Investment Management

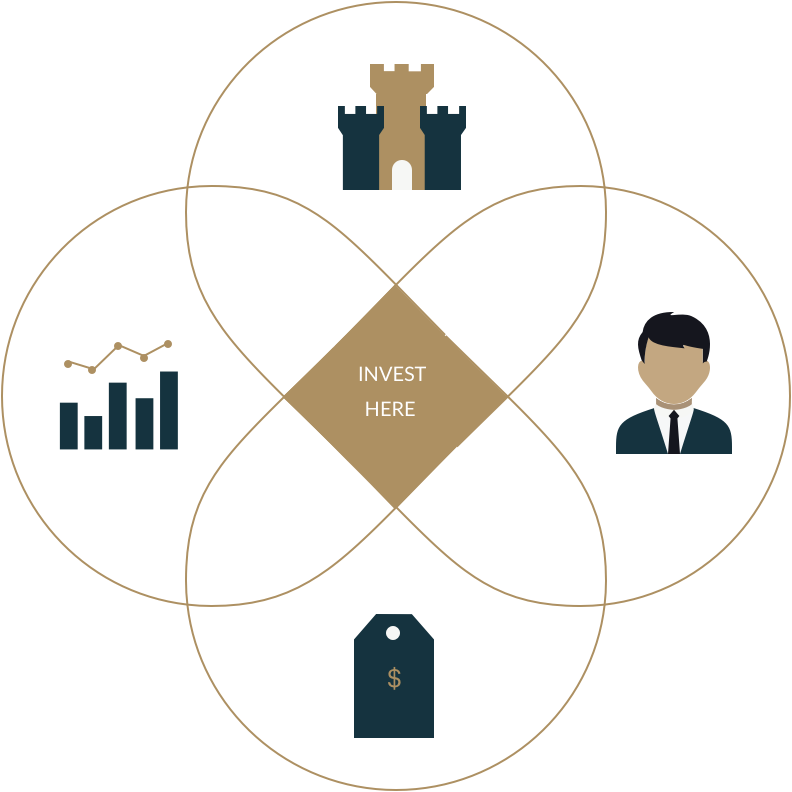

We offer customized portfolio management, including a sensible and simple approach to asset allocation and investment selection: we want to invest in whatever makes good sense. This means quality, liquidity, and value. Most of all, it means a focus on managing risk in its various forms.

Investment Management

We offer customized portfolio management, including a sensible and simple approach to asset allocation and investment selection: we want to invest in whatever makes good sense. This means quality, liquidity, and value. Most of all, it means a focus on managing risk in its various forms.

Dedicated to investing RATIONALLY

We believe that when done right, one’s securities portfolio becomes a driver of wealth accumulation, a reliable source of value and liquidity, and a diversified and complementary asset to your other assets. We seek superior risk-adjusted gains for our managed portfolios and increased soundness to your overall financial picture.

We are investors with a wide lens for opportunities and uncompromising standards for quality. We approach markets humbly and with little bias outside of a desire to maintain overall portfolio quality, liquidity, and relative conservatism.

We are lifelong learners and voracious readers, mindful of our “circle of competence” and what we don’t (or can’t) know. We actively study mistakes–ours and others’–and believe doing so is a major source for investment “edge,” worldly wisdom, and improving our craft.

Above all, we strive to be rational investors, seeking value in all we do.

Our asset allocation strategies are equally driven by the opportunities we find and the individual needs of clients.

Allocation

We are business analysts buying ownership in real businesses, not market pundits and gurus selling a crystal ball.

Forecastable

- Within our “circle of competence”

- Understandable; simple enough

- Economics unlikely to change much over time

- Durable competitive advantages

- Evidence: high and consistent returns on capital

- Unique, indispensable, “hard to kill”

Share Price

- Reasonable price means price is less than intrinsic value

- Ask what would we pay if we had the means to buy the whole business

- Discount debt and off-balance sheet liabilities

- Able and honest

- Rational capital allocators

- Proper corporate governance and incentives

- Look for changes in any of the above

We never forget that bonds and other fixed income securities are loans.

We approach fixed income securities similarly to how we analyze stocks: by assessing the quality and fundamentals of the business (or government). We assess fixed income securities in the context of the whole portfolio, looking for diversification and risk management capabilities. In our multi-asset portfolios, government bonds play an important role in our asset allocations with their lower correlation to stocks, liquidity, and hedges against declining economic environments.

While we diversify among bonds, we look for an overall duration/maturity structure that makes sense given our views and portfolios’ other investments.

Cash is an overlooked but powerful investment option for managing risk and growth.

Standard investment dogma instructs us to be fully invested in stocks and bonds with no cash reserves. Our investments in cash – including short term Treasury bills and high-quality money market funds – play an important role not just for managing risk but also for generating longer term returns. That is because cash also represents a “call option” on future opportunities; investors do not have to be fully invested in only today’s opportunity set, especially when markets are overly bullish.

We may invest in other asset types, including gold, real estate, and foreign currencies for further diversification or return opportunities. Like with stocks and bonds, we require quality and liquidity and will avoid unnecessarily complex or esoteric securities.

Investment Strategies

We offer portfolio strategies for various asset allocation policies (risk/reward objectives).

Conservative, multi-risk aware, and absolute-return driven. Prospective and varied allocation among high quality equities, fixed income, cash, and other investments. Seeks lower volatility than traditional balanced allocation strategies and superior risk-adjusted returns.

For investors seeking…

Comprehensive and evergreen risk management; lower volatility with exposure to stocks.

Benchmark

Absolute return

Inception

January 1, 2021

Our balanced solution to the traditional “60/40” between stocks and fixed income. Allocations may be overweight or underweight. Smaller allocations in other asset classes are always under consideration, as are secular and cyclical themes.

For investors seeking…

Growth and income; a more dynamic and actively managed balanced portfolio.

Benchmark

60% S&P 500 Index / 40% US Agg. Bond Index

Inception

January 1, 2021

Equity strategy seeking great businesses with durable competitive advantages, proven management, and high returns on capital at reasonable prices. Longer-term focus to allow companies’ earnings to compound over time.

For investors seeking…

Capital appreciation over the long term; ownership of great businesses.

Benchmark

S&P 500 Index

Inception

January 1, 2021

Global equity strategy primarily seeking great businesses and compounding potential. Regional allocations driven by fundamental and “top-down” analyses. Global growth with diversification and value

For investors seeking…

Capital appreciation in global stocks over the long-term; ownership of great businesses.

Benchmark

MSCI ACWI Index

Inception

January 1, 2021

An income strategy primarily invested in fixed income securities. For enhanced income, inflation risk, and a longer-term orientation, the strategy may invest up to 20% in a combination of common and preferred stocks, or other security types.

For investors seeking…

Current and future income.

Benchmark

US Agg. Bond Index

Inception

January 1, 2021