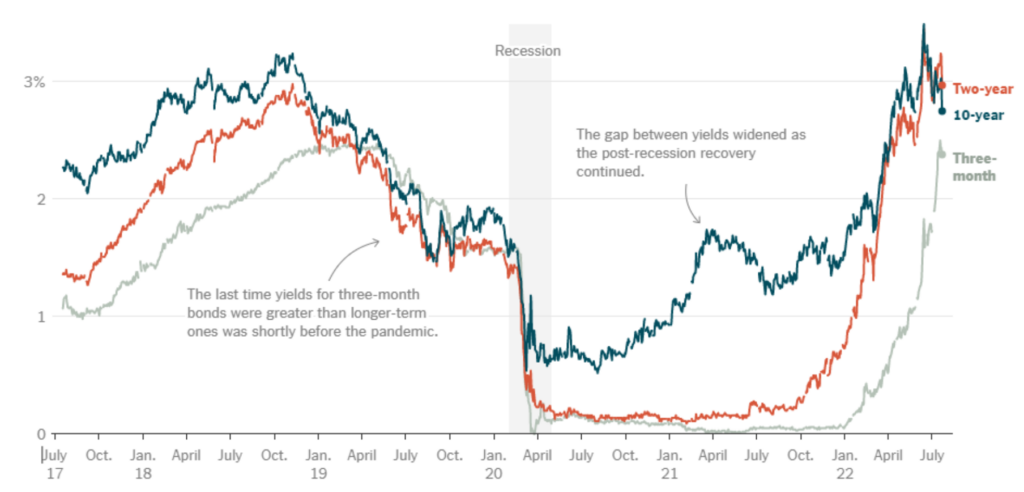

Yields on U.S. Bonds

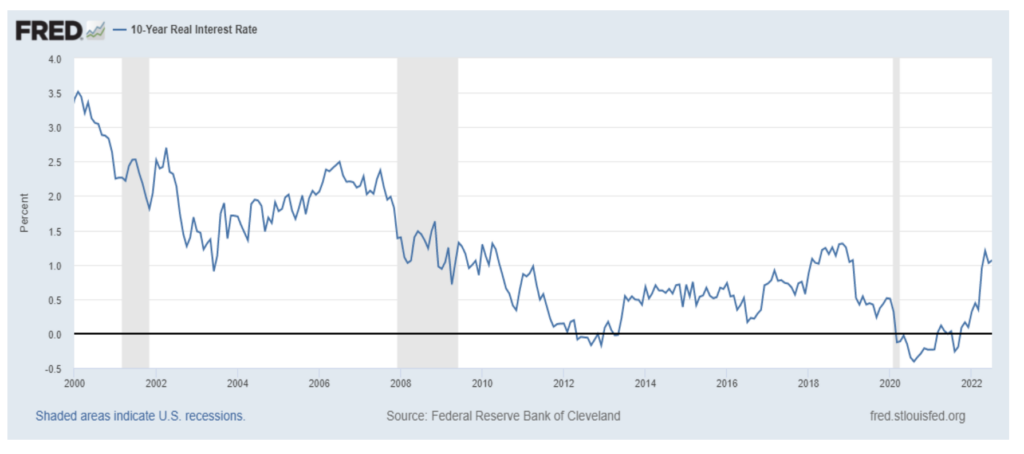

With interest rates suppressed since the Great Financial Crisis, the biggest threat to savers and investors has arguably been a long future of no-to-low yields and higher vulnerability to eroding real wealth over time. (Think Japan over the past few decades but with higher inflation.)

Inflation is now the market’s biggest fear; however, that fear drives interest rates upward and may possibly overshoot, leaving investors (us) the opportunity to capture not just higher nominal yields but positive real yields, something investors haven’t seen in a long time. In addition to picking up higher- yielding Treasury, agency, and corporate fixed income securities, we have been buyers of newly-issued TIPS—at yields a good amount higher than the market’s longer-term inflation expectations.

All of this means we are being increasingly compensated for various risks, including inflation, credit, and opportunity costs. Think of our modest losses in 2022 as a small price to pay for a future stream of income materially higher than what was offered just a year ago. Already, I’m finding reasons to increase our long-term return expectations.

10-Year Real Interest Rates

Stocks

We have had a lower exposure to stocks in 2022, limiting investments to issues we remain highly confident in over the longer term. Our stocks represent what I think is a combination of superior quality and value to the market as a whole. And despite investing in far fewer companies than the broad stock market, I think our holdings offer more diversification. Among other factors, our stocks are more distributed across sectors while the (capitalization-weighted) stock market remains over one- third in technology and internet companies.

We also allocate smaller amounts in areas or themes we think increase overall portfolio diversification and defensiveness. Some are macro-related themes (e.g. inflation-beneficiaries); some are idiosyncratic, “special situation” investments that are fairly uncorrelated to the broader market or economic cycle. A combination of lower stock prices and rising dividend payouts have made stocks productive and growing income sources as well.

Regardless of the macro environment, it always makes sense for the long-term investor and anyone seeking to reduce longer-term risks, like running out of money, to invest patiently in a healthy allocation in stocks. No other investment type has hedged inflation better or compounded at a higher rate overall, not bonds, gold, or even real estate. It’s also the hardest investment because of the volatility that comes with daily liquidity. Stocks are volatile and always will be, but volatility is the price an investor pays for higher returns over time. I still see no reason why having ownership in corporate America and human capital should be a relative loser over the long run. However, we’ll always be looking for paradigm shifts where this is no longer the case. History is full of times and places of complete and irreversible collapse.

Current All-Weather Absolute-Return model holdings:

Macro

The macro picture is murkier than ever but guessing what’s in store for the economy is both futile and unnecessary for successful investing. I think an investment strategy built on macro forecasts is rather dangerous today. So long as we stay conservative and continue to reinvest cash at higher yields and in securities not terribly susceptible to the economy, we should do just fine (rest assured I want better than just fine.) As before, we approach portfolio construction assuming growth and inflation data will disappoint. It may be likely—or at least 50-50—that a recession is imminent if not already here. New lows in consumer confidence, high inventories, and most importantly, the Fed’s aggressive rate hikes, have markets anticipating recession.

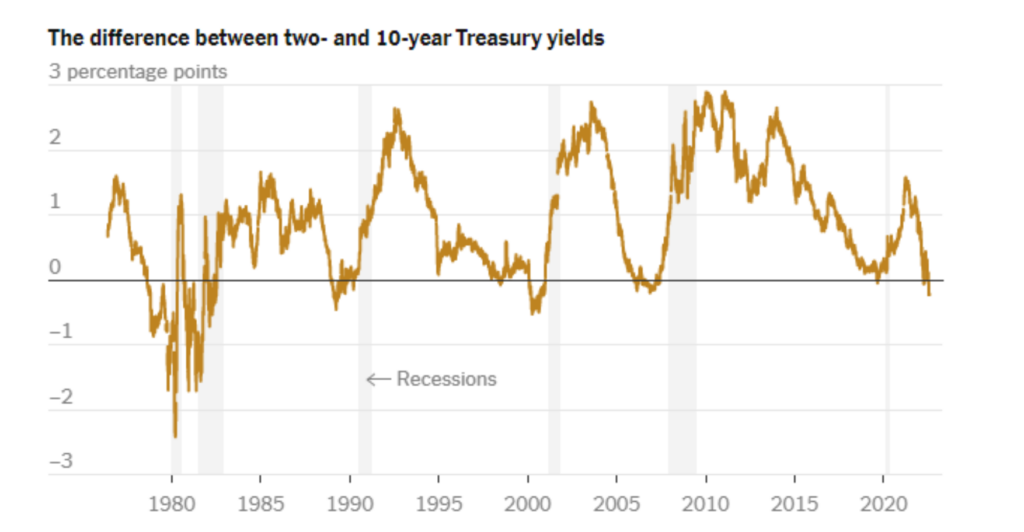

Perhaps the biggest clue comes from the bond market. The yield curve suggests investors anticipate the Fed will hike rates only to reverse and cut rates next year to combat recession. One of the better indicators for recessions has been when two-year Treasury notes offer a higher yield than 10-year bonds; the “2-10” curve has been inverted for weeks now.

Yet, there are signs suggesting a true recession is not inevitable. Employment remains strong, with many jobs left unfilled. Wages are rising across most industries. An overwhelming consensus calling for recession is also a good sign since recessions are rarely this anticipated by the crowd.

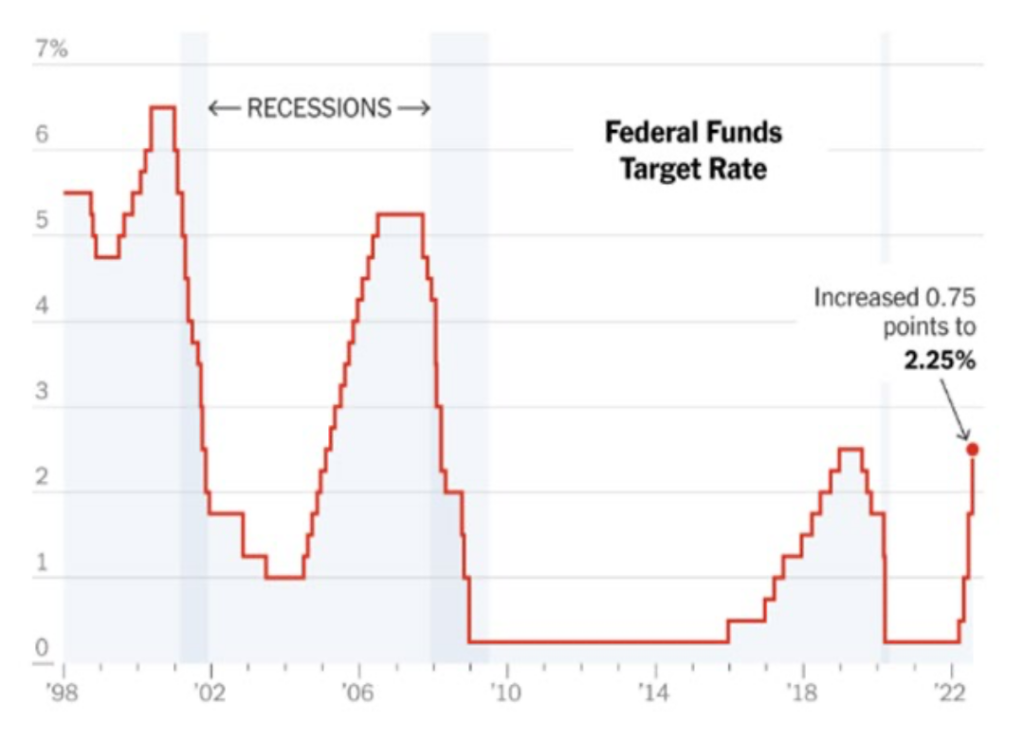

Source: Federal Reserve, New York Times

In the meantime, watching the Fed and other central banks might be more important than ever. For years, central banks seemed omnipotent in delivering ideal conditions and good fortune. They injected trillions of dollars “curing” the financial crisis over a decade ago, then injected trillions more instead of removing excess liquidity. Covid then accelerated the global money printing. So successful was the Fed in particular in reversing recession and pushing asset prices to ever-increasing record levels—and with no inflationary consequences—that many academics and policymakers believed the world had finally found a silver bullet to peddle prosperity forever. Deficits, debt, and money printing no longer mattered even to a growing number of traditional fiscal conservatives.

The gasoline of cheap and copious amounts of excess liquidity found a lit match with Covid and a new war in Ukraine. Trade fell, already-weakening supply chains broke, and a massive imbalance in supply and demand quickly introduced levels of inflation not seen in decades.

Central banks no longer have it easy: they must choose between fighting inflation versus supporting economic growth. Fed chair Jerome Powell has been the first to prioritize inflation. The Fed Funds Rate has risen from virtually zero percent in early March to 2.25 percent today. The Fed is expected to take rates to over 3 percent by year-end. In contrast, the Bank of Japan’s has its policy rate currently at negative-0.10 percent; the European Central Bank is zero; and the Bank of England is 1.25 percent.

How high rates ultimately go, how fast and how much monetary tightening hits the economy, we don’t know. What we see, however, is a market with a new fear of inflation and more rational pricing for money. Inflation’s last reading of 9.1 percent was eye-popping, but we don’t assume such rates will last. As I mentioned in previous communications, we are going to assume inflation runs higher than in past years and require lower prices and more yield from both stocks and fixed income securities.

Price and position sizing are two under- rated and under-utilized tools in risk management. Being disciplined on both can make for the best macro hedges. The cheaper one buys, the less vulnerable he is to macroeconomic conditions. Thus, the cheaper we buy, the less we need to be right about the future. Price matters in investing, not just in consuming.

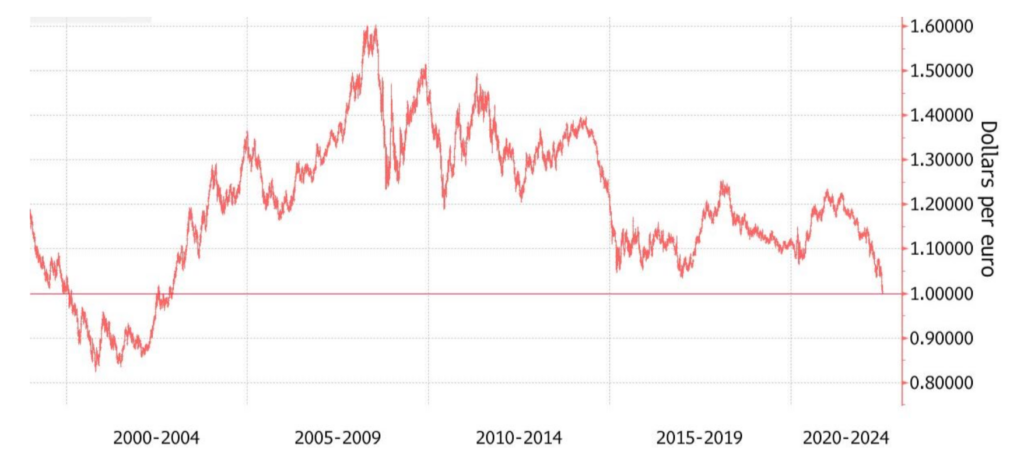

Last macro mention is the dollar, which has climbed tremendously versus major currencies. The dollar is almost on par with the euro for the first time in nearly 30 years. Before Covid, I received 105 yen per dollar on a trip to Japan. As I write, the rate is 132 yen per dollar (it hit 139 in July).

U.S. dollars per euro

I have no currency forecast, so I’ll just state the obvious: it is a cheaper time to travel abroad. Anecdotally, I’m seeing lots of “shopping-arbitrage” in higher priced goods. Buying goods in countries like Japan may create savings and make a vacation even cheaper.

We will update you on developments keeping in mind our communications should be relevant and in service to you. Our goal with communications like these is primarily to inform you of our approach, strategy, material assumptions, performance, and mistakes. From time to time I’ll pass along lessons learned and ideas and tools I find helpful in improving one’s financial savvy or saving money.

We will be respectful of clients’ time and resist the urge to constantly produce “content” or talk just to talk. And our communications will never be to sound smart, confuse, or obfuscate during inevitable times of poor performance. Beyond service to clients, our communications should help our team advance in Regency Capital’s core values of integrity, rational thinking, humility, and continuous improvement—our permanent “non-negotiables.”

I struggle to find the words to describe the experience of the past year and a half. Being able to put theory and ideas to full practice, working with outstanding people, and finding greater capabilities, opportunities, and purpose for stakeholders—have been nothing short of life-changing for me. I know all of this is possible only because of a truly special clientele.

I am irredeemably indebted to you.

Warm regards,

Neil Rose, CFA

The content provided in this document is for informational purposes and does not constitute a solicitation, recommendation, endorsement, or offer to purchase or sell securities. Nothing should be considered personal financial, investment, legal, tax, or any other advice. Content is information general in nature and is not an attempt to address particular financial circumstance of any client or prospect. Clients receive advice directly and are encouraged to contact their Adviser for counsel and to answer any questions. Any information or commentary represents the views of the Adviser at the time of each report and is subject to change without notice. There is no assurance that any securities discussed herein will remain in an account at the time you receive this report or that securities sold have not been repurchased. Any securities discussed may or may not be included in all client accounts due to individual needs or circumstances, account size, or other factors.

It should not be assumed that any of the securities transactions or holdings discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.